Question: answer questions 1 and 2 fully with all work shown 1. The returns on the common stock of New Image Products are quite cyclical. In

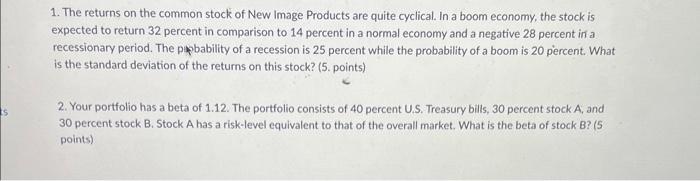

1. The returns on the common stock of New Image Products are quite cyclical. In a boom economy, the stock is expected to return 32 percent in comparison to 14 percent in a normal economy and a negative 28 percent in a recessionary period. The pepbability of a recession is 25 percent while the probability of a boom is 20 percent. What is the standard deviation of the returns on this stock? (5. points) 2. Your portfolio has a beta of 1.12. The portfolio consists of 40 percent U.S. Treasury bills, 30 percent stock A, and 30 percent stock B. Stock A has a risk-level equivalent to that of the overall market. What is the beta of stock B ? ( 5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts