Question: Answer questions Problem 17-16 (Algo) Part 3 3. Prepare a pension spreadsheet to assist you in determining end of 2021 balances in the PEG, plan

Answer questions

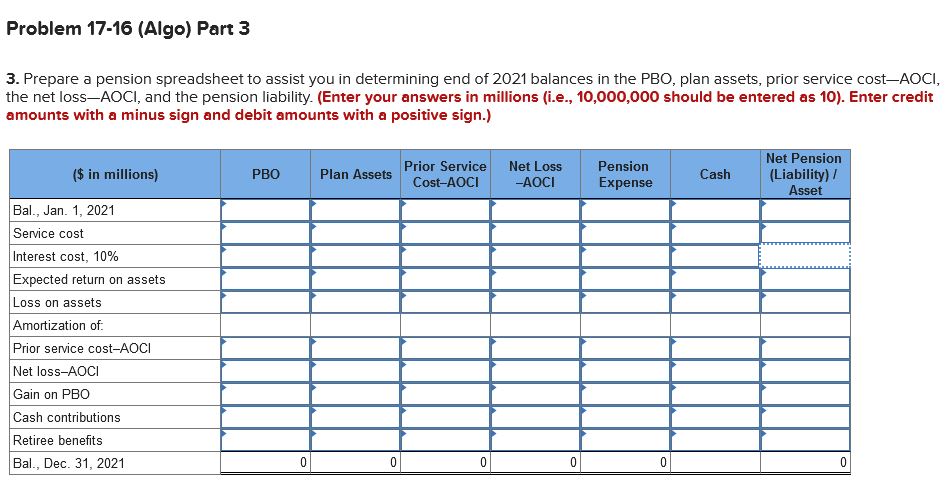

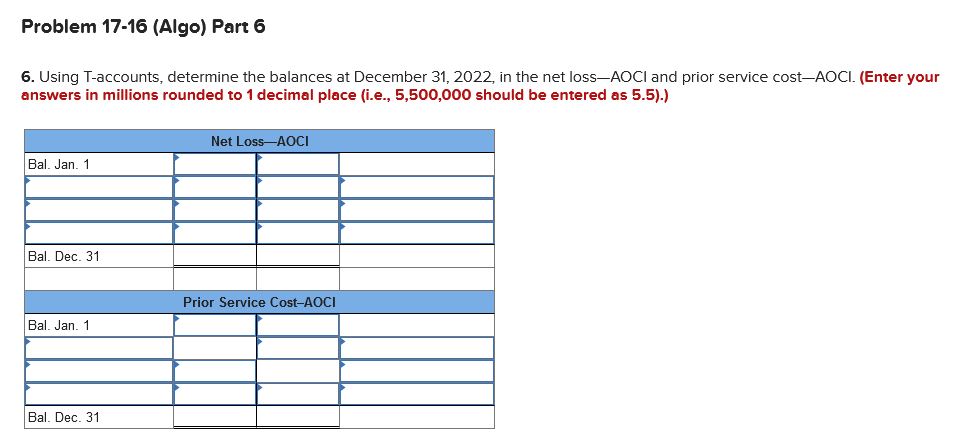

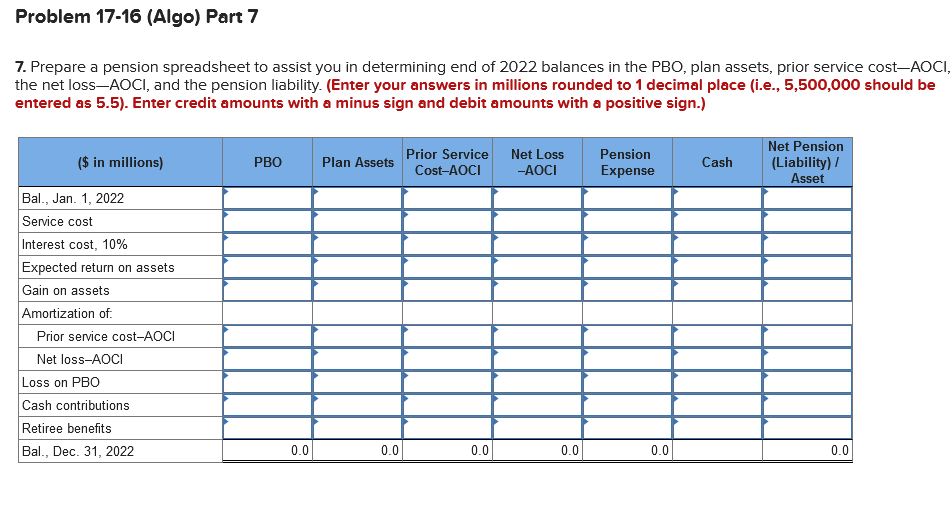

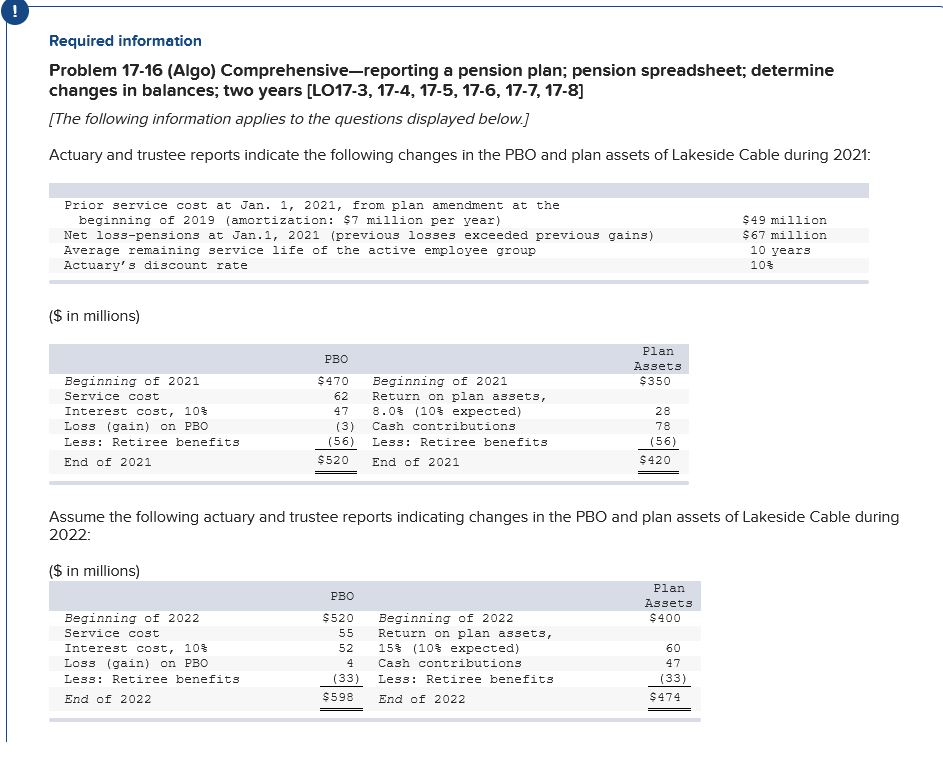

Problem 17-16 (Algo) Part 3 3. Prepare a pension spreadsheet to assist you in determining end of 2021 balances in the PEG, plan assets, pn'or service costAOCI, the net lossAOCI, and the pension liability. {Enter your answers in millions {i.e., 10,000,000 should be entered as 10}. Enter credit amounts with a minus sign and debit amounts with a positive sign.) BaL, Dec. 3'1, 2021 Problem 17-16 (Algo) Part 6 6. Using T-accounts, determine the balances at December 31, 2022, in the net loss-AOCI and prior service cost-AOCI. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).) Net Loss-AOCI Bal. Jan. 1 Bal. Dec. 31 Prior Service Cost-AOCI Bal. Jan. 1 Bal. Dec. 31Problem 17-16 (Algo) Part 7 7. Prepare a pension spreadsheet to assist you in determining end of 2022 balances in the PBO, plan assets, prior service cost-AOCI, the net loss-AOCI, and the pension liability. (Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Enter credit amounts with a minus sign and debit amounts with a positive sign.) Net Pension ($ in millions) PBO Plan Assets Prior Service Net Loss Pension Cost-AOCI -AOCI Cash Expense (Liability) / Asset Bal., Jan. 1, 2022 Service cost Interest cost, 10% Expected return on assets Gain on assets Amortization of. Prior service cost-AOCI Net loss-AOCI Loss on PBO Cash contributions Retiree benefits Bal., Dec. 31, 2022 0.0 0.0 0.0 0.0 0.0 0.0Required information Problem 17-16 {Algal Comprehensivereporting a pension plan; pension spreadsheet; determine changes in balances; two years [L017-3, 17-4, 17-5, 17-6, 17-7, 17-8] (The foiiowing infomaiion applies to the questions displayed beiovu] Actuary and trustee reports indicate the following changes in the P30 and plan assets of Lakeside Cable during 2021: Prior service cost at Jan. 1, 2021Ir from plan amendment at the beginning of 2019 {amortization: $? million per year} $49 million Net losspensions at Jan.1, 2021 {previous losses exceeded previous gains} $6? million Average remaining service life of the active employee group 10 years Actuary's discount rate 10% {5 in millions} Plan 950- Assets Beginning of 2021 $470 Beginning of 2021 $350 Service cost 62 Return on plan assets, Interest cost, 10% 47 8.0% {10% expected} 28 Loss {gain} on PEG {3} Cash contributions T3 Less: Retiree benefits E56} Less: Retiree benefits {56} End of 2021 $520 End of 2:321 $420 Assume the following actuary and tmstee reports indicating changes in the PEG and plan assets of Lakeside Cable during 2022: {5 in millions] Plan P30 Assets Beginning of 2022 $520 Beginning of 2022 $400 Service cost 55 Return on plan assets, Interest costr 10% 52 15% {10% expected} 60 Loss {gain} on PEG 4 Cash contributions 4? Less: Retiree benefits I33} Less: Retiree benefits {33} End of 2022 $593 End of 2022 $474

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts