Question: Answer required A and B please. EzTech, a calendar year accrual basis corporation, generated $ 9 9 4 . 3 0 0 ordinary income from

Answer required A and B please.

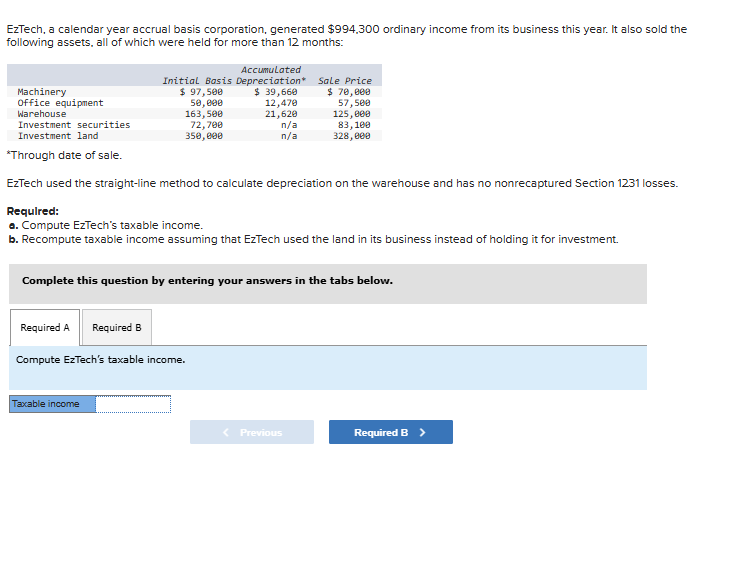

EzTech, a calendar year accrual basis corporation, generated $ ordinary income from its business this year. It also sold the

following assets, all of which were held for more than months:

Through date of sale.

EzTech used the straightline method to calculate depreciation on the warehouse and has no nonrecaptured Section losses.

Required:

a Compute EzTech's taxable income.

b Recompute taxable income assuming that EzTech used the land in its business instead of holding it for investment.

Complete this question by entering your answers in the tabs below.

Compute EzTech's taxable income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock