Question: Answer T/F for each question 6) _ Corporate divisions may vary in risk, therefore, it is conceptually correct to use different WACC for different divisions

Answer T/F for each question

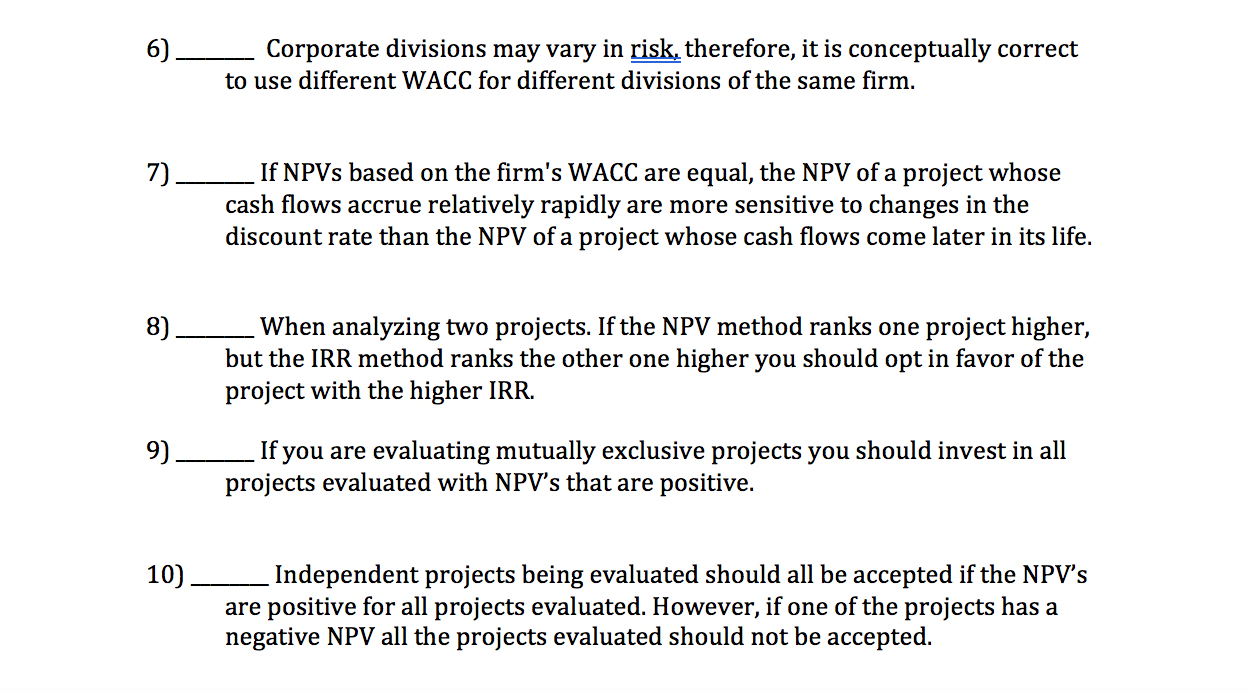

6) _ Corporate divisions may vary in risk, therefore, it is conceptually correct to use different WACC for different divisions of the same firm. If NPVs based on the firm's WACC are equal, the NPV of a project whose cash flows accrue relatively rapidly are more sensitive to changes in the discount rate than the NPV of a project whose cash flows come later in its life. When analyzing two projects. If the NPV method ranks one project higher, but the IRR method ranks the other one higher you should opt in favor of the project with the higher IRR. If you are evaluating mutually exclusive projects you should invest in all projects evaluated with NPV's that are positive. 10) Independent projects being evaluated should all be accepted if the NPV's are positive for all projects evaluated. However, if one of the projects has a negative NPV all the projects evaluated should not be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts