Question: Can you please show me step by step on how to figure out the answers? I can't use excel can you show me how to

Can you please show me step by step on how to figure out the answers? I can't use excel can you show me how to do it by hand? Thank you!

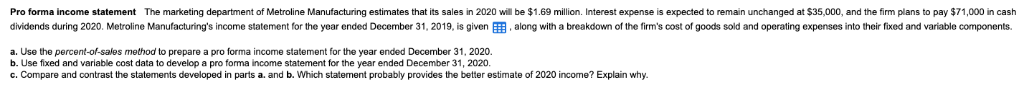

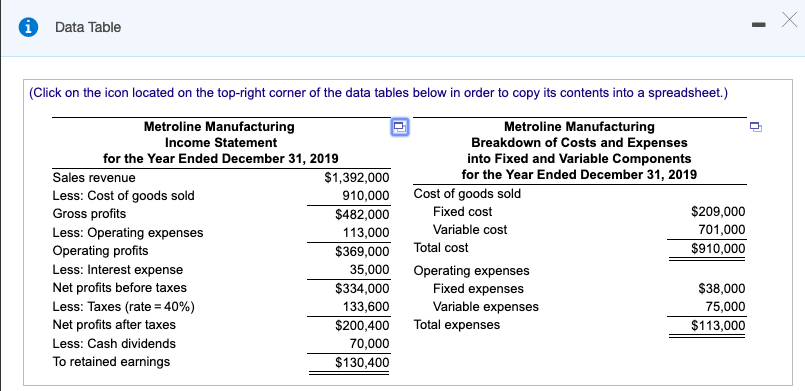

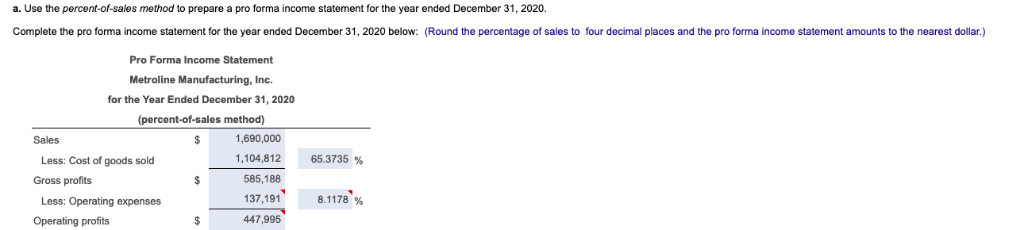

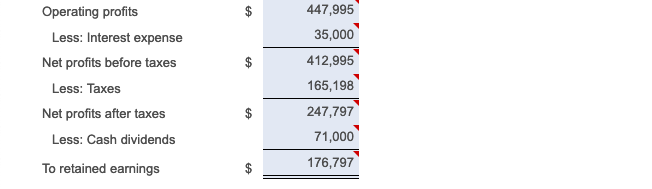

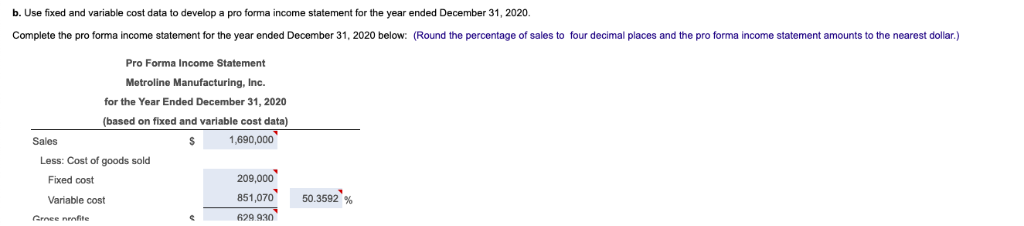

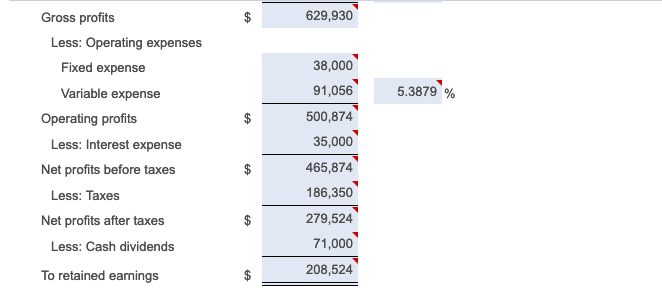

Pro forma income statement The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.69 million. Interest expense is expected to remain unchanged at $35,000, and the firm plans to pay $71,000 in cash dividends during 2020. Metroline Manufacturing's income statement for the year ended December 31, 2019, is givenEB, along with a breakdown of the firm's cost of goods sold and operating expenses into their fixed and variable components. a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020. b. Use fixed and variable cost data to develop a pro forma income statement for the year ended December 31, 2020 c. Compare and contrast the statements developed in parts a. and b. Which statement probably provides the better estimate of 2020 income? Explain why. Data Table (Click on the icon located on the top-right corner of the data tables below in order to copy its contents into a spreadsheet.) Metroline Manufacturing Income Statement for the Year Ended December 31, 2019 Metroline Manufacturing Breakdown of Costs and Expenses into Fixed and Variable Components for the Year Ended December 31, 2019 $1,392,000 910,000 $482,000 113,000 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate-40%) Net profits after taxes Less: Cash dividends To retained earnings Cost of goods sold Fixed cost Variable cost $209,000 701,000 $910,000 $369,000 Total cost 35,000 Operating expenses $334,000 133,600 Fixed expenses Variable expenses $38,000 75,000 $113,000 $200,400 Totalexpenses 70,000 $130,400 a. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020. Complete the pro forma income statement for the year ended December 31, 2020 below: (Round the percentage of sales to four decimal places and the pro forma income statement amounts to the nearest dollar.) Pro Forma Income Statement Metroline Manufacturing, Inc. for the Year Ended December 31, 2020 (percent-of-sales method) Sales 1,690,000 1,104,812 653735 % Less: Cost of goods sold Gross profits 585,188 137,191 447,995 8.1178 % Less: Operating expenses Operating profits 447,995 35,000 412,995 165,198 247,797 71,000 176,797 Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Cash dividends To retained earnings b. Use fixed and variable cost data to develop a pro forma income statement for the year ended December 31, 2020 Complete the pro forma income statement for the year ended December 31, 2020 below: (Round the percentage of sales to four decimal places and the pro forma income statement amounts to the nearest dollar.) Pro Forma Income Statement Metroline Manufacturing, Inc. for the Year Ended December 31, 2020 (based on fixed and variable cost data) Sales 1,690,000 Less: Cost of goods sold 209,000 851,070 629.930 Fixed cost Variable cost 50.3592 % Gross profits 629,930 Less: Operating expenses 38,000 91,056 500,874 35,000 465,874 186,350 279,524 71,000 208,524 Fixed expense Variable expense 5.3879 % Operating profits Less: Interest expense Net profits before taxes Less: Taxes Net profits after taxes Less: Cash dividends To retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts