Question: Answer questions 1-18 from the information given. Please help solve with copy of work or provide equations. Thank you! TUNC = = 6 Calibri (Body)

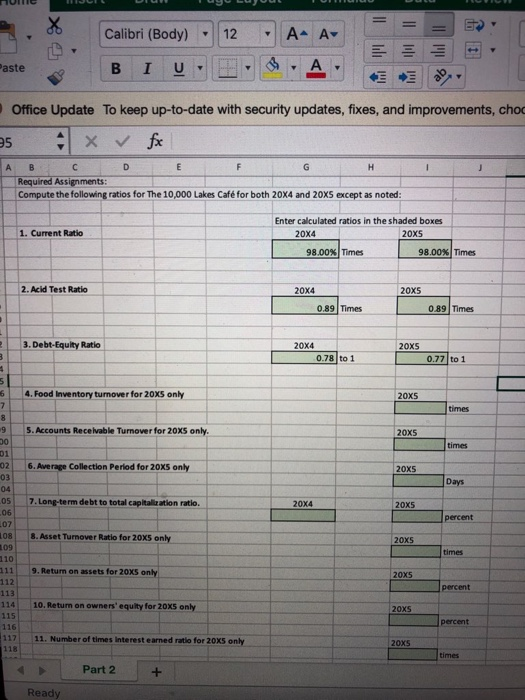

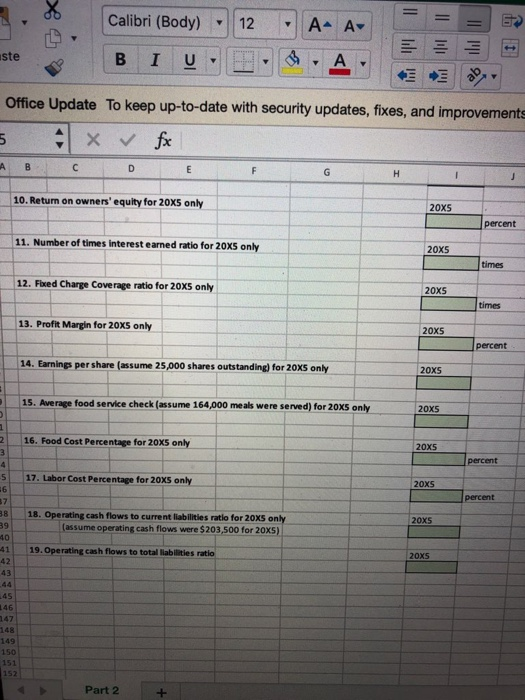

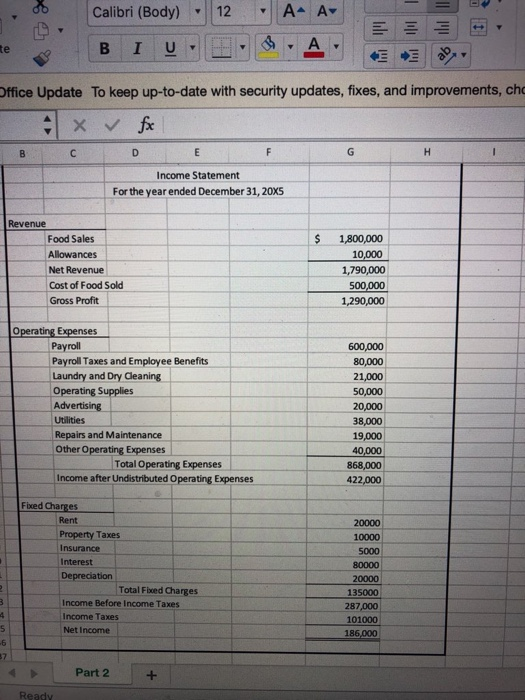

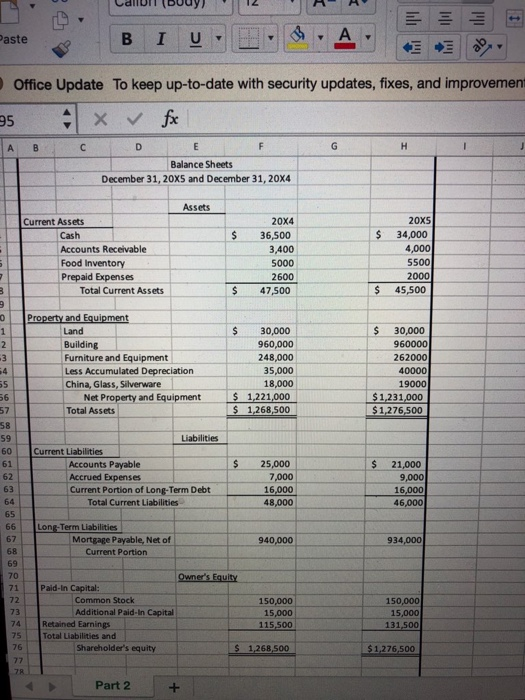

TUNC = = 6 Calibri (Body) - 12 A- B IUBIA Paste aste Office Update To keep up-to-date with security updates, fixes, and improvements, choc 25 x fx A B C D E Required Assignments: Compute the following ratios for The 10,000 Lakes Caf for both 20x4 and 20XS except as noted: 1. Current Ratio Enter calculated ratios in the shaded boxes 20X4 20x5 1 98.00% Times 98.00% Times 2. Acid Test Ratio 20X5 20x4 0.89 Times 0.89 Times 3. Debt-Equity Ratio 20x5 20X4 0.78 to 1 0.77 to 1 4. Food Inventory turnover for 20XS only 20x5 times 5. Accounts Receivable Turnover for 20x5 only. 20X5 times 6. Average Collection Period for 20x5 only SO 20X5 Days 05 .06 7. Long-term debt to total capitalization ratio. 20X4 20X5 percent 108 8 . Asset Turnover Ratio for 20x5 only | 20XS times 9. Return on assets for 20XS only 20x5 110 111 112 113 114 1 percent 10. Return on owners' equity for 20x5 only 20xS 115 percent 116 117 11. Number of times interest earned ratio for 20x5 only 118 Part 2 + Ready 1. Calibri (Body) - 12 A- A B IUEA este DO Office Update To keep up-to-date with security updates, fixes, and improvements 5x & fx ABCD 10. Return on owners' equity for 20x5 only 20x5 percent 11. Number of times interest earned ratio for 20XS only 20X5 12. Fixed Charge Coverage ratio for 20XS only 205. times 13. Profit Margin for 20XS only 20X5 percent 14. Earnings per share (assume 25,000 shares outstanding) for 20x5 only 1 20x5 15. Average food service check (assume 164,000 meals were served) for 20x5 only 20x5 16. Food Cost Percentage for 20x5 only 20X5 percent 17. Labor Cost Percentage for 20x5 only 20x5 percent 18. Operating cash flows to current liabilities ratio for 20x5 only (assume operating cash flows were $ 203,500 for 20x5) 20X5 19. Operating cash flows to total liabilities ratio 146 147 148 149 150 151 152 Part 2 Calibri (Body) BI U Office Update To keep up-to-date with security updates, fixes, and improvements, cho x & fox CDE Income Statement For the year ended December 31, 20X5 $ Revenue Food Sales Allowances Net Revenue Cost of Food Sold Gross Profit 1,800,000 10,000 1,790,000 500,000 1,290,000 Operating Expenses Payroll Payroll Taxes and Employee Benefits Laundry and Dry Cleaning Operating Supplies Advertising Utilities Repairs and Maintenance Other Operating Expenses Total Operating Expenses Income after Undistributed Operating Expenses 600,000 80,000 21,000 50,000 20,000 38,000 19,000 40,000 868,000 422,000 Fixed Charges Rent Property Taxes Insurance Interest Depreciation Total Fixed Charges Income Before Income Taxes Income Taxes Net Income 20000 10000 5000 80000 20000 135000 287,000 101000 186.000 Part 2 Ready Callum (boy) 12 A A Paste B I U Office Update To keep up-to-date with security updates, fixes, and improvement 25 A fx A B C D E Balance Sheets December 31, 20X5 and December 31, 20X4 Assets $ Current Assets Cash Accounts Receivable Food Inventory Prepaid Expenses Total Current Assets 20x4 36,500 3,400 5000 2600 47,500 20x5 34,000 4,000 5500 2000 45,500 $ NA Property and Equipment Land Building Furniture and Equipment Less Accumulated Depreciation China, Glass, Silverware Net Property and Equipment Total Assets 30,000 960,000 248,000 35,000 18,000 $ 1,221,000 $ 1,268,500 30,000 960000 262000 40000 19000 $1,231,000 $ 1,276,500 $ Liabilities Current Liabilities Accounts Payable Accrued Expenses Current Portion of Long-Term Debt Total Current Liabilities 25,000 7.000 16,000 48,000 21,000 9,000 16,000 46.000 Long-Term Liabilities Mortgage Payable, Net of Current Portion 940,000 934,000 Owner's Equity Paid-In Capital: Common Stock Additional Paid-In Capital Retained Earnings Total Liabilities and Shareholder's equity 150,000 15,000 115.500 150,000 15,000 131,500 $ 1.268,500 $1,276,500 Part 2 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts