Question: Use Facts from Problem P 17-16 in the textbook for Lakeside Cable company to prepare pension worksheet for 2021 and 2022 (ignore other requirements). Create

Use Facts from Problem P 17-16 in the textbook for Lakeside Cable company to prepare pension worksheet for 2021 and 2022 (ignore other requirements). Create a separate tab in excel for each year.

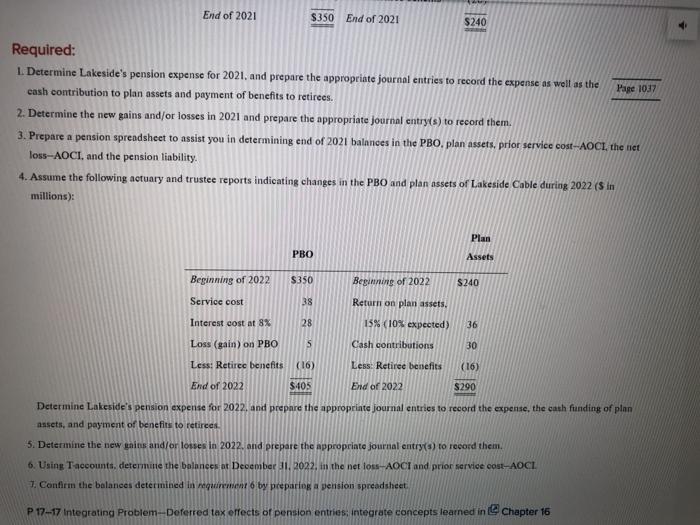

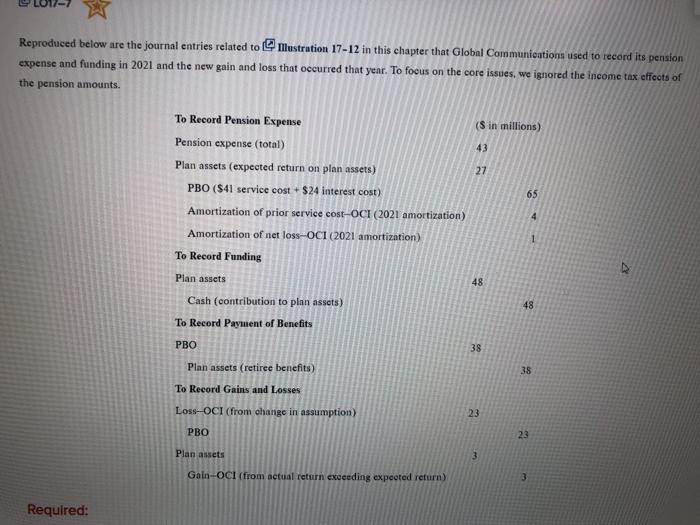

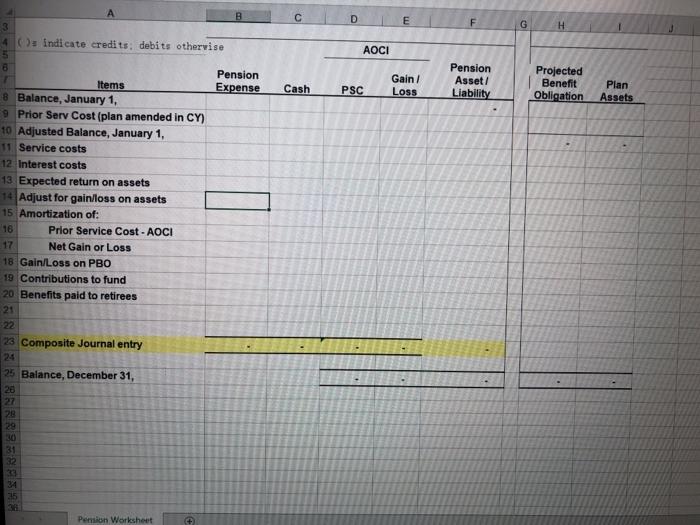

Use Facts from Problem P 17-16 in the textbook for Lakeside Cable company to prepare pension worksheet for 2021 and 2022 (ignore other requirements). Create a separate tab in excel for each year.End of 2021 $350 End of 2021 $240 Required: 1. Determine Lakeside's pension expense for 2021. and prepare the appropriate journal entries to record the expense as well as the Hage 1037 eash contribution to plan assets and payment of benefits to retirees. 2. Determine the new gains and/or losses in 2021 and prepare the appropriate journal entry(s) to record them. 3. Prepare a pension spreadsheet to assist you in determining end of 2021 balances in the PBO. plan assets, prior service cost-AOCL the net loss-AOCI. and the pension liability. 4. Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2022 (S in millions): Plan PBO Assets Beginning of 2022 $350 Beginning of 2022 $240 Service cost 38 Return on plan assets, Interest cost at 8% 28 15% (10% expected) 36 Loss (gain) on PBO S Cash contributions 30 Less: Retiree benefits (16) Less: Retiree benefits (16) End of 2022 $405 End of 2022 $290 Determine Lakeside's pension expense for 2022, and prepare the appropriate journal entries to record the expense, the cash funding of plan assets, and payment of benefits to retirees 5. Determine the new gains and/or losses in 2022. and prepare the appropriate journal entry to record them. 6. Using Taccounts, determine the balances at December 11, 2022, in the net loss-AOCI and prior service cost-AOCI 7. Confirm the balances determined in requirement 6 by preparios pension spreadsheet P 17-17 Integrating Problem-Deferred tax effects of pension entries: integrate concepts learned in Chapter 16 Reproduced below are the journal entries related to Mustration 17-12 in this chapter that Global Communications used to record its pension expense and funding in 2021 and the new gain and loss that occurred that year. To focus on the core issues, we ignored the income tax effects of the pension amounts. (S in millions) 43 27 To Record Pension Expense Pension expense (total) Plan assets (expected return on plan assets) PBO ($41 service cost + $24 interest cost) Amortization of prior service cost-OCI (2021 amortization) Amortization of net loss-OCI (2021 amortization) To Record Funding 65 4 1 Plan assets 48 48 Cash (contribution to plan assets) To Record Payment of Benefits PBO 38 38 Plan assets (retiree benefits) To Record Gains and Losses Loss-OCI (from change in assumption) 23 PBO 23 Plan assets 3 Gain-OCI (from actual return exceeding expected return) Required: D E G H 3 4 (): indicate credits: debits otherwise AOCI Pension Expense Pension Asset Liability Cash Gain/ Loss Projected Benefit Obligation PSC Plan Assets 8 Items 8 Balance, January 1, 9 Prior Serv Cost (plan amended in CY) 10 Adjusted Balance, January 1, 11 Service costs 12 Interest costs 13 Expected return on assets 14 Adjust for gain/loss on assets 15 Amortization of: 16 Prior Service Cost - AOCI 17 Net Gain or Loss 18 Gain/Loss on PBO 19 Contributions to fund 20 Benefits paid to retirees 21 22 23 Composite Journal entry 24 25 Balance, December 31, 28 27 28 30 31 32 34 35 3 Pension Worksheet End of 2021 $350 End of 2021 $240 Required: 1. Determine Lakeside's pension expense for 2021. and prepare the appropriate journal entries to record the expense as well as the Hage 1037 eash contribution to plan assets and payment of benefits to retirees. 2. Determine the new gains and/or losses in 2021 and prepare the appropriate journal entry(s) to record them. 3. Prepare a pension spreadsheet to assist you in determining end of 2021 balances in the PBO. plan assets, prior service cost-AOCL the net loss-AOCI. and the pension liability. 4. Assume the following actuary and trustee reports indicating changes in the PBO and plan assets of Lakeside Cable during 2022 (S in millions): Plan PBO Assets Beginning of 2022 $350 Beginning of 2022 $240 Service cost 38 Return on plan assets, Interest cost at 8% 28 15% (10% expected) 36 Loss (gain) on PBO S Cash contributions 30 Less: Retiree benefits (16) Less: Retiree benefits (16) End of 2022 $405 End of 2022 $290 Determine Lakeside's pension expense for 2022, and prepare the appropriate journal entries to record the expense, the cash funding of plan assets, and payment of benefits to retirees 5. Determine the new gains and/or losses in 2022. and prepare the appropriate journal entry to record them. 6. Using Taccounts, determine the balances at December 11, 2022, in the net loss-AOCI and prior service cost-AOCI 7. Confirm the balances determined in requirement 6 by preparios pension spreadsheet P 17-17 Integrating Problem-Deferred tax effects of pension entries: integrate concepts learned in Chapter 16 Reproduced below are the journal entries related to Mustration 17-12 in this chapter that Global Communications used to record its pension expense and funding in 2021 and the new gain and loss that occurred that year. To focus on the core issues, we ignored the income tax effects of the pension amounts. (S in millions) 43 27 To Record Pension Expense Pension expense (total) Plan assets (expected return on plan assets) PBO ($41 service cost + $24 interest cost) Amortization of prior service cost-OCI (2021 amortization) Amortization of net loss-OCI (2021 amortization) To Record Funding 65 4 1 Plan assets 48 48 Cash (contribution to plan assets) To Record Payment of Benefits PBO 38 38 Plan assets (retiree benefits) To Record Gains and Losses Loss-OCI (from change in assumption) 23 PBO 23 Plan assets 3 Gain-OCI (from actual return exceeding expected return) Required: D E G H 3 4 (): indicate credits: debits otherwise AOCI Pension Expense Pension Asset Liability Cash Gain/ Loss Projected Benefit Obligation PSC Plan Assets 8 Items 8 Balance, January 1, 9 Prior Serv Cost (plan amended in CY) 10 Adjusted Balance, January 1, 11 Service costs 12 Interest costs 13 Expected return on assets 14 Adjust for gain/loss on assets 15 Amortization of: 16 Prior Service Cost - AOCI 17 Net Gain or Loss 18 Gain/Loss on PBO 19 Contributions to fund 20 Benefits paid to retirees 21 22 23 Composite Journal entry 24 25 Balance, December 31, 28 27 28 30 31 32 34 35 3 Pension Worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts