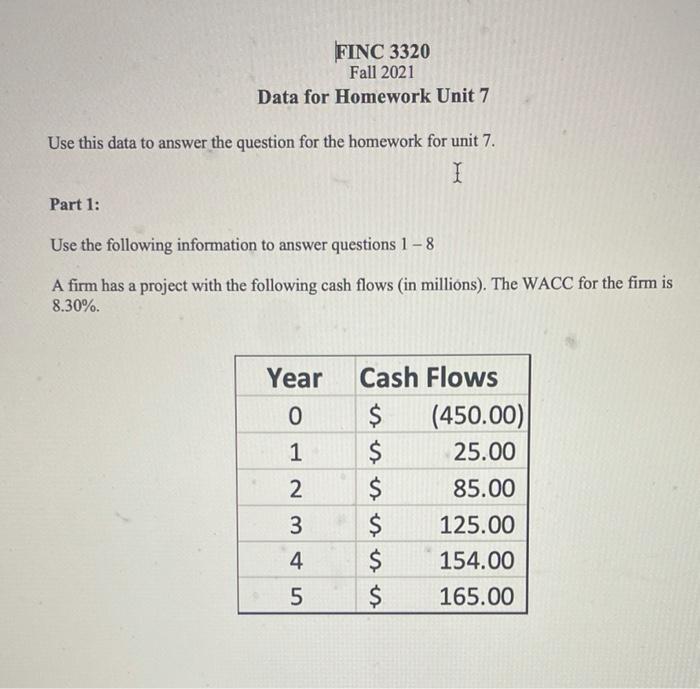

Question: FINC 3320 Fall 2021 Data for Homework Unit 7 Use this data to answer the question for the homework for unit 7. I Part 1:

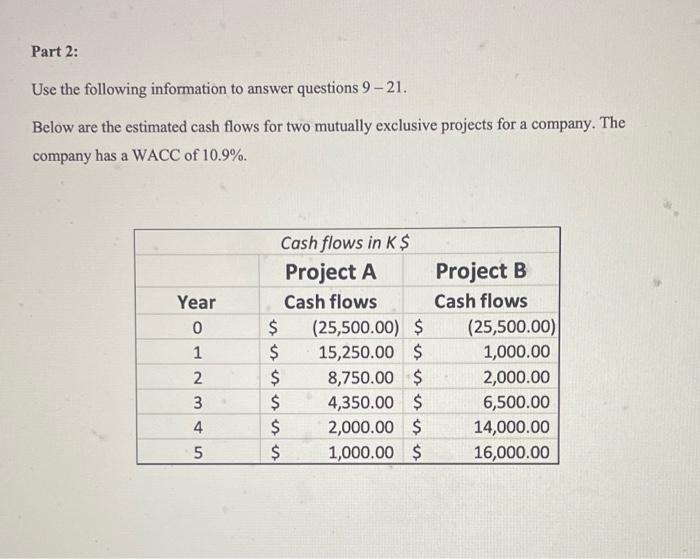

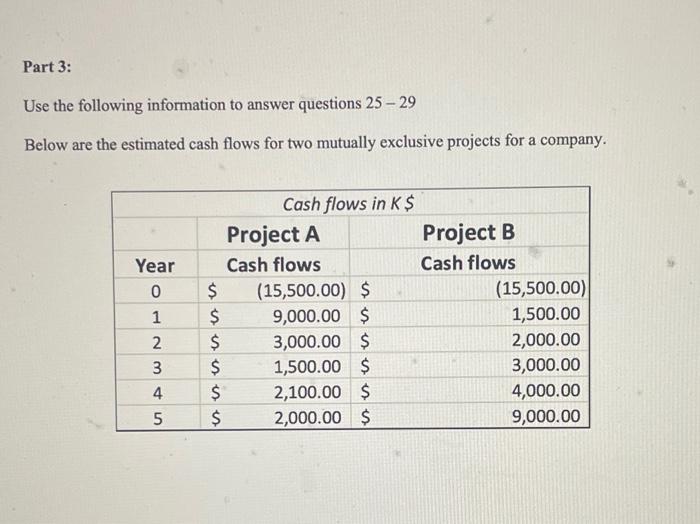

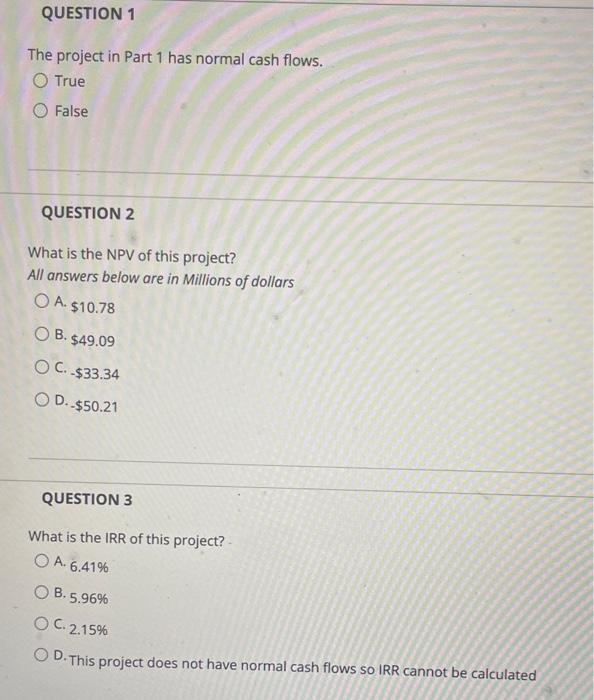

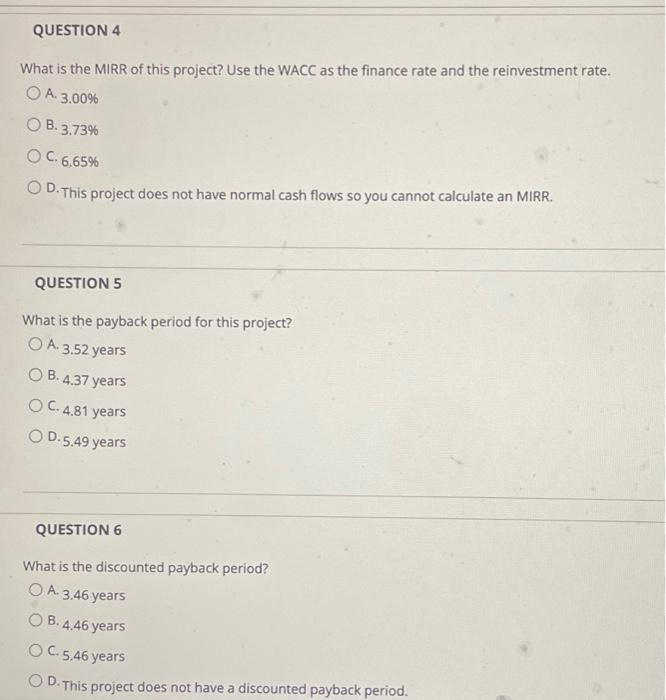

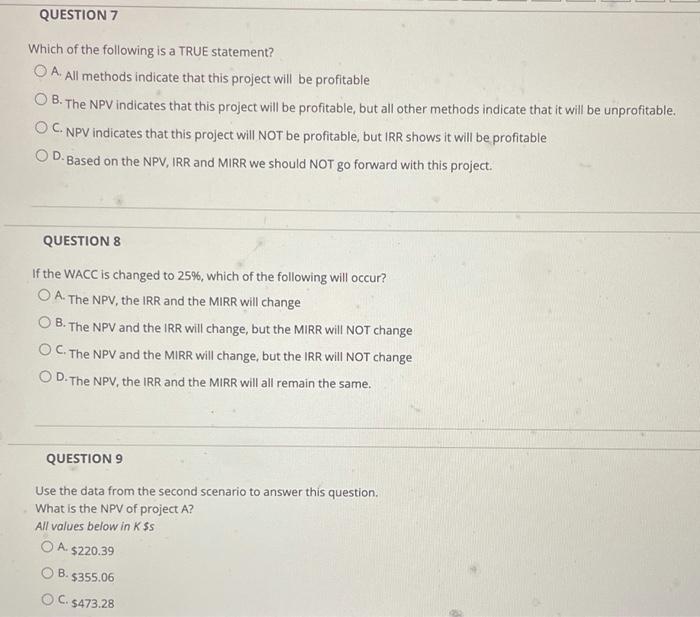

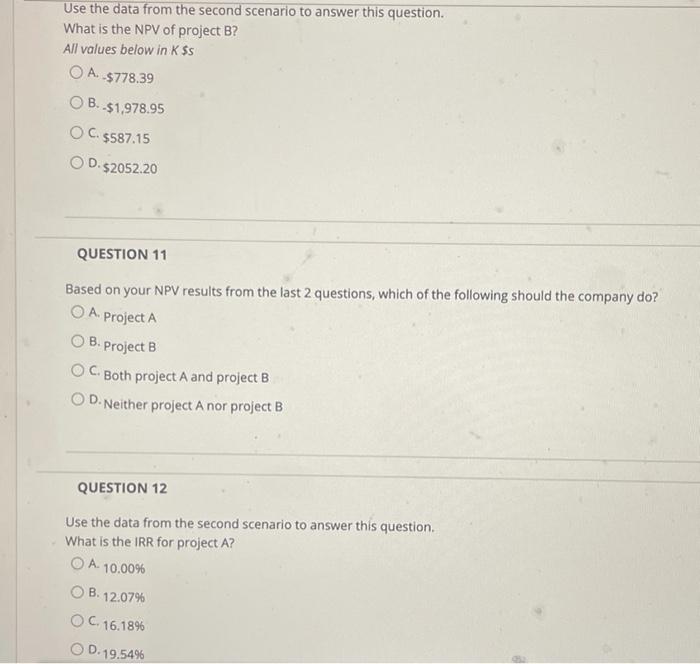

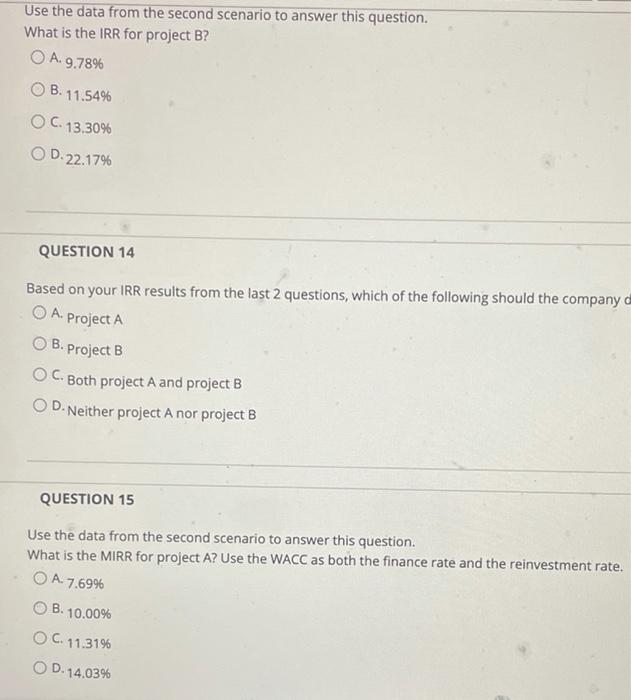

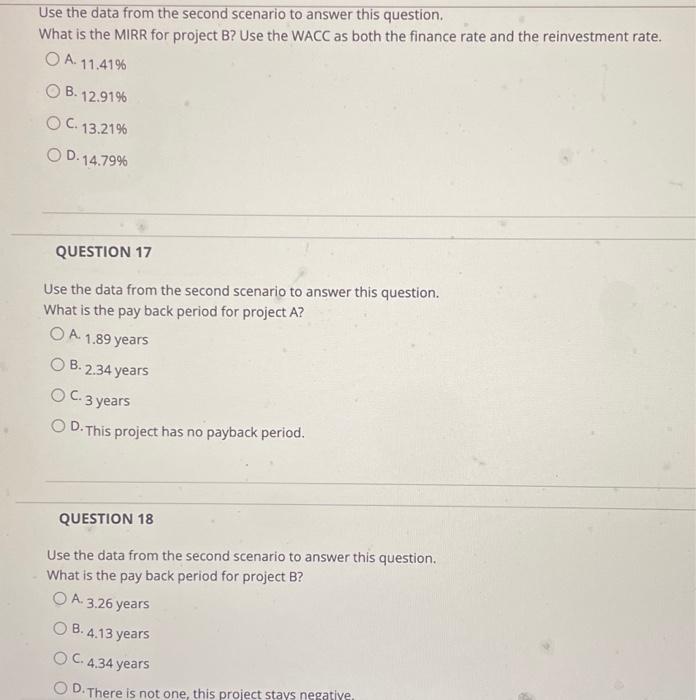

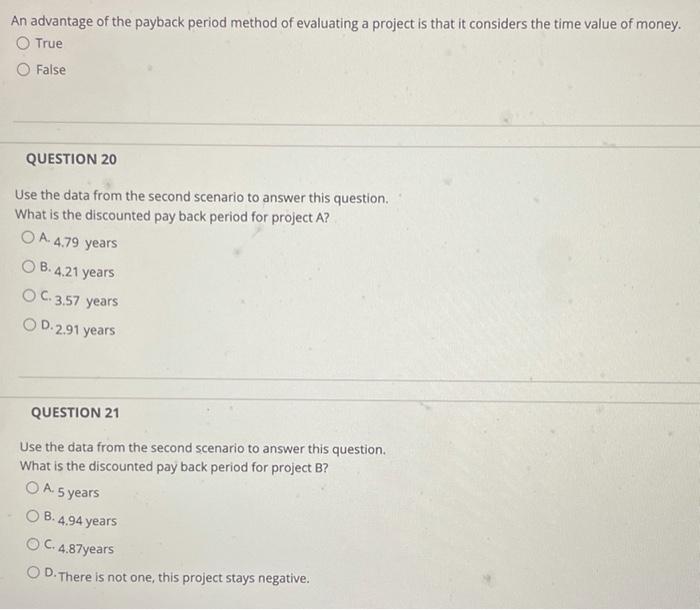

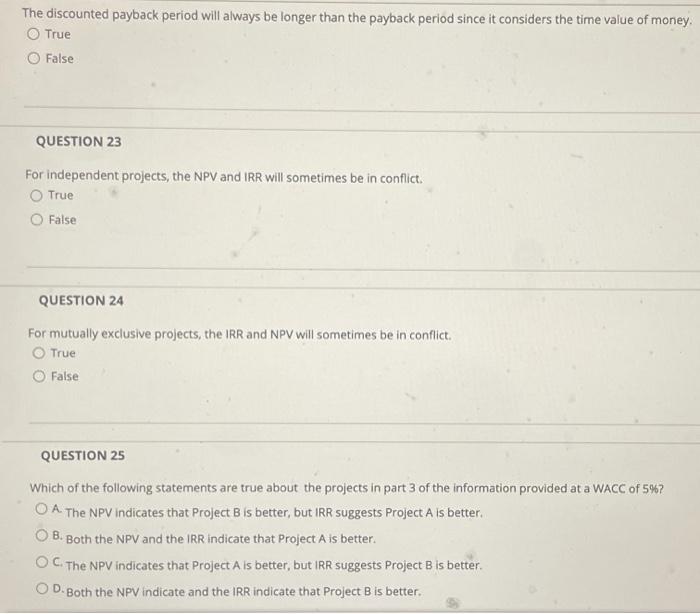

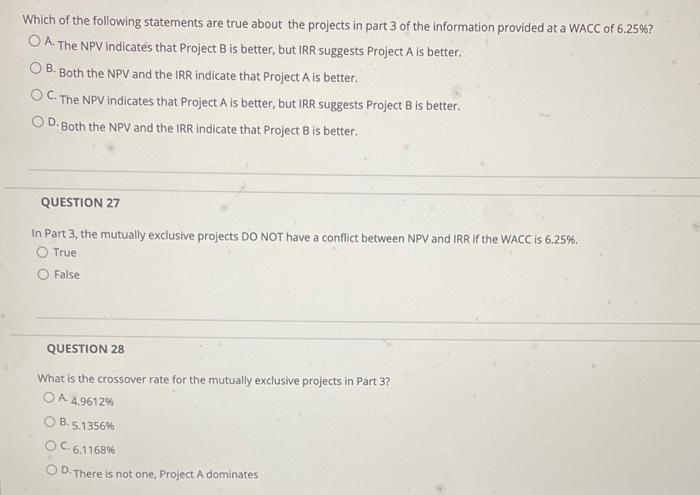

FINC 3320 Fall 2021 Data for Homework Unit 7 Use this data to answer the question for the homework for unit 7. I Part 1: Use the following information to answer questions 1 - 8 A firm has a project with the following cash flows (in millions). The WACC for the firm is 8.30% Year 0 un W NP Cash Flows $ (450.00) $ 25.00 $ 85.00 $ 125.00 $ 154.00 $ 165.00 4 Part 2: Use the following information to answer questions 9-21. Below are the estimated cash flows for two mutually exclusive projects for a company. The company has a WACC of 10.9%. Year 0 1 2. 3 4 5 Cash flows in KS Project A Cash flows $ (25,500.00) $ $ 15,250.00 $ $ 8,750.00 $ $ 4,350.00 $ $ 2,000.00 $ $ 1,000.00 $ Project B Cash flows (25,500.00) 1,000.00 2,000.00 6,500.00 14,000.00 16,000.00 Part 3: Use the following information to answer questions 25 - 29 Below are the estimated cash flows for two mutually exclusive projects for a company. Year 0 1 Cash flows in K$ Project A Project B Cash flows Cash flows $ (15,500.00) $ (15,500.00) $ 9,000.00 $ 1,500.00 $ 3,000.00 $ 2,000.00 $ 1,500.00 $ 3,000.00 $ 2,100.00 $ 4,000.00 $ 2,000.00 $ 9,000.00 N 3 4 5 QUESTION 1 The project in Part 1 has normal cash flows. True False QUESTION 2 What is the NPV of this project? All answers below are in Millions of dollars A. $10.78 O B. $49.09 O C. -$33,34 O D. $50.21 QUESTION 3 What is the IRR of this project? O A. 6.41% B.5.96% O C.2.15% OD. This project does not have normal cash flows so IRR cannot be calculated QUESTION 4 What is the MIRR of this project? Use the WACC as the finance rate and the reinvestment rate. A. 3.00% OB.3.73% OC. 6.6596 OD. This project does not have normal cash flows so you cannot calculate an MIRR. QUESTION 5 What is the payback period for this project? O A. 3.52 years OB. 4.37 years O C.4.81 years OD.5.49 years QUESTION 6 What is the discounted payback period? O A. 3.46 years OB.4.46 years OC.5,46 years OD. This project does not have a discounted payback period. QUESTION 7 Which of the following is a TRUE statement? O A. All methods indicate that this project will be profitable OB. The NPV indicates that this project will be profitable, but all other methods indicate that it will be unprofitable. OC. NPV indicates that this project will NOT be profitable, but IRR shows it will be profitable OD. Based on the NPV, IRR and MIRR we should NOT go forward with this project. QUESTION 8 If the WACC is changed to 25%, which of the following will occur? O A. The NPV, the IRR and the MIRR will change O B. The NPV and the IRR will change, but the MIRR will NOT change OC The NPV and the MIRR will change, but the IRR will NOT change OD. The NPV, the IRR and the MIRR will all remain the same. QUESTIONS Use the data from the second scenario to answer this question. What is the NPV of project A? All values below in K $s OA $220.39 OB. $355.06 OC. $473.28 Use the data from the second scenario to answer this question. What is the NPV of project B? All values below in K $s O A. $778.39 O B..$1,978.95 OC. $587.15 OD.52052.20 QUESTION 11 Based on your NPV results from the last 2 questions, which of the following should the company do? . Project A B. Project B C. Both project A and project B OD. Neither project A nor project B QUESTION 12 Use the data from the second scenario to answer this question. What is the IRR for project A? O A 10.00% B. 12.07% O C. 16.1896 OD. 19.5496 Use the data from the second scenario to answer this question. What is the IRR for project B? O A. 9.78% OB. 11.54% OC. 13.30 OD.22.17% QUESTION 14 Based on your IRR results from the last 2 questions, which of the following should the company d O A. Project A O B. Project B OC. Both project A and project B OD. Neither project A nor project B QUESTION 15 Use the data from the second scenario to answer this question. What is the MIRR for project A? Use the WACC as both the finance rate and the reinvestment rate. OA A 7.69% OB. 10.00% O C. 11.3196 OD.1 - 14.03% Use the data from the second scenario to answer this question. What is the MIRR for project B? Use the WACC as both the finance rate and the reinvestment rate. O A. 11.4196 OB.12.91% O C. 13.21% OD. 14.79% QUESTION 17 Use the data from the second scenario to answer this question. What is the pay back period for project A? O A 1.89 years O B. 2.34 years OC-3 years O D. This project has no payback period. QUESTION 18 Use the data from the second scenario to answer this question. What is the pay back period for project B? 6 years O A. 3.26) O B.4.13 years OC.4.34 years O D.There is not one, this project stays negative An advantage of the payback period method of evaluating a project is that it considers the time value of money. True False QUESTION 20 Use the data from the second scenario to answer this question. What is the discounted pay back period for project A? O A. 4.79 years OB.4.21 years O C.3.57 years OD.2.91 years QUESTION 21 Use the data from the second scenario to answer this question. What is the discounted pay back period for project B? O A 5 years OB.4.94 years OC 4.87years O D. There is not one, this project stays negative. The discounted payback period will always be longer than the payback period since it considers the time value of money. True O False QUESTION 23 For independent projects, the NPV and IRR will sometimes be in conflict. O True False QUESTION 24 For mutually exclusive projects, the IRR and NPV will sometimes be in conflict. True O False QUESTION 25 Which of the following statements are true about the projects in part 3 of the information provided at a WACC of 5%7 O A The NPV indicates that Project B is better, but IRR suggests Project A is better. O B. Both the NPV and the IRR indicate that Project A is better. . The NPV indicates that Project A is better, but IRR suggests Project B is better. D. Both the NPV indicate and the IRR indicate that Project B is better. Which of the following statements are true about the projects in part 3 of the information provided at a WACC of 6.25%? O A. The NPV Indicates that Project B is better, but IRR suggests Project A is better. O B. Both the NPV and the IRR indicate that Project A is better. OC. The NPV indicates that Project A is better, but IRR suggests Project B is better. OD. Both the NPV and the IRR indicate that Project B is better. QUESTION 27 In Part 3, the mutually exclusive projects DO NOT have a conflict between NPV and IRR if the WACC is 6.25%. True O False QUESTION 28 What is the crossover rate for the mutually exclusive projects in Part 3? O A 4.9612% OB.5.1356% OC.6.1168% OD. There is not one, Project A dominates If the WACC changes, the crossover rate will change O True as well. O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts