Question: Answer the following concisely but substantially: 1. From the point of view of Engineering Economics, explain why it is important to screen, assess or evaluate

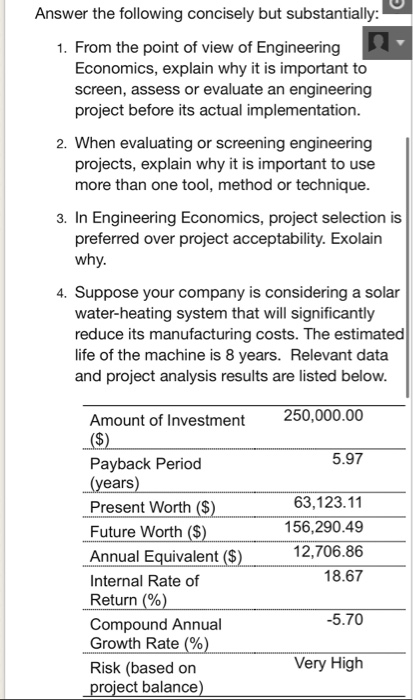

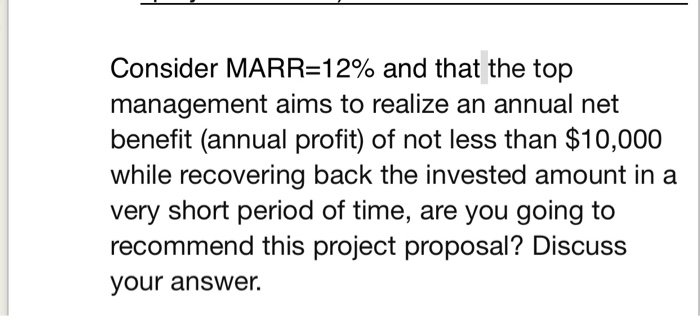

Answer the following concisely but substantially: 1. From the point of view of Engineering Economics, explain why it is important to screen, assess or evaluate an engineering project before its actual implementation. 2. When evaluating or screening engineering projects, explain why it is important to use more than one tool, method or technique. 3. In Engineering Economics, project selection is preferred over project acceptability. Exolain why. 4. Suppose your company is considering a solar water-heating system that will significantly reduce its manufacturing costs. The estimated life of the machine is 8 years. Relevant data and project analysis results are listed below. 250,000.00 5.97 Amount of Investment ($) Payback Period (years) Present Worth ($) Future Worth ($) Annual Equivalent ($) Internal Rate of Return (%) Compound Annual Growth Rate (%) Risk (based on project balance) 63.123.11 156,290.49 12,706.86 18.67 -5.70 Very High Consider MARR=12% and that the top management aims to realize an annual net benefit (annual profit) of not less than $10,000 while recovering back the invested amount in a very short period of time, are you going to recommend this project proposal? Discuss your answer. Answer the following concisely but substantially: 1. From the point of view of Engineering Economics, explain why it is important to screen, assess or evaluate an engineering project before its actual implementation. 2. When evaluating or screening engineering projects, explain why it is important to use more than one tool, method or technique. 3. In Engineering Economics, project selection is preferred over project acceptability. Exolain why. 4. Suppose your company is considering a solar water-heating system that will significantly reduce its manufacturing costs. The estimated life of the machine is 8 years. Relevant data and project analysis results are listed below. 250,000.00 5.97 Amount of Investment ($) Payback Period (years) Present Worth ($) Future Worth ($) Annual Equivalent ($) Internal Rate of Return (%) Compound Annual Growth Rate (%) Risk (based on project balance) 63.123.11 156,290.49 12,706.86 18.67 -5.70 Very High Consider MARR=12% and that the top management aims to realize an annual net benefit (annual profit) of not less than $10,000 while recovering back the invested amount in a very short period of time, are you going to recommend this project proposal? Discuss your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts