Question: answer question 6 please A foreign exchange trader with a U.S. bank took a short position of 5,000,000 when the $/ exchange rate was 1.55.

answer question 6 please

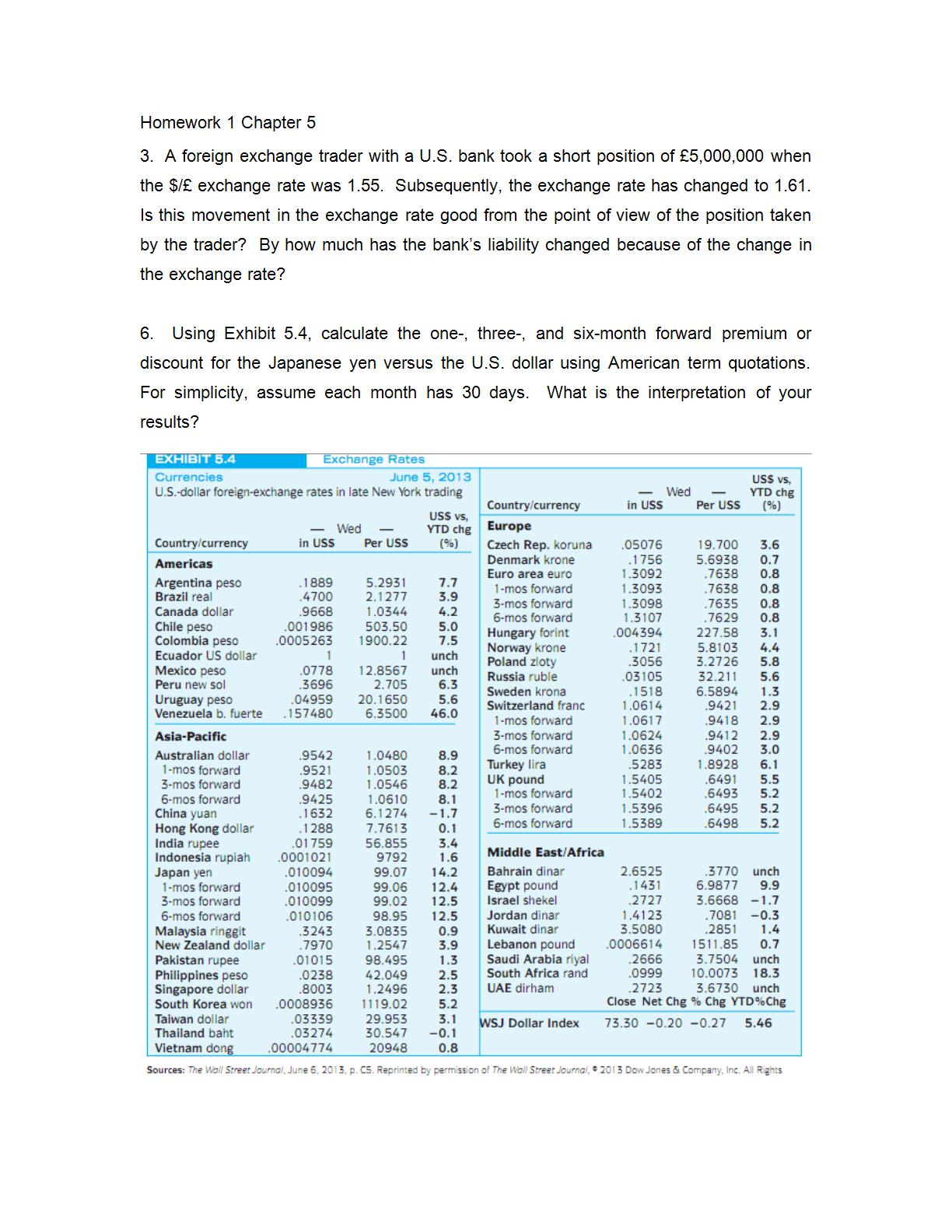

A foreign exchange trader with a U.S. bank took a short position of 5,000,000 when the $/ exchange rate was 1.55. Subsequently, the exchange rate has changed to 1.61. Is this movement in the exchange rate good from the point of view of the position taken by the trader? By how much has the bank's liability changed because of the change in the exchange rate? Using Exhibit 5.4, calculate the one-, three-, and six-month forward premium or discount for the Japanese yen versus the U.S. dollar using American term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts