Question: Answer quickly for thumbs up 1. PDE-I, Inc. is considering the manufacture of novelty items for a given market. Land may be purchased adjacent to

Answer quickly for thumbs up

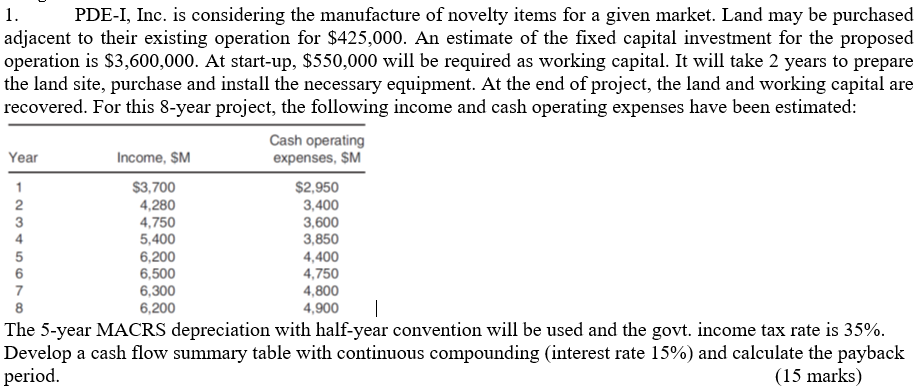

1. PDE-I, Inc. is considering the manufacture of novelty items for a given market. Land may be purchased adjacent to their existing operation for $425,000. An estimate of the fixed capital investment for the proposed operation is $3,600,000. At start-up, $550,000 will be required as working capital. It will take 2 years to prepare the land site, purchase and install the necessary equipment. At the end of project, the land and working capital are recovered. For this 8-year project, the following income and cash operating expenses have been estimated: The 5-year MACRS depreciation with half-year convention will be used and the govt. income tax rate is 35%. Develop a cash flow summary table with continuous compounding (interest rate 15\%) and calculate the payback period. (15 marks) 1. PDE-I, Inc. is considering the manufacture of novelty items for a given market. Land may be purchased adjacent to their existing operation for $425,000. An estimate of the fixed capital investment for the proposed operation is $3,600,000. At start-up, $550,000 will be required as working capital. It will take 2 years to prepare the land site, purchase and install the necessary equipment. At the end of project, the land and working capital are recovered. For this 8-year project, the following income and cash operating expenses have been estimated: The 5-year MACRS depreciation with half-year convention will be used and the govt. income tax rate is 35%. Develop a cash flow summary table with continuous compounding (interest rate 15\%) and calculate the payback period. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts