Question: ANSWER QUESTION C(Net Income) ONLY PLEASE!!! Data Table Click on the icons located on the top-right corners of the data tables below to copy its

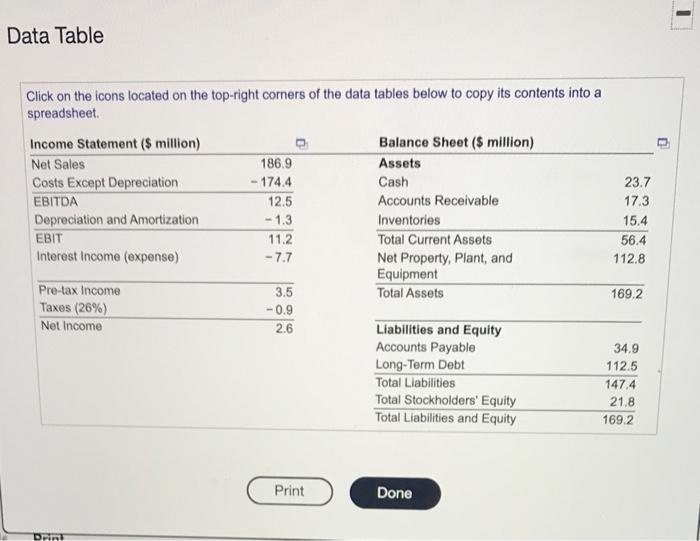

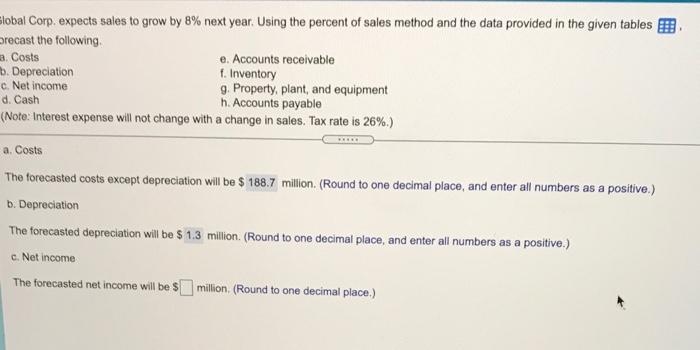

Data Table Click on the icons located on the top-right corners of the data tables below to copy its contents into a spreadsheet Income Statement ($ million) Balance Sheet ($ million) Net Sales 186.9 Assets Costs Except Depreciation - 174.4 Cash 23.7 EBITDA 12.5 Accounts Receivable 17.3 Depreciation and Amortization -1.3 Inventories 15.4 EBIT 11.2 Total Current Assets 56.4 Interest Income (expense) - 7.7 Net Property, Plant, and 112.8 Equipment Pre-tax Income 3.5 Total Assets 169.2 Taxes (26%) -0.9 Net Income 2.6 Liabilities and Equity Accounts Payable 34.9 Long-Term Debt 112.5 Total Liabilities 147.4 Total Stockholders' Equity 21.8 Total Liabilities and Equity 169.2 Print Done Drin Slobal Corp, expects sales to grow by 8% next year. Using the percent of sales method and the data provided in the given tables orecast the following 3. Costs e Accounts receivable b. Depreciation f. Inventory c. Net income g. Property, plant, and equipment d. Cash h. Accounts payable (Note: Interest expense will not change with a change in sales. Tax rate is 26%.) a. Costs The forecasted costs except depreciation will be $ 188.7 million. (Round to one decimal place, and enter all numbers as a positive.) b. Depreciation The forecasted depreciation will be $ 1.3 million (Round to one decimal place, and enter all numbers as a positive.) c. Net income The forecasted net income will be $ million (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts