Question: Answer should be provide with formulas for excel The following table gives the current balance sheet for Travellers Inn Inc. (TIT), a company that was

Answer should be provide with formulas for excel

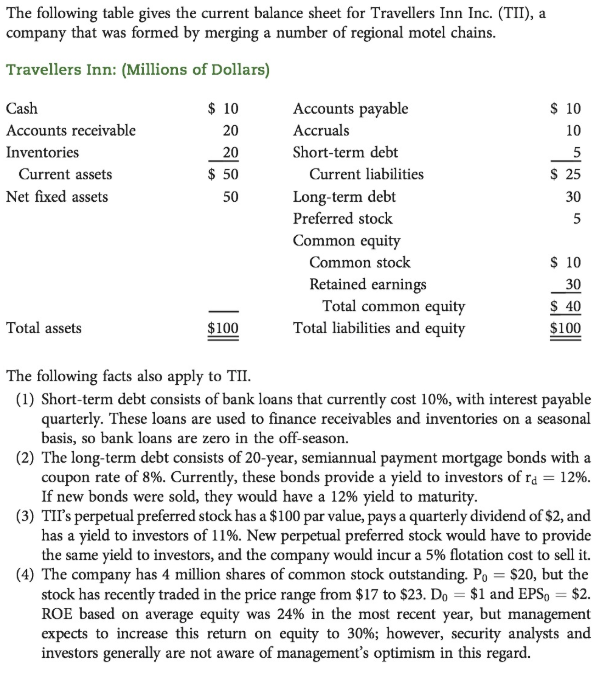

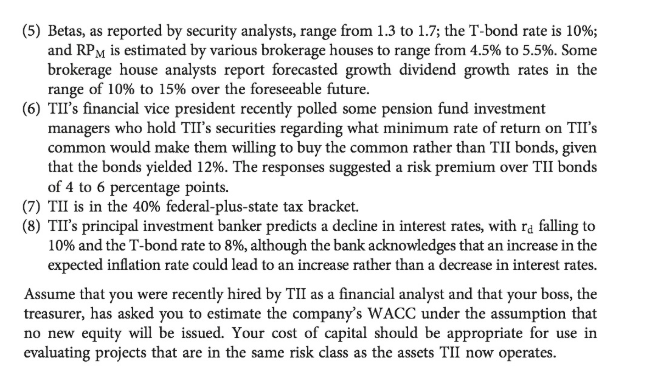

The following table gives the current balance sheet for Travellers Inn Inc. (TIT), a company that was formed by merging a number of regional motel chains. Travellers Inn: (Millions of Dollars) Cash Accounts receivable Inventories $ 10 Accounts payable Accruals Short-term debt Current assets Net fixed assets $ 50 50 Current liabilities Long-term debt Preferred stock Common equity Common stock Retained earnings Total common equity Total liabilities and equity S 40 $100 Total assets $100 The following facts also apply to TII (1) Short-term debt consists of bank loans that currently cost 10%, with interest payable quarterly. These loans are used to finance receivables and inventories on a seasonal basis, so bank loans are zero in the off-season (2) The long-term debt consists of 20-year, semiannual payment mortgage bonds with a coupon rate of 8%. Currently, these bonds provide a yield to investors of rd-12%. If new bonds were sold, they would have a 12% yield to maturity. (3) TII's perpetual preferred stock has a $100 par value, pays a quarterly dividend of $2, and has a yield to investors of 11%. New perpetual preferred stock would have to provide the same yield to investors, and the company would incur a 5% flotation cost to sell it. (4) The company has 4 million shares of common stock outstanding. Po $20, but the stock has recently traded in the price range from $17 to $23. Do $1 and EPSo $2. ROE based on average equity was 24% in the most recent year, but management expects to increase this return on equity to 30%; however, security analysts and investors generally are not aware of management's optimism in this regard

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts