Question: Answer the below Question and also explain the types of cost discuss in this Question ? Marshal's JPMorgan Chase credit card has a 15 percent

Answer the below Question and also explain the types of cost discuss in this Question ?

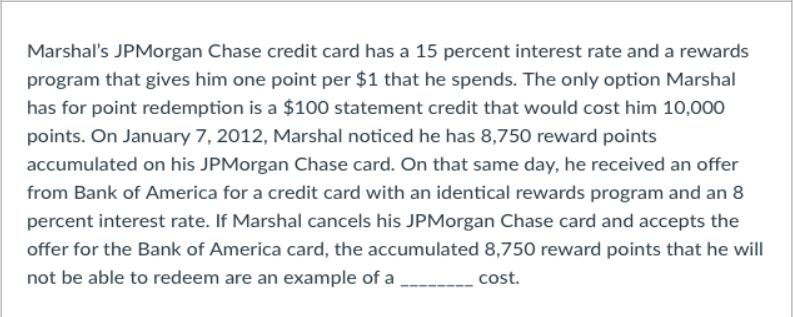

Marshal's JPMorgan Chase credit card has a 15 percent interest rate and a rewards program that gives him one point per $1 that he spends. The only option Marshal has for point redemption is a $100 statement credit that would cost him 10,000 points. On January 7, 2012, Marshal noticed he has 8,750 reward points accumulated on his JPMorgan Chase card. On that same day, he received an offer from Bank of America for a credit card with an identical rewards program and an 8 percent interest rate. If Marshal cancels his JPMorgan Chase card and accepts the offer for the Bank of America card, the accumulated 8,750 reward points that he will not be able to redeem are an example of a cost.

Step by Step Solution

There are 3 Steps involved in it

The accumulated 8750 reward points that Marshal will not be able to redeem upon canceling his JPMorgan Chase credit card represent an opportunity cost 1 Opportunity Cost Opportunity cost refers to the ... View full answer

Get step-by-step solutions from verified subject matter experts