Question: answer step by step please. You are analyzing a project using an after-tax replacement analysis of the installed system (defender) and a challenger as detailed

answer step by step please.

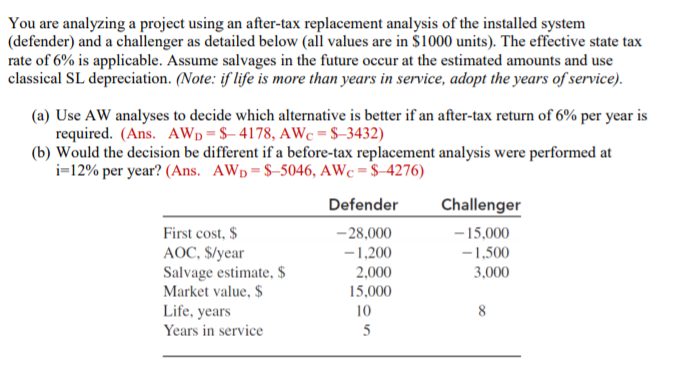

You are analyzing a project using an after-tax replacement analysis of the installed system (defender) and a challenger as detailed below (all values are in $1000 units). The effective state tax rte of 6% is applicable. Assume salvages in the future occur at the estimated amounts and use classical SL depreciation. (Note: if life is more than years in service, adopt the years of service) (a) Use Aw analyses to decide which alternative is better if an after-tax return of 6% per year is required. (Ans. AWD S-4178, AWc -S-3432) (b) Would the decision be different if a before-tax replacement analysis were performed at i-12% per year? (Ans. AWD-$-5046. Ave-s-4276) Defender Challenger -15,000 1,500 3,000 First cost, $ AOC, S/year Salvage estimate, $ Market value, Life, years Years in service -28,000 -1,200 2,000 15,000 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts