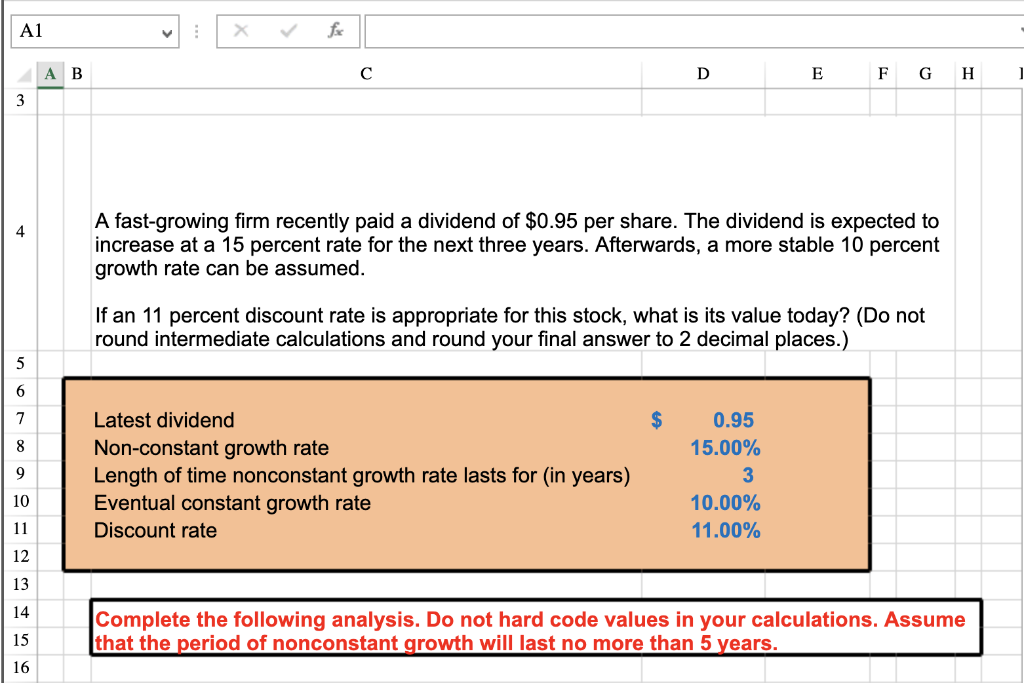

Question: ANSWER SHOULD BE EXCEL FORMULAS. A1 A B G 3 A fast-growing firm recently paid a dividend of $0.95 per share. The dividend is expected

ANSWER SHOULD BE EXCEL FORMULAS.

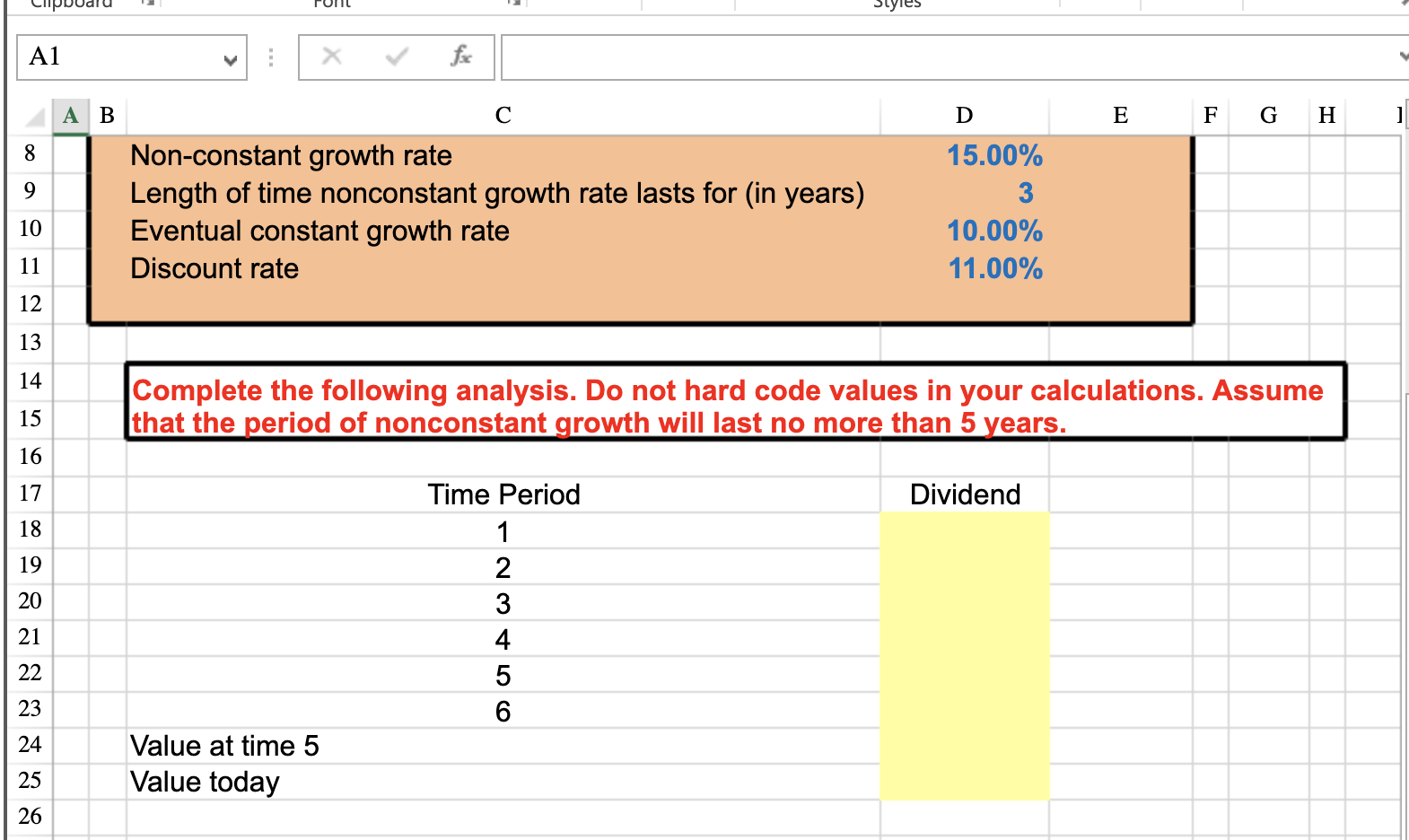

A1 A B G 3 A fast-growing firm recently paid a dividend of $0.95 per share. The dividend is expected to increase at a 15 percent rate for the next three years. Afterwards, a more stable 10 percent growth rate can be assumed 4 If an 11 percent discount rate is appropriate for this stock, what is its value today? (Do not round intermediate calculations and round your final answer to 2 decimal places.) 5 6 $ 15.00% 7 Latest dividend 0.95 Non-constant growth rate Length of time nonconstant growth rate lasts for (in years) Eventual constant growth rate 8 9 10 10.00% 11 Discount rate 11.00% 12 13 14 Complete the following analysis. Do not hard code values in your calculations. Assume that the period of nonconstant growth will last no more than 5 years. 15 16 fax A1 X C G Non-constant growth rate Length of time nonconstant growth rate lasts for (in years) Eventual constant growth rate 15.00% 10.00% 10 11.00% 11 Discount rate 12 13 14 Complete the following analysis. Do not hard code values in your calculations. Assume that the period of nonconstant growth will last no more than 5 years. 15 16 Dividend Time Period 17 18 1 19 2 20 21 4 22 5 23 6 Value at time 5 24 Value today 25 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts