Question: answer should be 12.28% but not sure how to do it need step by step solution (please dont use excel) A mining corporation purchased $120,000

answer should be 12.28% but not sure how to do it

need step by step solution (please dont use excel)

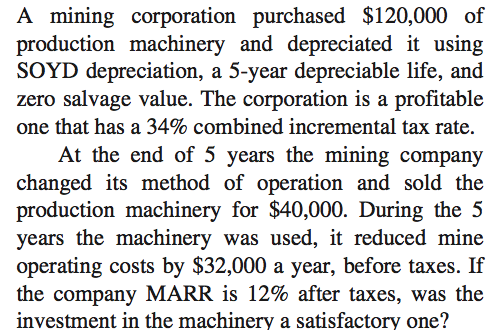

A mining corporation purchased $120,000 of production machinery and depreciated it using SOYD depreciation, a 5-year depreciable life, and zero salvage value. The corporation is a profitable one that has a 34% combined incremental tax rate. At the end of 5 years the mining company changed its method of operation and sold the production machinery for $40,000. During the 5 years the machinery was used, it reduced mine operating costs by $32,000 a year, before taxes. If the company MARR is 12% after taxes, was the investment in the machinery a satisfactory one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts