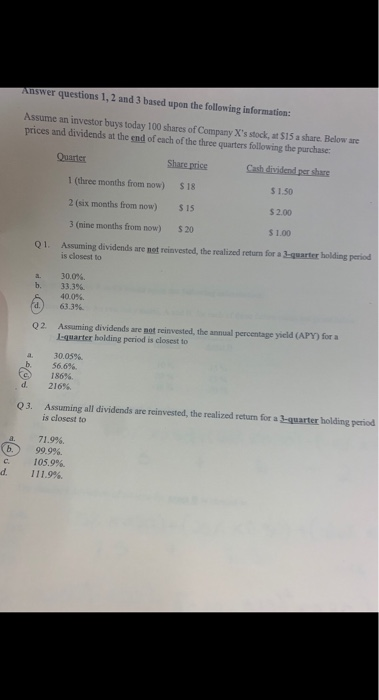

Question: answer questions 1, 2 and 3 based upon the following information: Assume an investor buys today 100 shares of Company X's stock, at $15 a

answer questions 1, 2 and 3 based upon the following information: Assume an investor buys today 100 shares of Company X's stock, at $15 a share. Below are prices and dividends at the end of each of the three quarters following the purchase Quarter Share price Cash dividends share 1 (three months from now) $18 $1.50 $2.00 2 (six months from now) $15 3 (nine months from now) $20 $1.00 Assuming dividends are not reinvested the realized return for L is closest to 01. a ter holding period 30.0% 33.3% 40.06 63.3% Q2 Assuming dividends are not reinvested, the annual percentage yield (APY) for a Lquarter holding period is closest to a. 30.0596 56.6% 186% 21696 Q3. Assuming all dividends are reinvested, the realized return for a is closest to quarter holding period a. 71.9% 99.9% 105.9% 111.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts