Question: Answer the first 1 2 questions What is the current ratio for Otis for year 1 ? Round your final answer to two decimal places.

Answer the first questions

What is the current ratio for Otis for year

Round your final answer to two decimal places.

What is days in inventory ratio for Alma for year Round your final answer to one decimal place.

for a horizontal analysis for Alma, what is the percent change in cost of goods sold for year Convert your final answer to a percentage, round to one decimal place and enter without the sign eg a final answer of would be entered as

What is the average collection period for Otisfor year Round your final answer to onedecimal place.

What is the debt to assets ratio for Alma for year Convert your final answer to a percentage, round to one decimal place and enter without the sign eg a final answer of would be entered as

What is the times interest earned ratio for Otis for year Round your final answer to one decimal place

what is the gross profit rate for alma for year

Convert your tinal answer to a percentage, round to one decimal place and enter without the sign eg a final answer of would be entered as

What is the net profit margin ratio for Otis for year Convert your final answer to a percentage, round to one decimal place and enter without the sign eg a final answer of would be entered as

What is the return on assets ratio for Alma for year Convert your final answer to a percentage, round to one decimal place and enter without the sign eg a final answer of would be entered as

Which company would you rather invest in Briefly explain.

If Alma borrowed $ on a longterm loan in year how would that transaction impact the times interest earned ratio?

improve

worsen

no impact

h

Which company would you rather extend

a longterm loan to Briefly explain.

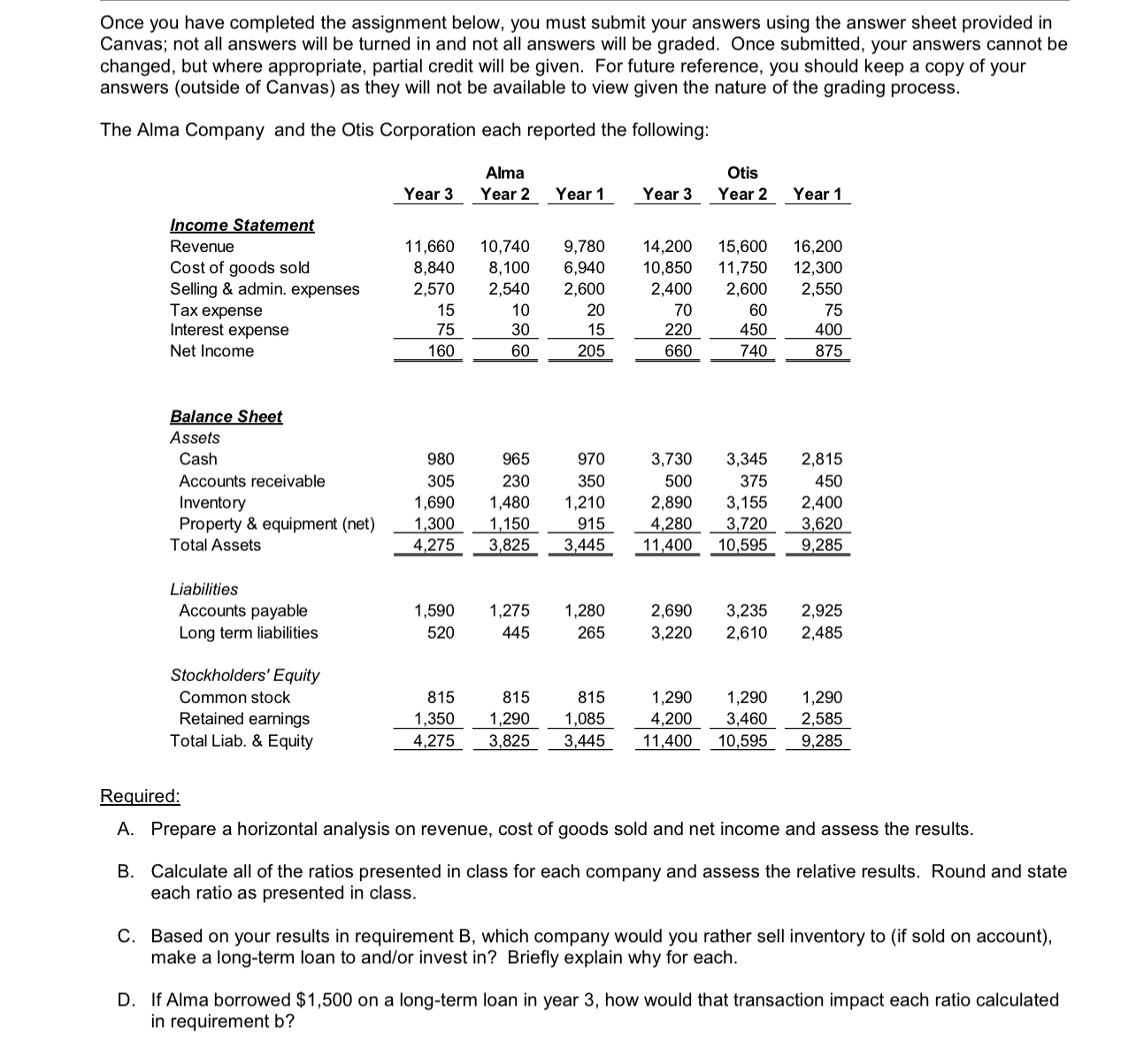

Once you have completed the assignment below, you must submit your answers using the answer sheet provided in Canvas; not all answers will be turned in and not all answers will be graded. Once submitted, your answers cannot be changed, but whl credit will be given. For future reference, you should keep a copy of your answers outside of Canvas as they will not be available to view given the nature of the grading process.

The Alma Company and the Otis Corporation each reported the following:

tableAlma,OtisYear Year Year Year Year Year Income StatementRevenueCost of goods sold,Selling & admin. expenses,Tax expense,Interest expense,Net Income,

tableBalance SheetAssetsCashAccounts receivable,InventoryProperty & equipment netTotal Assets,LiabilitiesAccounts payable,Long term liabilities,Stockholders EquityCommon stock,Retained earnings,Total Liab. & Equity,

Required:

A Prepare a horizontal analysis on revenue, cost of goods sold and net income and assess the results.

B Calculate all of the ratios presented in class for each company and assess the relative results. Round and state each ratio as presented in class.

C Based on your results in requirement B which company would you rather sell inventory to if sold on account make a longterm loan to andor invest in Briefly explain why for each.

D If Alma borrowed $ on a longterm loan in year how would that transaction impact ea

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock