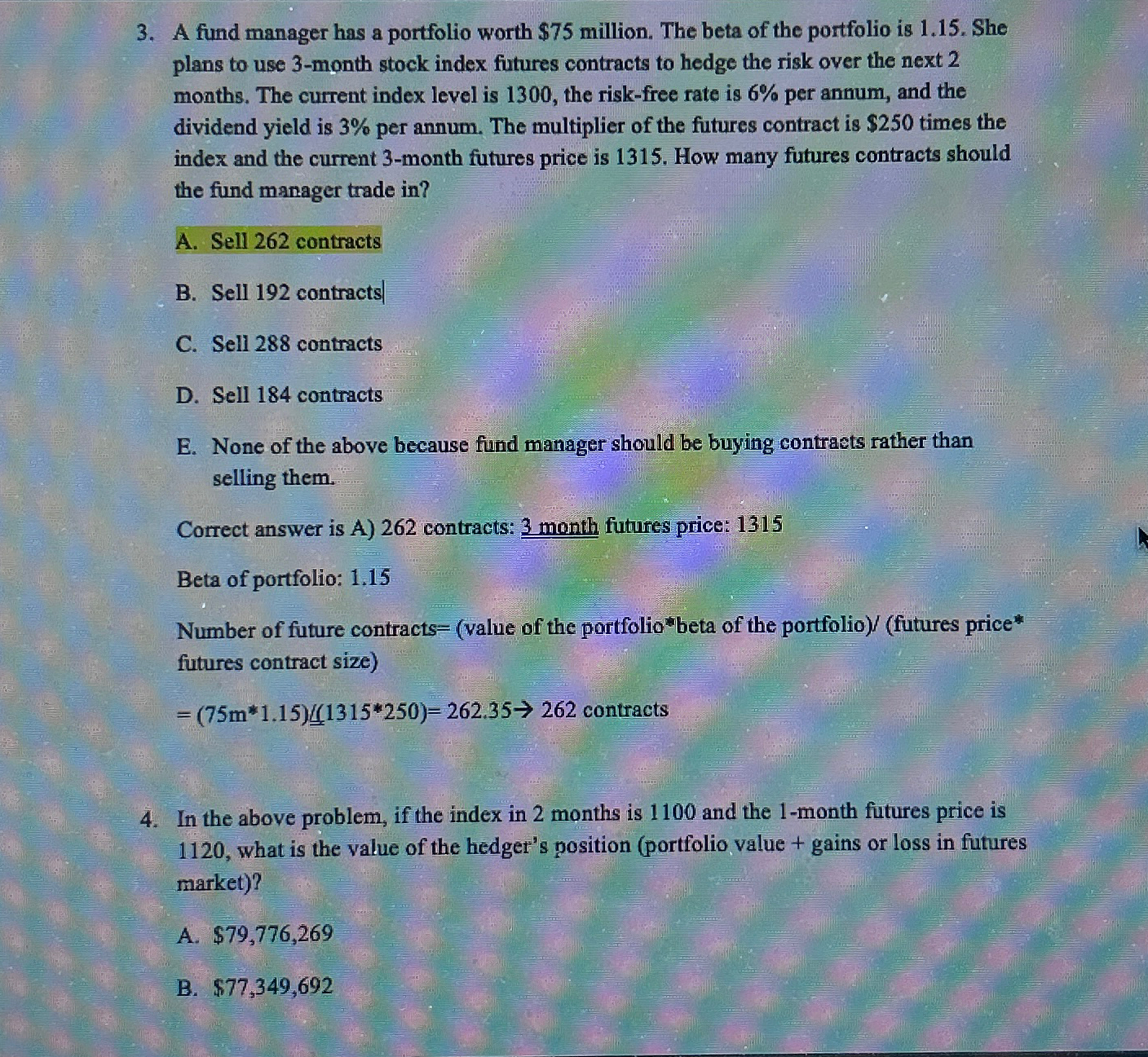

Question: ANSWER QUESTION 4 : A fund manager has a portfolio worth $ 7 5 million. The beta of the portfolio is 1 . 1 5

ANSWER QUESTION : A fund manager has a portfolio worth $ million. The beta of the portfolio is She plans to use month stock index futures contracts to hedge the risk over the next months. The current index level is the riskfree rate is per annum, and the dividend yield is per annum. The multiplier of the futures contract is $ times the index and the current month futures price is How many futures contracts should the fund manager trade in

A Sell contracts

B Sell contracts

C Sell contracts

D Sell contracts

E None of the above because fund manager should be buying contracts rather than selling them.

Correct answer is A contracts: month futures price:

Beta of portfolio:

Number of future contractsvalue of the portfolio "beta of the portfoliofutures price futures contract size

In the above problem, if the index in months is and the month futures price is what is the value of the hedger's position portfolio value gains or loss in futures market

A $

B $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock