Question: Timelet 1.52:56 1 stat Question 1 Over the past half a century, Paramount Corporation Berhad made big strides. It started from its brick-and-mortar roots as

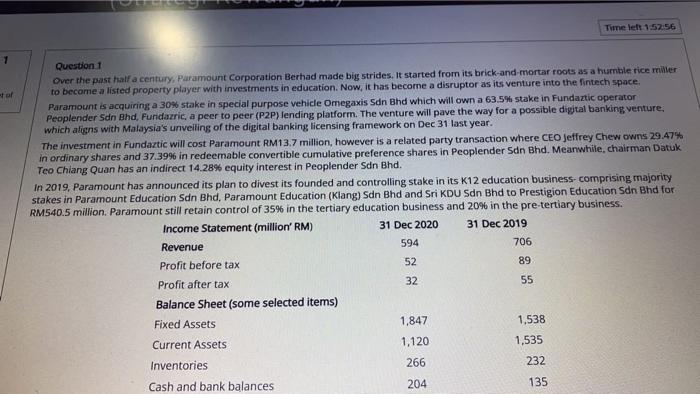

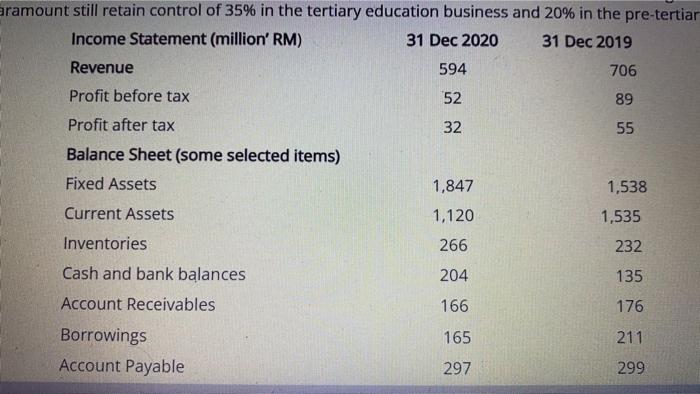

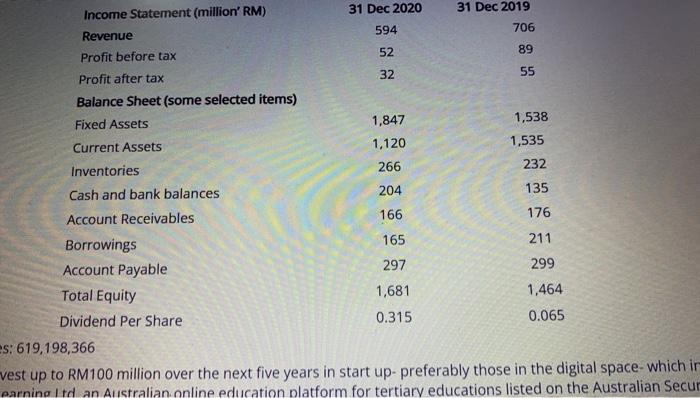

Timelet 1.52:56 1 stat Question 1 Over the past half a century, Paramount Corporation Berhad made big strides. It started from its brick-and-mortar roots as a humble rice miller to become a listed property player with investments in education. Now, it has become a disruptor as its venture into the fintech space. Paramount is acquiring a 30% stake in special purpose vehicle Omegaxis Sdn Bhd which will own a 63.5 stake in Fundaztic operator Peoplender Sdn Bhd, Fundazric, a peer to peer (P2P) lending platform. The venture will pave the way for a possible digital banking, venture, which aligns with Malaysia's unveiling of the digital banking licensing framework on Dec 31 last year. The investment in Fundaztic will cost Paramount RM13.7 million, however is a related party transaction where CEO Jeffrey Chew owns 29.47% in ordinary shares and 37.39% in redeemable convertible cumulative preference shares in Peoplender Sdn Bhd. Meanwhile, chairman Datuk Teo Chiang Quan has an indirect 14.28% equity interest in Peoplender Sdn Bhd. In 2019, Paramount has announced its plan to divest its founded and controlling stake in its K12 education business comprising majority stakes in Paramount Education Sdn Bhd, Paramount Education (Klang) Sdn Bhd and Sri KDU Sdn Bhd to Prestigion Education Sdn Bhd for RM540.5 million. Paramount still retain control of 35% in the tertiary education business and 20% in the pre-tertiary business. Income Statement (million' RM) 31 Dec 2020 31 Dec 2019 Revenue 594 706 Profit before tax 52 89 Profit after tax 32 55 Balance Sheet (some selected items) Fixed Assets 1,847 1.538 Current Assets 1,120 1.535 Inventories 266 232 Cash and bank balances 204 135 55 aramount still retain control of 35% in the tertiary education business and 20% in the pre-tertiar Income Statement (million' RM) 31 Dec 2020 31 Dec 2019 Revenue 594 706 Profit before tax 52 89 Profit after tax 32 Balance Sheet (some selected items) Fixed Assets 1,847 1,538 Current Assets 1,120 1,535 Inventories 266 232 Cash and bank balances 204 135 Account Receivables 166 176 Borrowings 165 211 Account Payable 297 299 Income Statement (million' RM) 31 Dec 2020 31 Dec 2019 Revenue 594 706 Profit before tax 52 89 Profit after tax 32 55 Balance Sheet (some selected items) Fixed Assets 1,847 1,538 Current Assets 1,120 1.535 Inventories 266 232 Cash and bank balances 204 135 Account Receivables 166 176 Borrowings 165 211 Account Payable 297 299 Total Equity 1,681 1,464 Dividend Per Share 0.315 0.065 es: 619,198,366 vest up to RM100 million over the next five years in start up-preferably those in the digital space which in warnino Itd an Australian online education platform for tertiary educations listed on the Australian Secur Nurnber of shares 79.106.365 Paramount wouldives up to RM100 million over the next five years in start up preferably those in the digtal space which nehme A2 Investment in Opentering ind, an Australian online education platform for tertiary educations listed on the lines tachan and Fundatie Despite all these. Paramounts property division revenues have been able to fill the hole left by the divested education semn However, CEON Jeffrey Chmure with the group to continue with land banking and development in the medium term. Paramount is need to digitize the businesses we want to keep. If we cannot digitize them, we would be better of tung nd of them. For future we believe digital is the way forward. Paramount has apto do a feasibility study on whether the venture would be viable, profitable and sustainable. Paramountains with the proceed to the divestment of education section, distributed a special dividend of 29.0 sen per share was paid on 2020, in addition to annual divide 25 sen per share. source: The Edge Malaysia Parcount: From brick and mortar to digital disruptor, May 24, 2027). Question: - Based on the information provided in the case study, elaborate and discuss in detail the evaluation of Paramount strategy of divestment. governance and the financial status in Paramount Corporation Berhad. What are your suggestions to Paramount? [25 marks] A- B 1 EE ? c? Timelet 1.52:56 1 stat Question 1 Over the past half a century, Paramount Corporation Berhad made big strides. It started from its brick-and-mortar roots as a humble rice miller to become a listed property player with investments in education. Now, it has become a disruptor as its venture into the fintech space. Paramount is acquiring a 30% stake in special purpose vehicle Omegaxis Sdn Bhd which will own a 63.5 stake in Fundaztic operator Peoplender Sdn Bhd, Fundazric, a peer to peer (P2P) lending platform. The venture will pave the way for a possible digital banking, venture, which aligns with Malaysia's unveiling of the digital banking licensing framework on Dec 31 last year. The investment in Fundaztic will cost Paramount RM13.7 million, however is a related party transaction where CEO Jeffrey Chew owns 29.47% in ordinary shares and 37.39% in redeemable convertible cumulative preference shares in Peoplender Sdn Bhd. Meanwhile, chairman Datuk Teo Chiang Quan has an indirect 14.28% equity interest in Peoplender Sdn Bhd. In 2019, Paramount has announced its plan to divest its founded and controlling stake in its K12 education business comprising majority stakes in Paramount Education Sdn Bhd, Paramount Education (Klang) Sdn Bhd and Sri KDU Sdn Bhd to Prestigion Education Sdn Bhd for RM540.5 million. Paramount still retain control of 35% in the tertiary education business and 20% in the pre-tertiary business. Income Statement (million' RM) 31 Dec 2020 31 Dec 2019 Revenue 594 706 Profit before tax 52 89 Profit after tax 32 55 Balance Sheet (some selected items) Fixed Assets 1,847 1.538 Current Assets 1,120 1.535 Inventories 266 232 Cash and bank balances 204 135 55 aramount still retain control of 35% in the tertiary education business and 20% in the pre-tertiar Income Statement (million' RM) 31 Dec 2020 31 Dec 2019 Revenue 594 706 Profit before tax 52 89 Profit after tax 32 Balance Sheet (some selected items) Fixed Assets 1,847 1,538 Current Assets 1,120 1,535 Inventories 266 232 Cash and bank balances 204 135 Account Receivables 166 176 Borrowings 165 211 Account Payable 297 299 Income Statement (million' RM) 31 Dec 2020 31 Dec 2019 Revenue 594 706 Profit before tax 52 89 Profit after tax 32 55 Balance Sheet (some selected items) Fixed Assets 1,847 1,538 Current Assets 1,120 1.535 Inventories 266 232 Cash and bank balances 204 135 Account Receivables 166 176 Borrowings 165 211 Account Payable 297 299 Total Equity 1,681 1,464 Dividend Per Share 0.315 0.065 es: 619,198,366 vest up to RM100 million over the next five years in start up-preferably those in the digital space which in warnino Itd an Australian online education platform for tertiary educations listed on the Australian Secur Nurnber of shares 79.106.365 Paramount wouldives up to RM100 million over the next five years in start up preferably those in the digtal space which nehme A2 Investment in Opentering ind, an Australian online education platform for tertiary educations listed on the lines tachan and Fundatie Despite all these. Paramounts property division revenues have been able to fill the hole left by the divested education semn However, CEON Jeffrey Chmure with the group to continue with land banking and development in the medium term. Paramount is need to digitize the businesses we want to keep. If we cannot digitize them, we would be better of tung nd of them. For future we believe digital is the way forward. Paramount has apto do a feasibility study on whether the venture would be viable, profitable and sustainable. Paramountains with the proceed to the divestment of education section, distributed a special dividend of 29.0 sen per share was paid on 2020, in addition to annual divide 25 sen per share. source: The Edge Malaysia Parcount: From brick and mortar to digital disruptor, May 24, 2027). Question: - Based on the information provided in the case study, elaborate and discuss in detail the evaluation of Paramount strategy of divestment. governance and the financial status in Paramount Corporation Berhad. What are your suggestions to Paramount? [25 marks] A- B 1 EE ? c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts