Question: Answer questions 7, 8, 9 and 10 based upon the following information: Answer questions 7, 8, 9 and 10 based upon the following information: Columbus

Answer questions 7, 8, 9 and 10 based upon the following information:

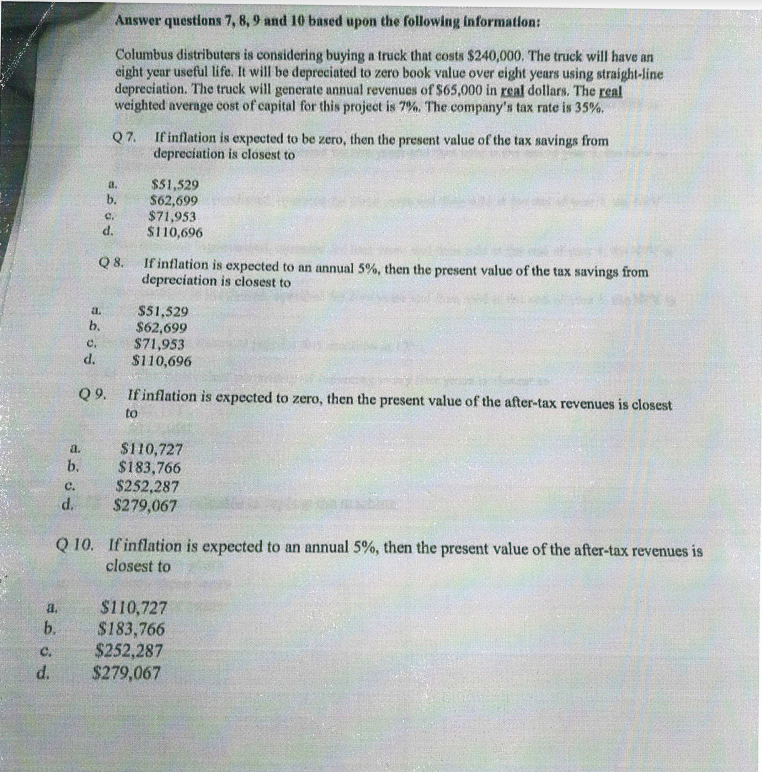

Answer questions 7, 8, 9 and 10 based upon the following information: Columbus distributers is considering buying a truck that costs $240,000. The truck will have an eight year useful life. It will be depreciated to zero book value over eight years using straight-line depreciation. The truck will generate annual revenues of $65,000 in real dollars. The real weighted average cost of capital for this project is 7%. The company's tax rate is 35%. Q7. If inflation is expected to be zero, then the present value of the tax savings from depreciation is closest to a. $51,529 b. S62,699 . $71,953 d. $110,696 Q8. If inflation is expected to an annual 5%, then the present value of the tax savings from depreciation is closest to a. S51,529 b. $62,699 . $71,953 d. S110,696 o9. If inflation is expected to zero, then the present value of the after-t to ax revenues is closest a. SI10,727 b. $183,766 c $252.287 d $279,067 Q 10. lfinflation is expected to an annual 5%, then the present value of the after-tax revenues is closest to a S110,727 b. $183,766 c. $252,287 d. $279,067

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts