Question: Answer questions 11 and 12 based upon the following information: A company is trying to determine the optimal replacement cycle for a machine that has

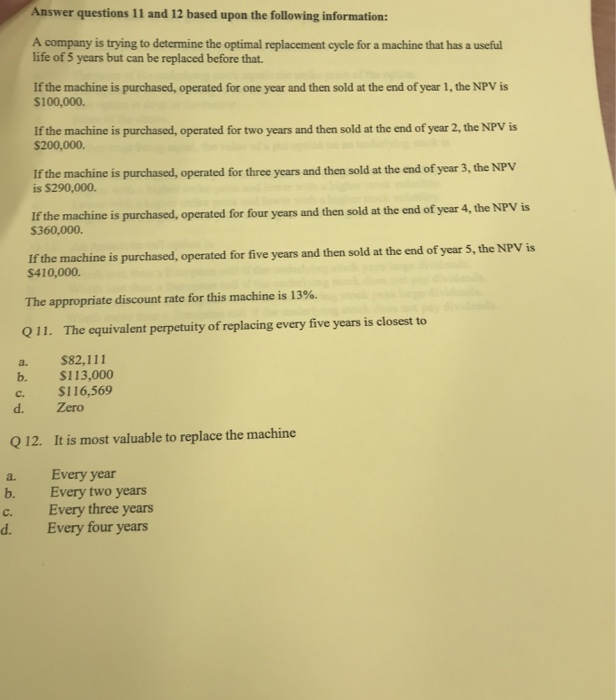

Answer questions 11 and 12 based upon the following information: A company is trying to determine the optimal replacement cycle for a machine that has a useful life of 5 years but can be replaced before that. If the machine is purchased, operated for one year and then sold at the end of year 1, the NPV is $100,000. If the machine is purchased, operated for two years and then sold at the end of year 2, the NPV is $200,000. If the machine is purchased, operated for three years and then sold at the end of year 3, the NPV is $290,000. If the machine is purchased, operated for four years and then sold at the end of year 4, the NPV is S360,000. If the machine is purchased, operated for five years and then sold at the end of year 5, the NPV is $410,000. The appropriate discount rate for this machine is 13%. Q11. The equivalent perpetuity of replacing every five years is closest to a. $82,111 b. $113,000 c. $116,569 d. Zero Q 12. It is most valuable to replace the machine a. b. c. d. Every year Every two years Every three years Every four years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts