Question: answer question a,b,c,d,e with clear steps! The capital structure of MSL consists of bonds, preferred shares, and common shares. MSL has outstanding debt with $120

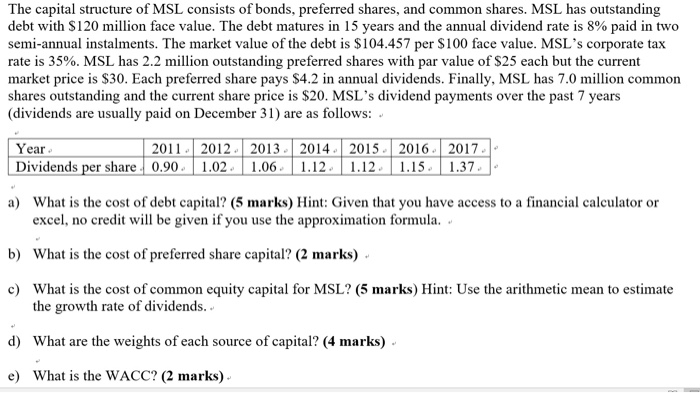

The capital structure of MSL consists of bonds, preferred shares, and common shares. MSL has outstanding debt with $120 million face value. The debt matures in 15 years and the annual dividend rate is 8% paid in two semi-annual instalments. The market value of the debt is $104.457 per $100 face value. MSL's corporate tax rate is 35%. MSL has 2.2 million outstanding preferred shares with par value of $25 each but the current market price is $30. Each preferred share pays $4.2 in annual dividends. Finally, MSL has 7.0 million commorn shares outstanding and the current share price is S20. MSL's dividend payments over the past 7 years (dividends are usually paid on December 31) are as follows: Year Dividends per share0.90 102.0612 1.1215 .37 2011 2012 20132014 2015 2016 2017 What is the cost of debt capital? (5 marks) Hint: Given that you have access to a financial calculator or excel, no credit will be given if you use the approximation formula. a) b) What is the cost of preferred share capital? (2 marks) c) What is the cost of common equity capital for MSL? (5 marks) Hint: Use the arithmetic mean to estimate the growth rate of dividends. What are the weights of each source of capital? (4 marks) . what is the WACC? (2 marks) . d) e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts