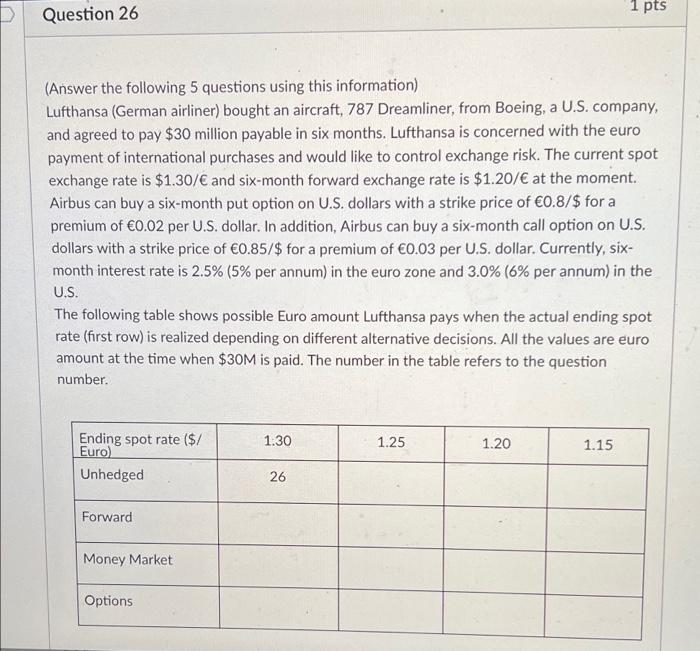

Question: Question 26 1 pts (Answer the following 5 questions using this information) Lufthansa (German airliner) bought an aircraft, 787 Dreamliner, from Boeing, a U.S. company,

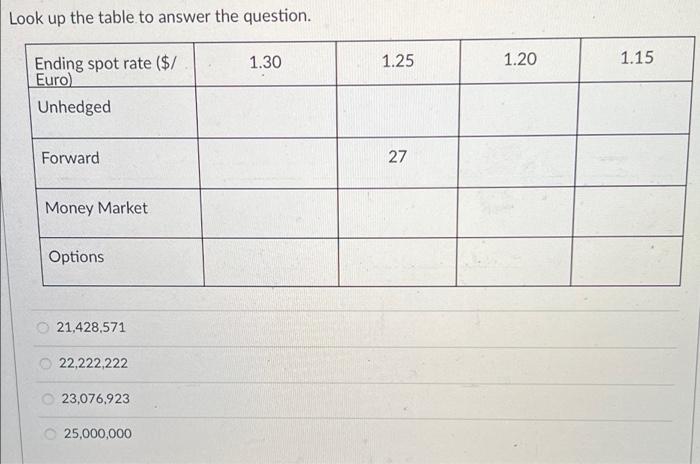

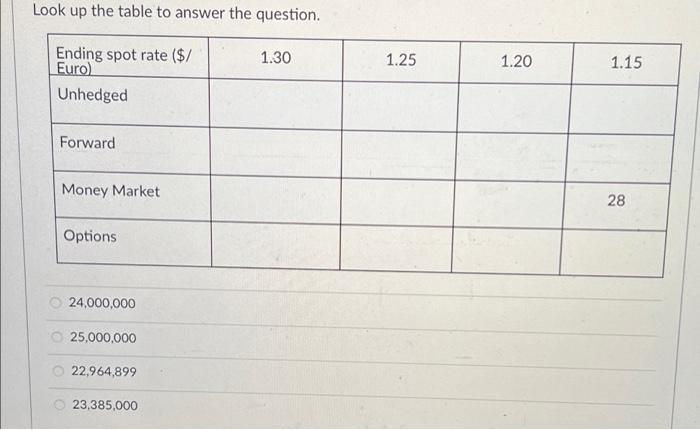

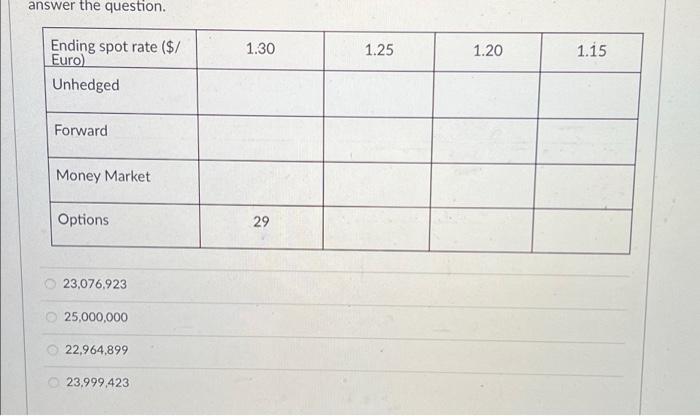

Question 26 1 pts (Answer the following 5 questions using this information) Lufthansa (German airliner) bought an aircraft, 787 Dreamliner, from Boeing, a U.S. company, and agreed to pay $30 million payable in six months. Lufthansa is concerned with the euro payment of international purchases and would like to control exchange risk. The current spot exchange rate is $1.30/ and six-month forward exchange rate is $1.20/ at the moment. Airbus can buy a six-month put option on U.S. dollars with a strike price of 0.8/$ for a premium of 0.02 per U.S. dollar. In addition, Airbus can buy a six-month call option on U.S. dollars with a strike price of 0.85/$ for a premium of 0.03 per U.S. dollar. Currently, six- month interest rate is 2.5% (5% per annum) in the euro zone and 3.0% (6% per annum) in the U.S. The following table shows possible Euro amount Lufthansa pays when the actual ending spot rate (first row) is realized depending on different alternative decisions. All the values are euro amount at the time when $30M is paid. The number in the table refers to the question number. 1.30 1.25 1.20 1.15 Ending spot rate ($/ Euro) Unhedged 26 Forward Money Market Options Look up the table to answer the question. 1.30 1.25 1.20 1.15 Ending spot rate ($/ Euro) Unhedged Forward 27 Money Market Options 21,428,571 22,222,222 23,076,923 25,000,000 Look up the table to answer the question. 1.30 1.25 1.20 1.15 Ending spot rate ($/ Euro) Unhedged Forward Money Market 28 Options 24,000,000 25,000,000 22,964,899 23,385,000 answer the question. 1.30 1.25 1.20 1.15 Ending spot rate ($/ Euro) Unhedged Forward Money Market Options 29 23,076.923 25,000,000 22,964,899 23.999,423

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts