Question: Answer questions #44 and #45 44. Consider a project with the following cash flows: The Payback Period of this project is 1.6 years. If the

Answer questions #44 and #45

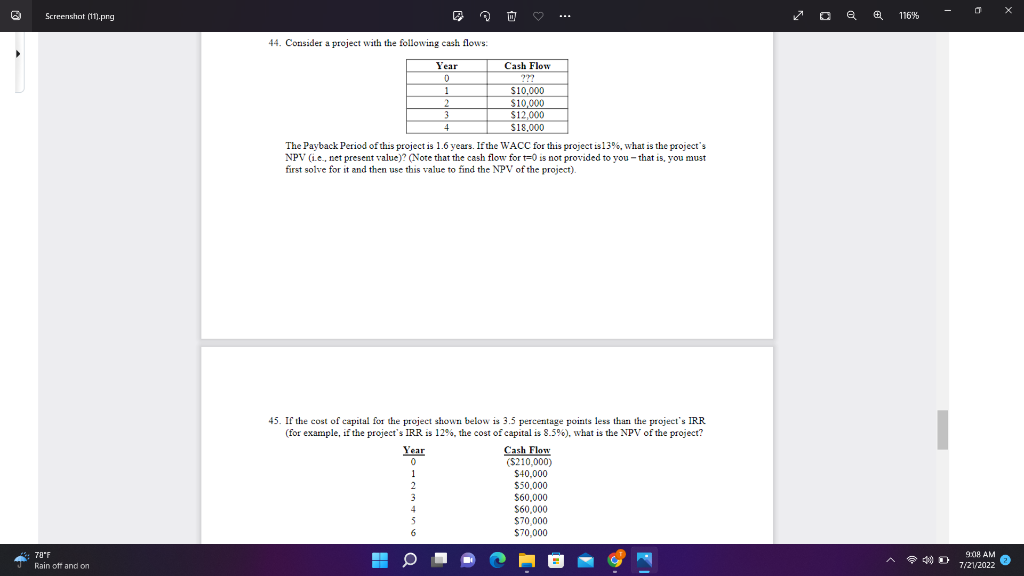

44. Consider a project with the following cash flows: The Payback Period of this project is 1.6 years. If the WACC for this project is 13%, what is the project's NPV (i.e., net present value)? (Note that the cash flow for t=0 is not provided to you - that is, you must first solve for it and then use this value to find the NPV of the project). 45. If the cost of eapital for the project shown below is 3.5 percentage points less than the project's IRR (for example, if the project's IRR is 12%, the cost of capital is 8.5% ), what is the NPV of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts