Question: BHMS 3 2 1 8 Intermediate Accounting 1 2 0 2 4 / 2 5 S 2 Question 2 ( 5 0 marks ) STAR

BHMS Intermediate Accounting

S

Question marks

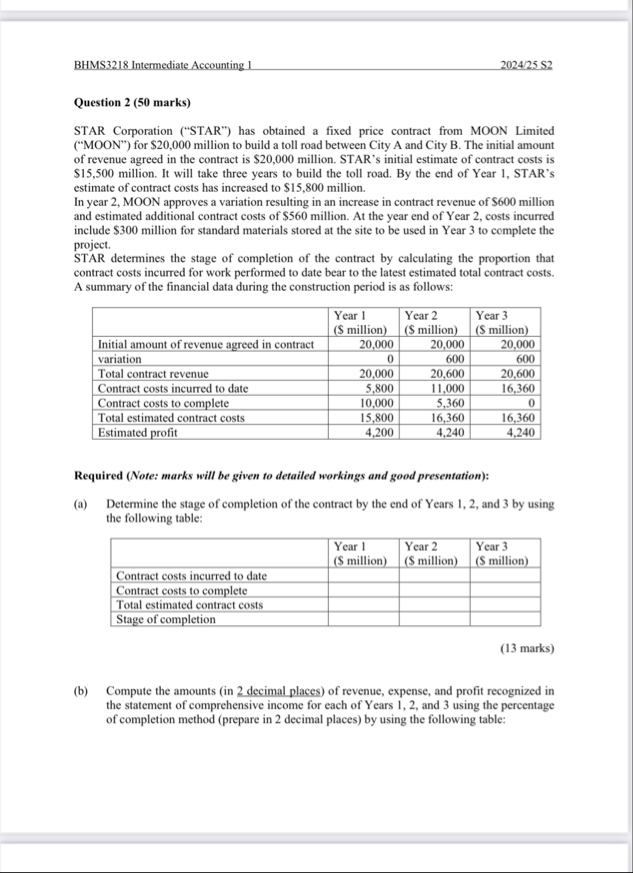

STAR Corporation STAR has obtained a fixed price contract from MOON Limited MOON for $ million to build a toll road between City A and City B The initial amount of revenue agreed in the contract is $ million. STAR's initial estimate of contract costs is $ million. It will take three years to build the toll road. By the end of Year STAR's estimate of contract costs has increased to $ million.

In year MOON approves a variation resulting in an increase in contract revenue of $ million and estimated additional contract costs of $ million. At the year end of Year costs incurred include $ million for standard materials stored at the site to be used in Year to complete the project.

STAR determines the stage of completion of the contract by calculating the proportion that contract costs incurred for work performed to date bear to the latest estimated total contract costs. A summary of the financial data during the construction period is as follows:

tabletableYear $ milliontableYear $ milliontableYear $ millionInitial amount of revenue agreed in contract,variationTotal contract revenue,Contract costs incurred to date,Contract costs to complete,Total estimated contract costs,Estimated profit,

Required Note: marks will be given to detailed workings and good presentation:

a Determine the stage of completion of the contract by the end of Years and by using the following table:

tabletableYear $ milliontableYear $ milliontableYear $ millionContract costs incurred to date,,,Contract costs to complete,,,Total estimated contract costs,,,Stage of completion,,,

marks

b Compute the amounts in decimal places of revenue, expense, and profit recognized in the statement of comprehensive income for each of Years and using the percentage of completion method prepare in decimal places by using the following table: of

tabletableTo Date$ milliontableRecognizedin prior years$ milliontableRecognizedin currentyears$ millionYear Year Year

marks

c Prepare journal entries to account for the contract revenue and expenses for Year prepare in the nearest dollar

marks

End of Assignment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock