Question: please read and answer the below questions, and each response should be 400-450 words. for a like and good rating!! THANKS :) Please answer questions

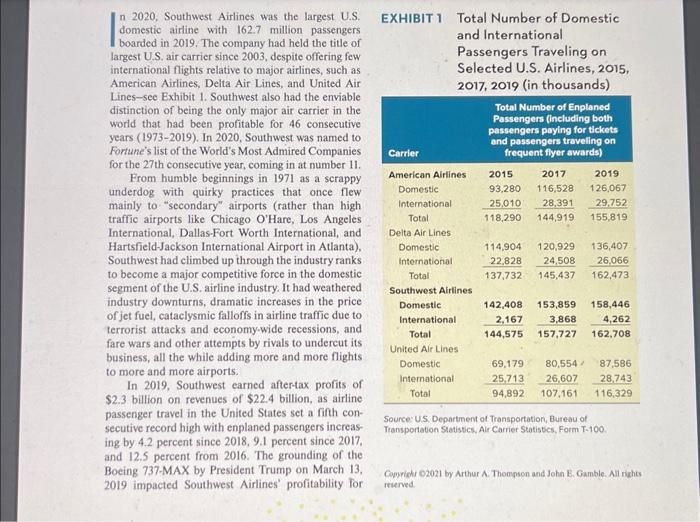

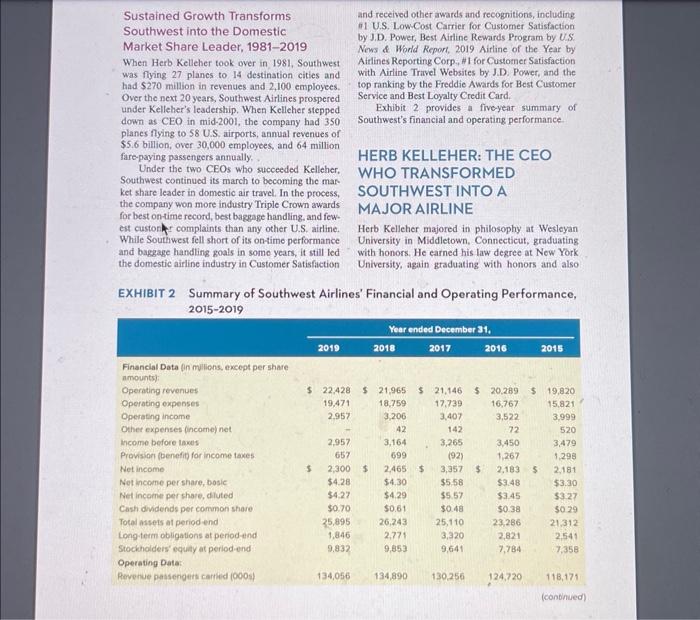

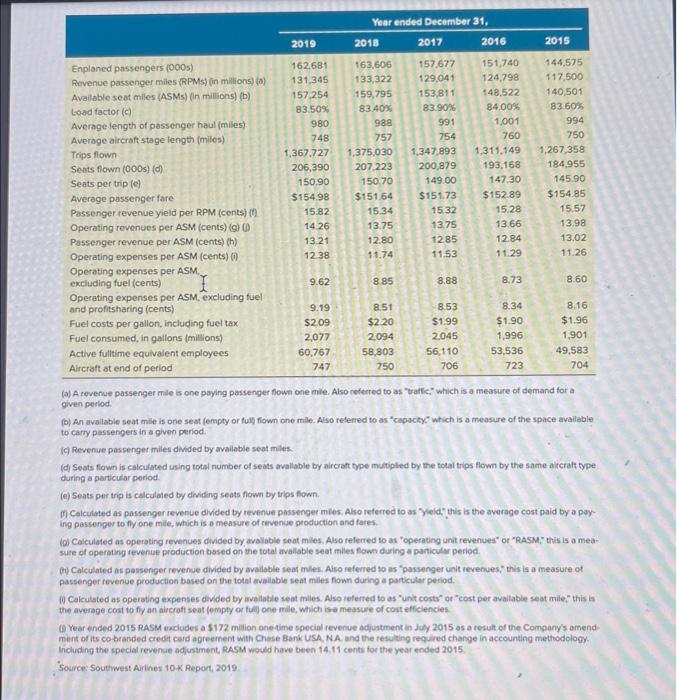

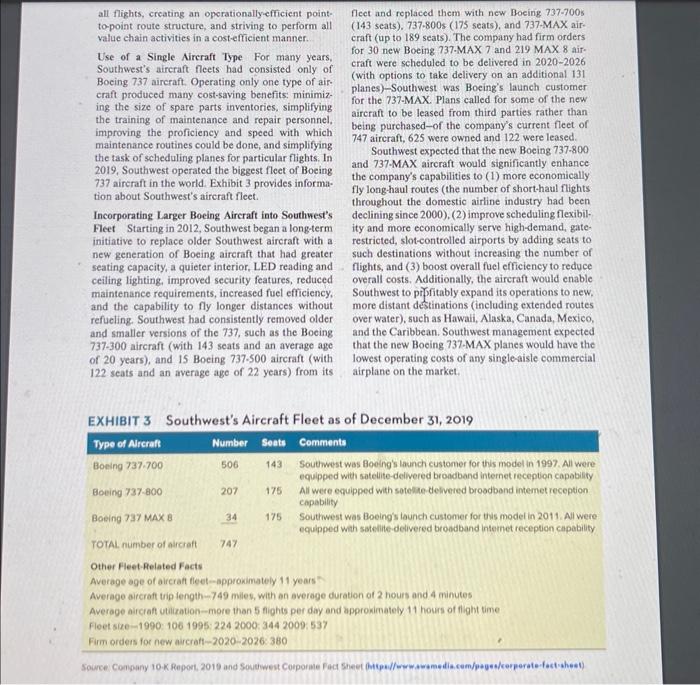

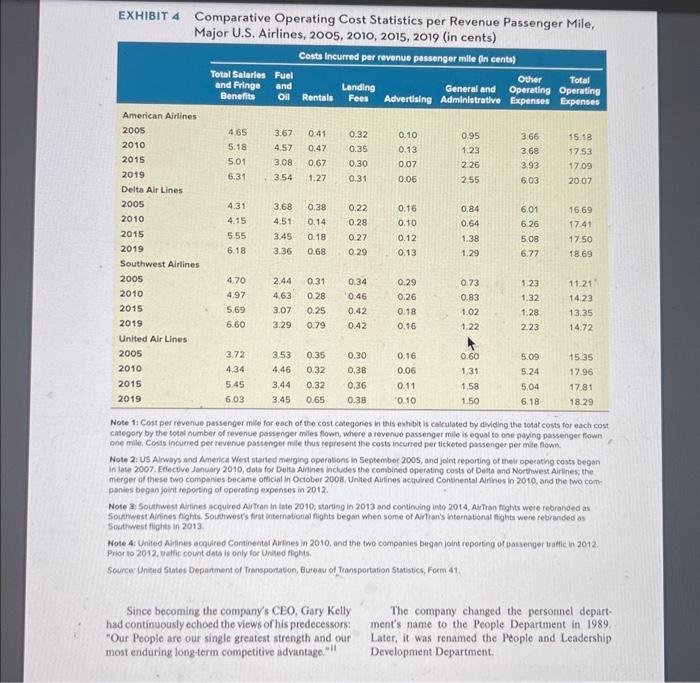

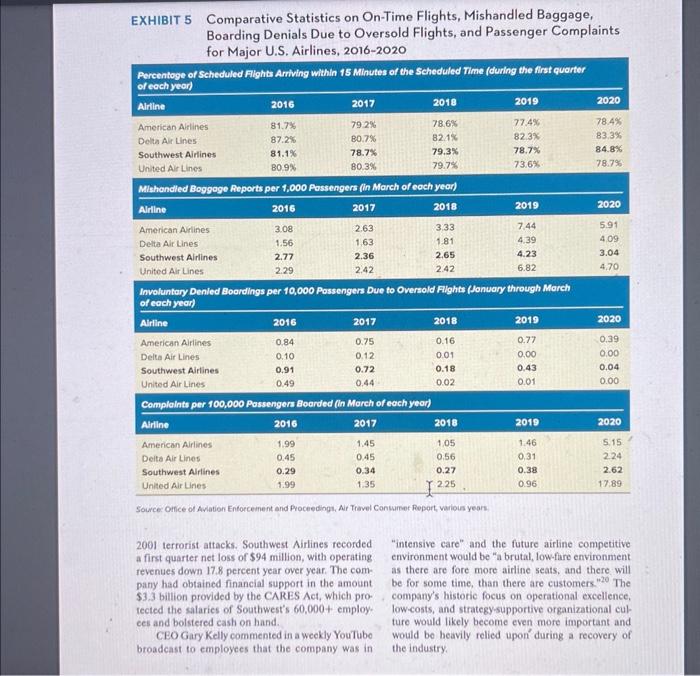

n 2020, Southwest Airlines was the largest U.S. domestic airline with 162.7 million passengers boarded in 2019. The company had held the title of largest U.S. air carrier since 2003, despite offering few international flights relative to major airlines, such as American Airlines, Delta Air Lines, and United Air Lines-see Exhibit 1. Southwest also had the enviable distinction of being the only major air carrier in the world that had been profitable for 46 consecutive years (1973-2019). In 2020, Southwest was named to Fortune's list of the World's Most Admired Companies for the 27 th consecutive year, coming in at number 11 . From humble beginnings in 1971 as a scrappy underdog with quirky practices that once flew mainly to "secondary" airports (rather than high traffic airports like Chicago O'Hare, Los Angeles International, Dallas-Fort Worth International, and Hartsfield-Jackson International Airport in Atlanta), Southwest had climbed up through the industry ranks to become a major competitive force in the domestic segment of the U.S. airline industry. It had weathered industry downturns, dramatic increases in the price of jet fuel, cataclysmic falloffs in airline traffic due to terrorist attacks and economy-wide recessions, and fare wars and other attempts by rivals to undercut its business, all the while adding more and more flights to more and more airports. In 2019, Southwest earned after-tax profits of $2.3 billion on revenues of $22.4 billion, as airline passenger travel in the United States set a fifth consecutive record high with enplaned passengers increasing by 4.2 percent since 2018,9.1 percent since 2017 , and 12.5 percent from 2016. The grounding of the Boeing 737-MAX by President Trump on March 13 , 2019 impacted Southwest Airlines' profitability Tor EXHIBIT 1 Total Number of Domestic and International Passengers Traveling on Selected U.S. Airlines, 2015, 2017, 2019 (in thousands) Source:US, Department of Transportation, Bureau of Transpertation SIatistics. Alr Carrier Statisbcs, Form F-100. Copried 02021 by Arthur A. Thompson and John B. Gamble. All riphts reierved the year as its fleet included 34 737.MAX aircraft. The reliability of the 737 MAX had been brought into question after the crash of Lion Air Flight 610 in Jakarta, Indonesia, on October 29, 2018, which was followed by the crash of Ethiopian Airlines Flight 302 on March 10, 2019. As of mid-2020, all 737-MAX aircraft remained grounded until poeing could develop design changes necessary to mest the Federal Aviation Administration's airworthiness directive. More challenges to the airline industry arose in 2020 as novel Coronavirus brought about stay-at-home orders, social distancing requirements, and remote working protocols. U.S. passenger airlines experienced a combined loss of $5.2 billion for the first quarter of 2020 as a result of the impact of the COVID-19 pandemic on global air travel. The number of passengers flying on U.S. airlines had declined by 96 percent between April 2019 and April 2020 as the world focused on limiting potential exposure to the virus. Only three million passengers flew on U.S, airlines in April 2020, which was the smallest number of monthly air travelers in the United States since 1974. Between March 2020 and April 2020, airline employment had decreased by 31,000 - workers to approximately 428,000 -the lowest total number of full-time employees in the industry since August 2017. Southwest Airlines' strategy, commitment to excellence in operations, and strategy-supportive culture would help the company recover from the devastating effects of the pandemic on the airline industry, but few were predicting when air travel would return to pro-COVID. 19 levels. COMPANY BACKGROUND In late 1966, Rollin King, a San Antonio entrepreneur who owned a small commuter air service, marched into Herb Kelleher's law office with a plan to start a low-cost/low-fare airline that would shuttle passengers between San Antonio, Dallas, and Houston! Over the years, King had heard many Texas business. men complain about the length of time that it took to drive between the three cities and the expense of flying the airlines currently serving these cities. His business concept for the airline was simple: Attract passengers by fying convenient schedules, get pas. sengers to their destination on time, make sure thcy have a good experience, and charge fares competitive with travel by automobile. Kelleher, skeptical that King's business idea was vable, dug into the possibilities during the next fow weeks and concluded a new airline was feasible; he agreed to handle the nee. essary legal work and also to invest $10,000 of his own funds in the venture. In 1967, Kelleher filed papers to incorporate the new airline and submitted an application to the Texas Aeronauties Commission for the new company to begin serving Dallas, Houston, and San Antonio, 2 But rival airlines in Texas pulled every string they could to block the new airline from commencing operations, precipitating a contentious four-year parade of legal and regulatory proceedings. Herb Kelleher led the fight on the company's behalf, eventually prevail ing in June 1971 after winning two appeals to the Texas Supreme Court and a favorable ruling from U.S. Supreme Court. Kelleher recalled, The constant proceedings had gradually come to enrage me. There was no merit to our competitors' legal asser tions. They were simply trying to use their superior economic power to squeeze us dry so we woald collapse before we ever got into business. I was bound and determined to show that Southwest Airlines was going to survive and was going into operation." 1 In January 1971, Lamar Muse was brought in as the CEO to get operations underway. Muse was an aggressive and selfconfident airline veteran who knew the business well and who had the entrepreneurial skills to tackle the challenges of building the airline from scratch and then competing head-on with the major carriers. Through private investors and an initial public offering of stock in June 1971, Muse reiked $7 million in new capital to purchase planes and equip ment and provide cash for startup, Boeing agreed to supply three new 737 s from its imventory, discounting its price from $5 million to $4 million and financing 90 percent of the $12 miltion deal. Muse was able to recruit a talented senior staff that included a number of veteran executives from other carriers. He particolarly sought out people who were innovative, would not shirk doing things differently or unconventionally, and were motivated by the challenge of building an airline from scratch. Muse wanted his executive team to be willing to think like mavericks and not be lulled into instituting practices at Southwest that imitated - what was done at other airlines Southwest's Struggle to Gain a Market Foothold In June 1971, Southwest initiated its first flights with a schedule that soon included six roundtrips between Sustained Growth Transforms Southwest into the Domestic Market Share Leader, 1981-2019 When Herb Kelleher took over in 1981, Southwest was flying 27 planes to 14 destination cities and had $270 million in revenues and 2,100 employees. Over the next 20 years, Southwest Airlines prospered under Kelleher's leadership. When Kelleher stepped down as CEO in mid-2001, the company had 350 planes flying to 58 U.S, airports, annual revenues of $5.6 billion, over 30,000 employees, and 64 million fare-paying passengers annually. Under the two CEOs who succeeded Kelleher. Southwest continued its march to becoming the market share leader in domestic air travel. In the process, the company won more industry Triple Crown awards for best ontime record, best baggage handling, and fewest custon er complaints than any other U.S. airline. While Southwest fell short of its on-time performance and baggage handling goals in some years, it still led the domestic airline industry in Customer Satisfiction and received other awards and recognitions, including 11. U.S. LowCCost Carrier for Customer Satisfaction by J.D. Power, Best Airtine Rewards Program by US. News \& World Report, 2019 Airline of the Year by Atrlines Reporting Corp;, HI for Customer Satisfaction with Airline Trivel Websites by J.D. Power, and the top ranking by the Freddie Awards for Best Customer Service and Best Loyalty Credit Card. Exhibit 2 provides a frveyear summary of Southwest's financial and operating performance. HERB KELLEHER: THE CEO WHO TRANSFORMED SOUTHWEST INTO A MAJOR AIRLINE Herb Kelleher majored in philosophy at Wesleyan University in Middletown, Connecticut, graduating with honors. He earned his law degree at New York University, again graduating with honors and also EXHIBIT 2 Summary of Southwest Airlines' Financial and Operating Performance, 20152019 (a) A cevenue passenger mile is one paying passenger flown one mile. Also referted to as "tratfic." which is a measure of demand for a given pesioct. (b) An avaitable seat mille is one seat (empty or full fiown one mile. Aso rederied to as colpactiy" which is a measure of the space available to carry pessengers in a given period. (c) Revenue pascenger miles didided by arvailable seat miles. (d) Seats fiown is calcuated using total number of seats avallable by aircraft type multipled by the total trips flown by the same aicraft type during a particular period. (e) Seats per trip is calculaied by dividing seats ficwn by trips fown. (f) Caiculated as passenger revenue divided by reventan possenger miles. Also referred to as "Yleld," this is the average cost paid by a paying passenger to fy one mile, which is a measure of revvenue groduction and fares. (a) Calculated as operating revenues divided by avallable se ot miles. Aso referted to as "operating unit revenues" or "RAsM," this is a mear sure of operating fevenie production tosed on the total avalbble seat fmiles flown during a particulur peried. (Py) Caiculated as passenger revenue divided by available seat mles. Also reterned to as "passenger unit revenues," this is a measure of passenger fevenise production based on the total avallable seat milles fown during a partictar period. i) Caiculated as operating expenses divided by avellable seat miles. Aso ieferted to as "unkt costs" or "cost per available seat mile, this is the average cost to fy an aircroft soat (empty or fuvi) one mile, which isa measure of cort efficlencies (1) Year ended 2015 RASM eraciudes a 5172 million one-ime special revenue adiustoment in duly 2015 as a result of the Company/s amend. ment of its co-branded credit cad agreernent with Chase Bbry USA. N.A. and the resulting requled change in accounting methodology. Including the special revenue adiustment RASM wodid have been 14,11 cents for the year ended 2015 . Source: Southwest Airines 10 Report, 2019 fares were bundled into three major categorics: "Wanna Get Away," "Anytime," and "Business Select" 1. "Wanna Get Away" fares were-always the lowest fares and were subject to advance purchase require ments. No fee was charged for changing a previously purchased ticket to a different time or day of travel (rival airlines charged a change fee of $75 to $550 ), but applicable fare differences were applied. The purchase price was non-refundable but the funds could be applied to future travel on Southwest, provided the tickets were not canceled or changed within ten minutes of a flight's scheduled departure. 2. "Anytime" fares were refundable and changeable, and funds could also be applied toward future travel on Southwest. Anytime fares also included a higher frequent flyer point multiplier under Southwest's Rapid Rewards frequent flyer program than do Wanna Get Away fares. 3. "Business Select" fares were refundable and changeable, and funds could be applied toward future travel on Southwest. Business Select fares also included additional perks such as priority boarding, a higher frequent flyer point multiplier than other Southwest fares (including twice as many points per dollar spent as compared to Wanna Get Away fares), priority security and ticket counter access in select airports, and one complimentary adult beverage coupon for the day of travel (for eustomers of legal drinking age). The Business Select fare had been introduced in 2007 to help attract economy-minded business travelers; Business Select customers had carly boarding privileges, received extra Rapid Rewards (frequent flyer) credit, and a free cocktail. 4. No fec was charged for changing a previously. purchased ticket to a different time or day of travel, but applicable fare differences were applied. The purchase price was nonrefundable, but funds could be applied to future travel on Southwest, provided the tickets were not canceled or changed within ten minutes of a flight's scheduled departure. Also, the company's "Bags Fly Frec" program that allowed passengers to check two bags at no additional charge was unmatched by all major airlines in 2020 . Southwest's Rapid Rewards Frequent Flyer Program 'Southwest's Rapid Rewards frequent flyer program. launched in March 2011. linked free travel awards to the number of points members earned purchas. ing tickets to fly Southwest. The amount of points earned was based on the fare and fare class purchased, with higher fare products (like Business Select) earning more points than lower fare products (like Wanna Get Away). Likewise, the amount of points required to be redeemed for a flight was based on the fare and fare class parchased. Rapid Rewards members could also earn points through qualifying purchases with Southwest's Rapid Rewards Partners (which included car rental agencies, hotels, restaurants, and retail locations), and they could purchase points. Members who opted to obtain a Southwest co-branded Chase Visa credir card earned two points for every dollar spent on purchases of Southwest tickets and on purchases with Southwest's car rental and hotel partners, and they earned one point on every dollar spent everywhere else. Holders of Southwest's co-branded Chase Visa credit card could redeem credit card points for items other than travel on Southwest, including international flights on other airlines, cruises, hotel stays, rental cars, gift cards. event tickets, and more. The most active members of Southwest's Rapid Rewards program qualified for priority check-in and security lane access (where available), standby priority, free inflight WiFi, and-provided they flew 100 qualifying flights or earned 125,000 qualifying points in a calendar year-automatically received a Companion Pass, which provided for unlimited free roundtrip travel for one year to any destination avail. able on Southwest for a designated companion of the qualifying Rapid Rewards Member. Rapid Rewards members coald redeem their points for every available seat, every day, on every flight, with no blackout dates. Points did not expire so long as the Rapid Rewards Member had pointscarning activity during the most recent 24 months. Ensuring a Superior Financial Position: Southwest's Strategy to Create and Sustain Low-Cost Operations - Southwest management fully understood that earning attractive profits by charging low fares necessitated the use of strategy elements that would enable the company to become a loweost provider of commercial air service. There were three main components of Southwest's strategic actions to a'chicve a low-cost operating structure, using a single aireraft type for EXHIBIT 4 Comparative Operating Cost Statistics per Revenue Passenger Mile, Maior Wote 1 I Cost per revenue passenger mile for each af the cast calegories in this exhibl is cakulated by dividing the totat costs for each cost category by the fotal number of revenue passenger miles flown, where a revenue passenger mile is equat io one paying passenger fown goe mile, Costs incurred per revenye passenger mile thus represent the costs incurred per ticketed passenger per mile flown. Note 2: US Airways and America Wett started meiging operatons in Septembor 2c05, and joint reporting of their opeeating costs began in late 2007. Effective January 2010, data for Delta Arllnes includes the combined operating costs of Deta and Northwest Arlines, the merger of these two companies became ofticial in October 2008. United Aurines acquied Continental Arines in 2010, and the fwo componies began jotrit reporting of operating expenses in 2012 Note 3i Soctfiwest Arines accuired AurTran in tate 2010 j starting in 2013 and continuing indo 2014 , Airfran faghts weie rebranded as Southwest Alhines fights. Southwost's tart international fights began when some of Artran's ihternational fights were retoranded as Southivest flights in 2013. Note 4: United Airines schiared Continental Airines in 2010 , and the two companies began joint reporting aM basienter trakic in 2012. Prior lo 2012, tedre count dath is only for Uniked flights. Source' Unifed 5 tates Depanment of Transportakion, Eureau of Transportation Statistict, Foem 41. Since becoming the company's CEO, Gary Kelly had continuously echoed the views of his predecessors: "Our People are our single greatest strength and our most enduring long-term competitive advantage." "1 The company changed the personnel department's name to the People Department in 1989. Later, it was renamed the People and Leadership Development Department. - Medical and prescription coverage - Mental health chemical dependency coverage - Vision coverage - Dental coverage. - Adoption assistance - Mental health assistance - Life insurance - Accidental death and dismemberment insurance - Long-term disability insurance - Dependent life insurance - Dependent care flexible spending account - Health care flexible spending account - Employee stock purchase plan - Wellness program - Flight privileges - Health care for committed partners - Early retiree health care Employee Relations About 83 percent of Southwest's 60,800 employees belonged to a union. An in-house union-the Southwest Airline Pilots Association (SWAPA)-represented the company's pilots. The Teamsters Union represented Southwest's material specialists and flight simulator technicians; a local of the Transportation Workers of America represented flight attendants; another local of the Transportation Workers of America represented baggage handlers, ground crews, and provisioning employees; the International Association of Machinists and Acrospace Workers represented customer service and reservation employees, and the Aireraft Mechanics Fraternal Association represented the company's mechanics. Management encouraged union members and negotiators to research their pressing issues and to conduct employee surveys before each contract negotiation. Southwest's contracts with the unions representing its employees were relatively free of restrictive work rules and narrow job classifications that might impede worker productivity. All of the contracts allowed any qualified employee to perform any function-thus pilots, tieket agents, and gate personnel could help load and unload baggage when needed and flight attendants could pick up trash and make flight cabins more presentable for passengers boarding the next flight. Except for one brief strike by machinists in the early 1980 s and some unusually difficult negotiations in 2000-2001, Southwest's relationships with the unions representing its employee groups had been harmonious and nonadversarial for the most part. However, the company was engaged in difficult contract negotiations with its pilots in 2016 and had been at odds with mechanics in 2019 over maintenance and safety concerns that had resulted in 40 planes being taken out of service and the company declaring an operational emergency. The No-Layoff Policy Southwest Airlines had never laid off or furloughed any of its employees since the company began operations in 1971. The company's no-layoff policy was seen as integral to how the company treated its employees and management efforts to sustain and nurture the culture. According to Kelleher, 15 Nothing kills your company's culture like layoffs. Nobody has ever been furloughed here, and that is unprecedented in the airline industry. It's been a huge strength of ours. It's certainly helped negotiate our union contracts..... We could have furioughed at various times and been more profitable, but I always thought that was shortsighted. You want to show your people you value them and you're not going to hurt them just 6 get a little more money in the short term. Not furloufhing people breeds loyalty. It breeds a sense of security. It breeds a sense of trust. Southwest had built up considerable goodwill with its employees and unions over the years by avoiding layoffs. Despite the impact of the Coronavirus pandemic, CEO Gary Kelly reiterated to employees in March 2020 that the company remained committed to its no-layoff policy even though small pay cuts might be necessary to protect the company's solvency. Kelly even pledged to employees that he would work for no salary if the company was forced to ask employees for large pay cuts as a result of the COVID-19 pandemic. Management Style At Southwest, management strived to do things in a manner that would make Southwest employees proud of the company they worked for and its work foree practices. Managers were expected to spend at least onethird of their time out of the oftice, walking around the facilities under their supervision, EXHIBIT 5 Comparative Statistics on On-Time Flights, Mishandled Baggage, Boarding Denials Due to Oversold Flights, and Passenger Complaints for Major U.S. Airlines, 2016-2020 Involuntary Denied Boardings per 10,000 Passengers Dve to Overeold Fights (Jonuary through March ifserehisend Source: Orice of Aviation Enforceinent and Proceedingi, Ar Trevel Consurset Report various years 2001 terrorist attacks. Southwest Airlines recorded a first quarter net loss of $94 million, with operating revenues down 17.8 percent year over year. The company had obtained financial support in the amount \$3.3 billion provided by the CARES Act, which protected the salaries of Southwest's 60,000+ employ: ees and bolstered cash on hand. CEO Gary Kelly commented in a weekly YouTube broadcast to employees that the company was in "intensive care" and the future airline competitive environment would be "a brutal, low-fare environment as there are fore more airline seats, and there will be for some time, than there are customers."20 The company's historic focus on operational excellence, low-costs, and strategy-supportive organizational culture would likely become even more important and would be beavily relied upon' during a recovery of the industry. 1. What are the key policies, procedures, operating practices, and core values underlying Southwest's efforts to implement and execute its low-costo-frills strategy? 2. What are the key elements of Southwest's culture? Is Southwest a strong culture company? Why or why not? What problems do you foresee that Gary Kelly has in sustaining the culture now that Herb Kelleher, the company's long-time spiritual leader, has departed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts