Question: Answer the following 5 questions using this information Lufthansa (German airline) bought an aircraft. 787 Dreamline from Boeing a US company and agreed to pay

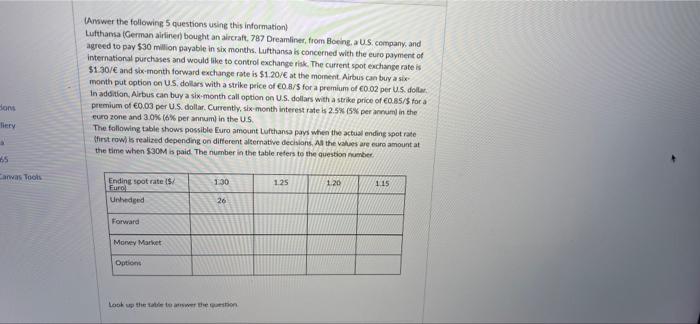

Answer the following 5 questions using this information Lufthansa (German airline) bought an aircraft. 787 Dreamline from Boeing a US company and agreed to pay $30 million payable in six months. Lufthansa is concerned with the euro payment of international purchases and would like to control exchange risk. The current spot exchange rate is $1.30/ and six-month forward exchange rate is $1.20/ at the moment. Airbus can buy a sie month put option on US dollars with a strike price of 0.8/5 for a premium of 0.02 per US dollar In addition, Arbus can buy a six-month call option on US dollars with a strike price of 0.85/$for a premium of 0.03 per US dollar. Currently, six-month interest rate is 2.5% 5% per annum in the euro zone and 3.0% (6% per annum) in the US The following table shows possible Euro amount Lufthansa pays when the actual ending spot rate first row is realized depending on different alternative dechions. All the values are euro amountat the time when $30M is paid. The number in the table refers to the question number dons By . 65 Canvas Took 130 1.25 120 1.15 Ending spot rate Furo Urhedged 26 Forward Money Market Options Look up the thesion Answer the following 5 questions using this information Lufthansa (German airline) bought an aircraft. 787 Dreamline from Boeing a US company and agreed to pay $30 million payable in six months. Lufthansa is concerned with the euro payment of international purchases and would like to control exchange risk. The current spot exchange rate is $1.30/ and six-month forward exchange rate is $1.20/ at the moment. Airbus can buy a sie month put option on US dollars with a strike price of 0.8/5 for a premium of 0.02 per US dollar In addition, Arbus can buy a six-month call option on US dollars with a strike price of 0.85/$for a premium of 0.03 per US dollar. Currently, six-month interest rate is 2.5% 5% per annum in the euro zone and 3.0% (6% per annum) in the US The following table shows possible Euro amount Lufthansa pays when the actual ending spot rate first row is realized depending on different alternative dechions. All the values are euro amountat the time when $30M is paid. The number in the table refers to the question number dons By . 65 Canvas Took 130 1.25 120 1.15 Ending spot rate Furo Urhedged 26 Forward Money Market Options Look up the thesion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts