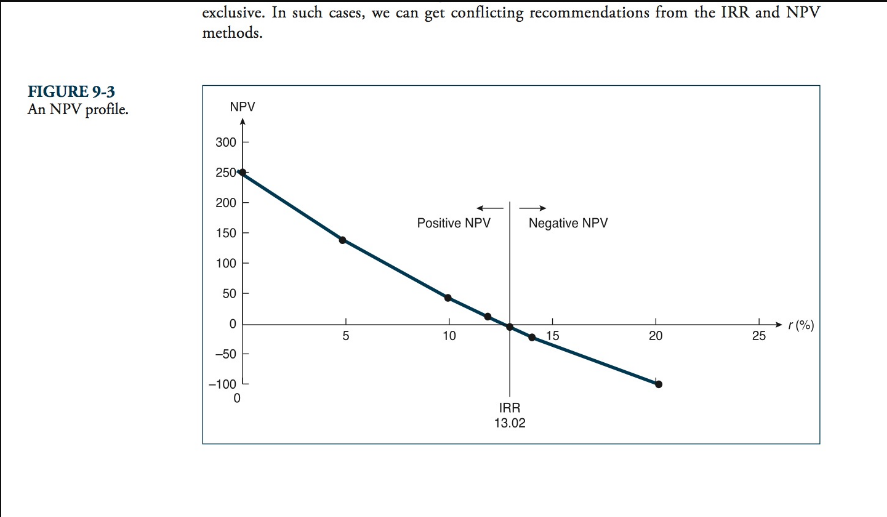

Question: Answer Question: 5. Based on your analysis in #2 and #3, would you undertake the plane project? Why? Please answer questions #1 - #5 in

Answer Question:

5. Based on your analysis in #2 and #3, would you undertake the plane project? Why?

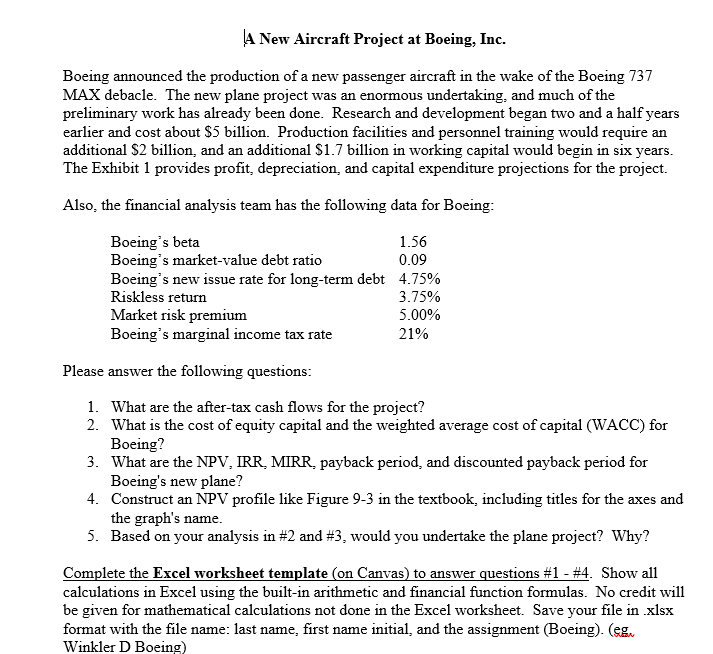

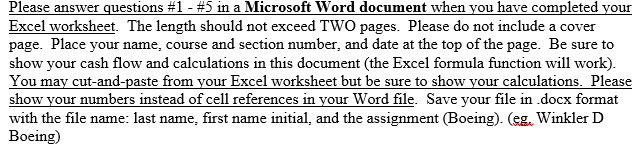

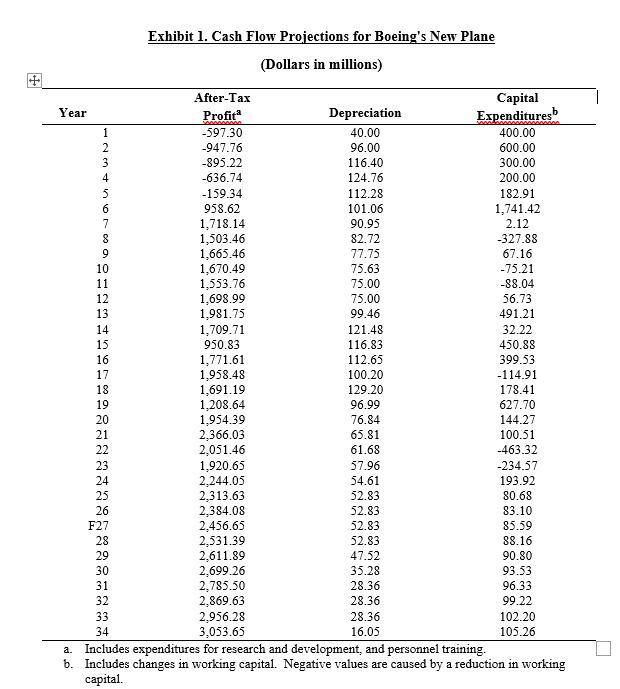

Please answer questions #1 - #5 in a Microsoft Word document when you have completed your Excel worksheet. The length should not exceed TWO pages. Please do not include a cover page. Place your name, course and section number, and date at the top of the page. Be sure to show your cash flow and calculations in this document (the Excel formula function will work). You may cut-and-paste from your Excel worksheet but be sure to show your calculations. Please show your numbers instead of cell references in your Word file. Save your file in .docx format with the file name: last name, first name initial, and the assignment (Boeing). (eg. Winkler D Boeing) Exhibit 1. Cash Flow Projections for Boeing's New Plane (Dollars in millions) 17 After-Tax Capital Year Profita Depreciation Expenditures 1 -597.30 40.00 400.00 2 -947.76 96.00 600.00 3 -895.22 116.40 300.00 4 -636.74 124.76 200.00 5 -159.34 112.28 182.91 6 958.62 101.06 1,741.42 7 1,718.14 90.95 2.12 8 1,503.46 82.72 -327.88 9 1,665.46 77.75 67.16 10 1,670.49 75.63 -75.21 11 1,553.76 75.00 -88.04 12 1,698.99 75.00 56.73 13 1,981.75 99.46 491.21 14 1,709.71 121.48 32.22 15 950.83 116.83 450.88 16 1,771.61 112.65 399.53 1,958.48 100.20 -114.91 18 1,691.19 129.20 178.41 19 1,208.64 96.99 627.70 20 1,954.39 76.84 144.27 21 2,366.03 65.81 100.51 22 2,051.46 61.68 -463.32 23 1,920.65 57.96 -234.57 24 2,244.05 54.61 193.92 25 2,313.63 52.83 80.68 26 2,384.08 52.83 83.10 F27 2.456.65 52.83 85.59 2,531.39 52.83 88.16 29 2,611.89 47.52 90.80 30 2,699.26 35.28 93.53 31 2,785.50 28.36 96.33 2,869.63 28.36 99.22 33 2.956.28 28.36 102.20 34 3,053.65 16.05 105.26 a. Includes expenditures for research and development, and personnel training. b. Includes changes in working capital. Negative values are caused by a reduction in working capital 28 32 Please answer questions #1 - #5 in a Microsoft Word document when you have completed your Excel worksheet. The length should not exceed TWO pages. Please do not include a cover page. Place your name, course and section number, and date at the top of the page. Be sure to show your cash flow and calculations in this document (the Excel formula function will work). You may cut-and-paste from your Excel worksheet but be sure to show your calculations. Please show your numbers instead of cell references in your Word file. Save your file in .docx format with the file name: last name, first name initial, and the assignment (Boeing). (eg. Winkler D Boeing) Exhibit 1. Cash Flow Projections for Boeing's New Plane (Dollars in millions) 17 After-Tax Capital Year Profita Depreciation Expenditures 1 -597.30 40.00 400.00 2 -947.76 96.00 600.00 3 -895.22 116.40 300.00 4 -636.74 124.76 200.00 5 -159.34 112.28 182.91 6 958.62 101.06 1,741.42 7 1,718.14 90.95 2.12 8 1,503.46 82.72 -327.88 9 1,665.46 77.75 67.16 10 1,670.49 75.63 -75.21 11 1,553.76 75.00 -88.04 12 1,698.99 75.00 56.73 13 1,981.75 99.46 491.21 14 1,709.71 121.48 32.22 15 950.83 116.83 450.88 16 1,771.61 112.65 399.53 1,958.48 100.20 -114.91 18 1,691.19 129.20 178.41 19 1,208.64 96.99 627.70 20 1,954.39 76.84 144.27 21 2,366.03 65.81 100.51 22 2,051.46 61.68 -463.32 23 1,920.65 57.96 -234.57 24 2,244.05 54.61 193.92 25 2,313.63 52.83 80.68 26 2,384.08 52.83 83.10 F27 2.456.65 52.83 85.59 2,531.39 52.83 88.16 29 2,611.89 47.52 90.80 30 2,699.26 35.28 93.53 31 2,785.50 28.36 96.33 2,869.63 28.36 99.22 33 2.956.28 28.36 102.20 34 3,053.65 16.05 105.26 a. Includes expenditures for research and development, and personnel training. b. Includes changes in working capital. Negative values are caused by a reduction in working capital 28 32

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts