Question: answer the following multiple choice questions with the most correct answer On January 1, The Blue Azul Diving Co. had total shareholders' equity as shown

answer the following multiple choice questions with the most correct answer

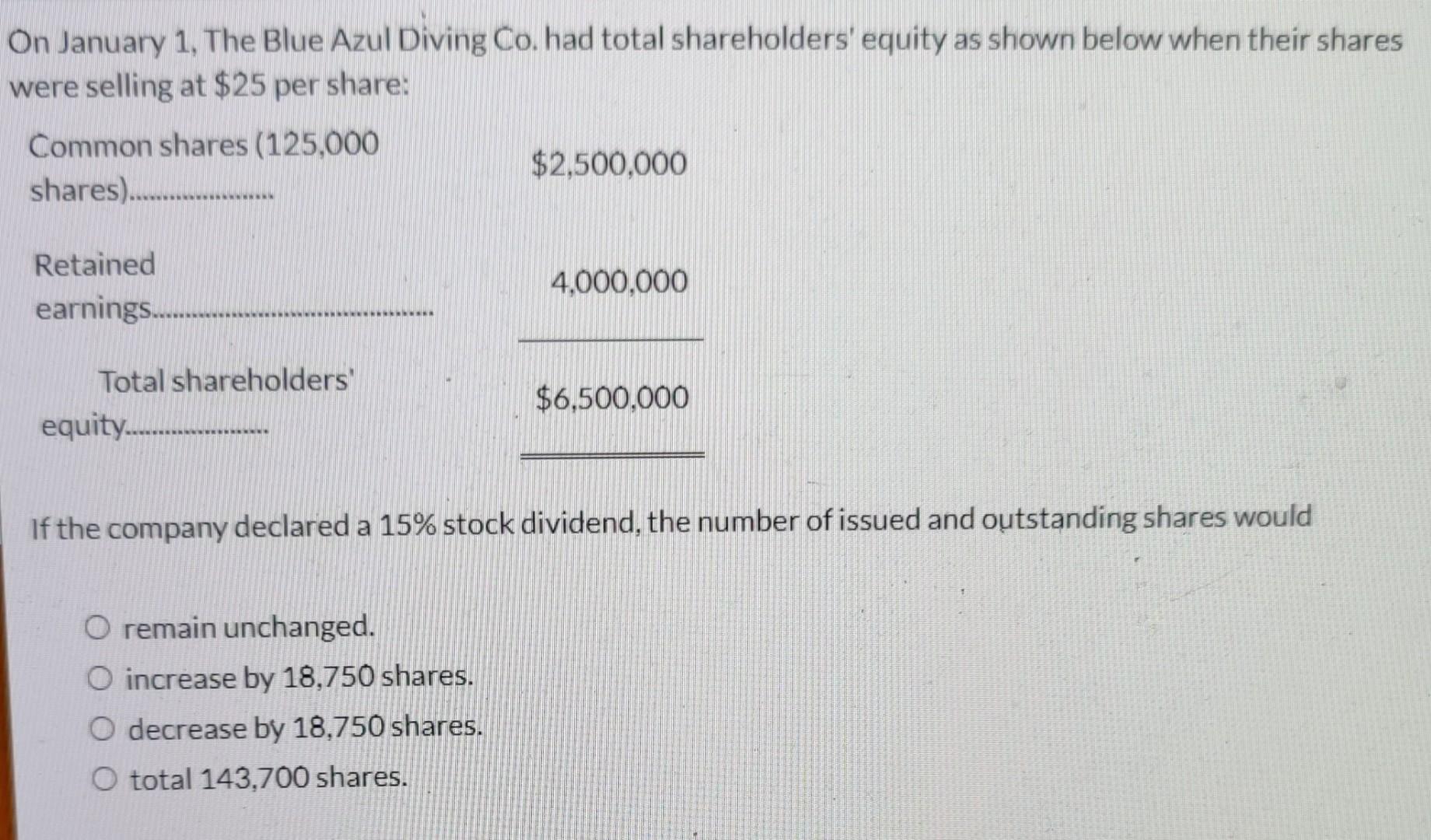

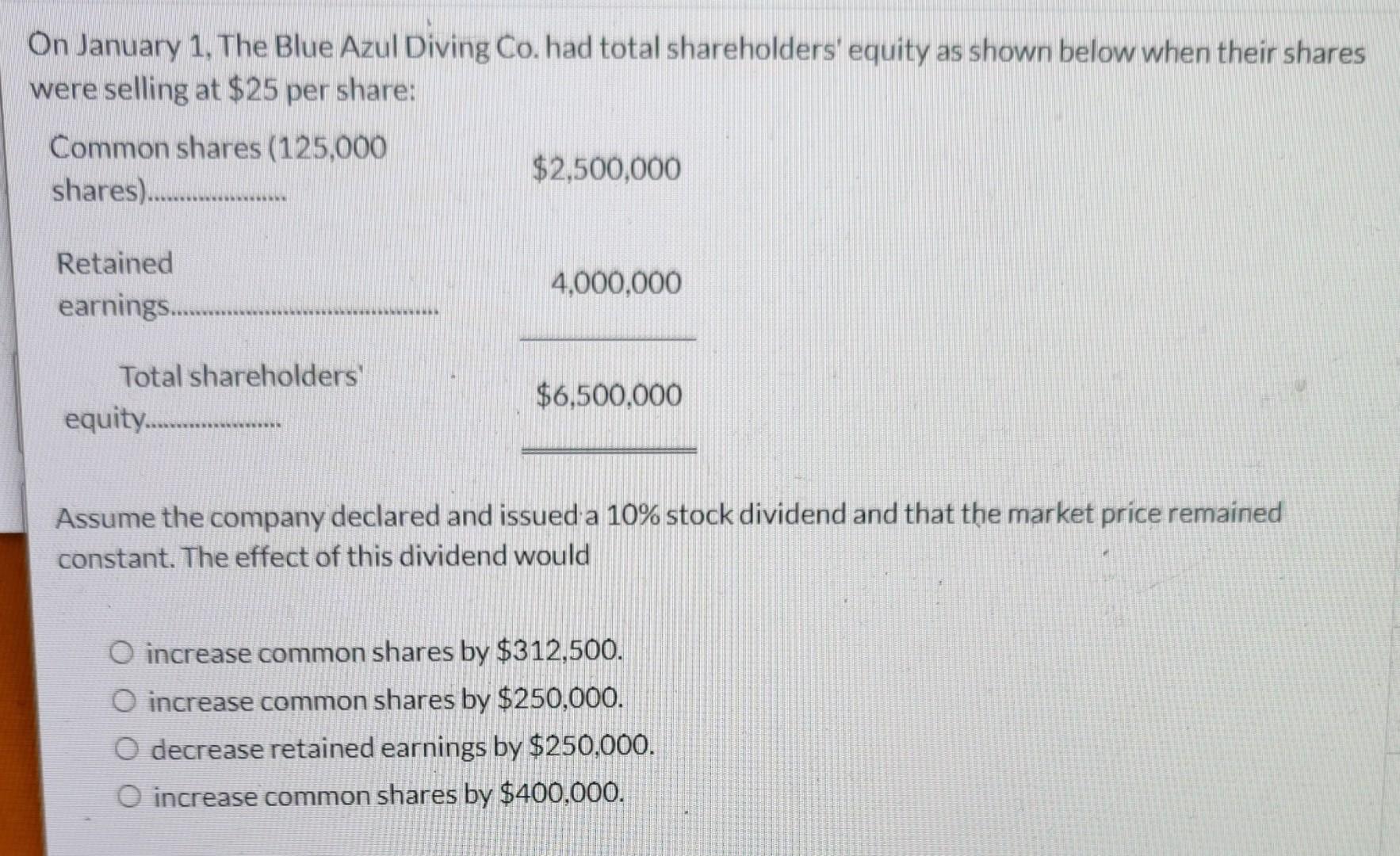

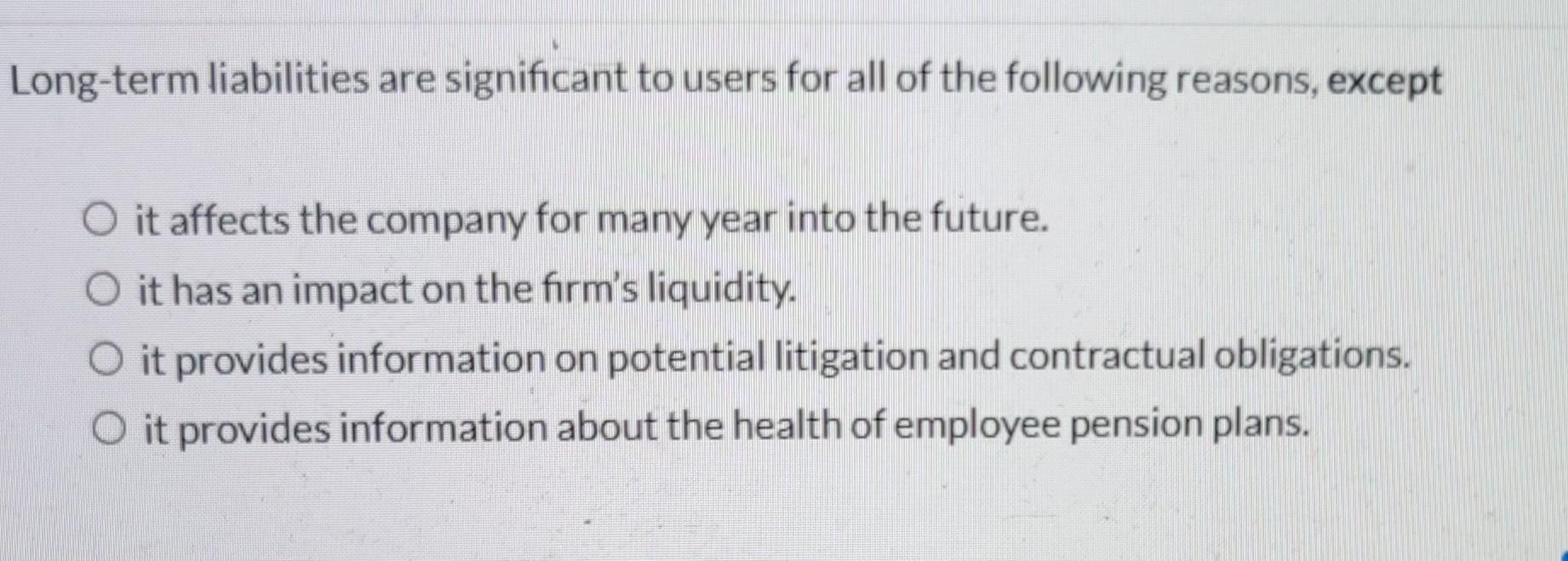

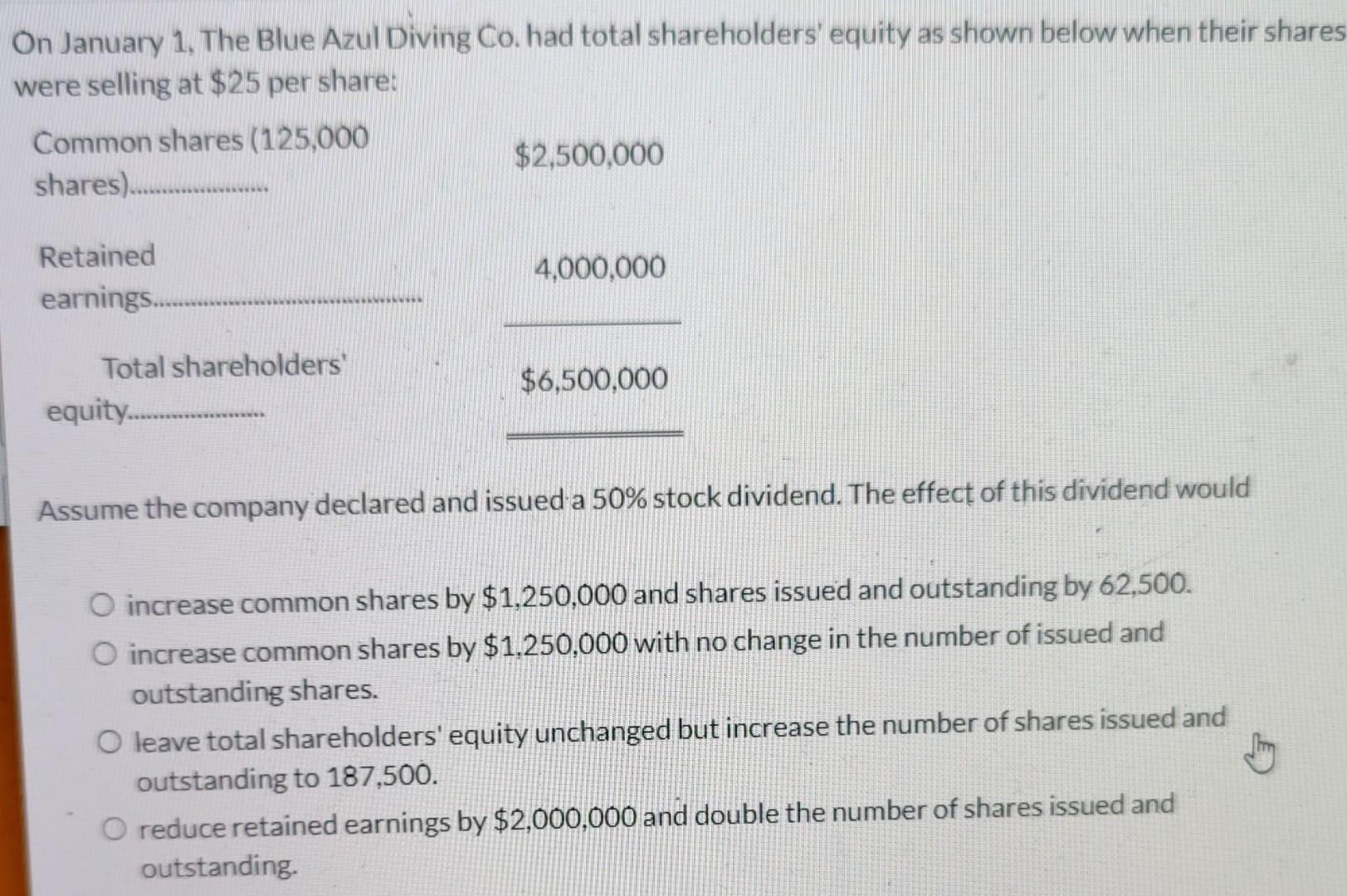

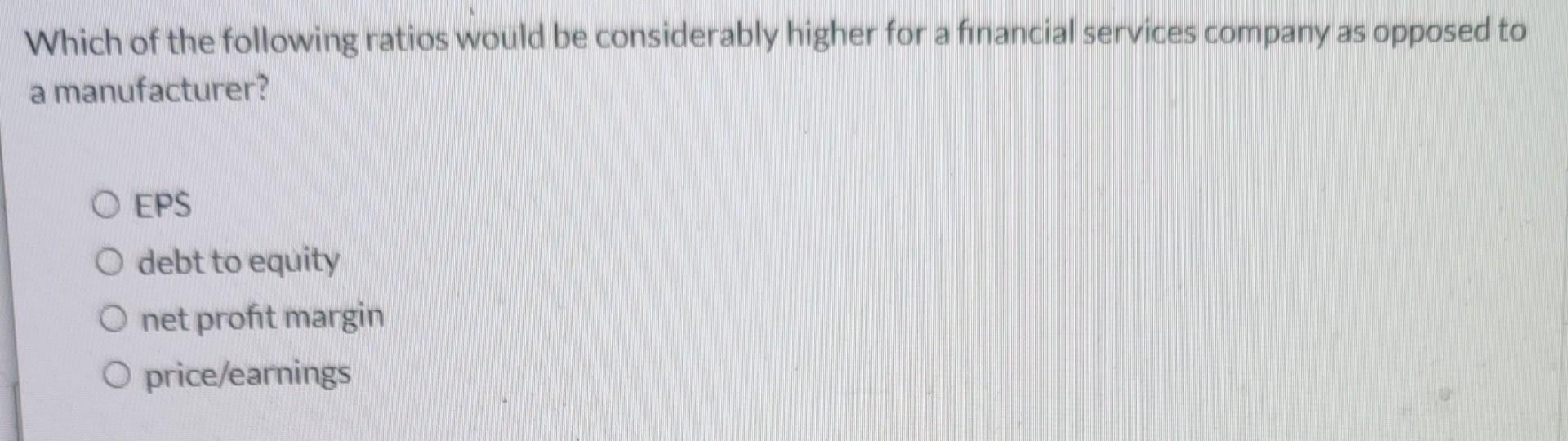

On January 1, The Blue Azul Diving Co. had total shareholders' equity as shown below when their shares were selling at $25 per share: Common shares (125,000 $2,500,000 shares)................... Retained earnings...... 4,000,000 Total shareholders equity....... $6,500,000 If the company declared a 15% stock dividend, the number of issued and outstanding shares would O remain unchanged. O increase by 18,750 shares. O decrease by 18,750 shares. O total 143,700 shares. On January 1, The Blue Azul Diving Co. had total shareholders' equity as shown below when their shares were selling at $25 per share: Common shares (125,000 shares).......... $2,500,000 Retained earnings........ 4,000,000 Total shareholders' equity................ $6.500.000 Assume the company declared and issued a 10% stock dividend and that the market price remained constant. The effect of this dividend would O increase common shares by $312,500. O increase common shares by $250,000. O decrease retained earnings by $250,000. o increase common shares by $400,000. Long-term liabilities are significant to users for all of the following reasons, except O it affects the company for many year into the future. O it has an impact on the firm's liquidity. O it provides information on potential litigation and contractual obligations. O it provides information about the health of employee pension plans. On January 1, The Blue Azul Diving Co. had total shareholders' equity as shown below when their shares were selling at $25 per share: Common shares (125,000 $2,500,000 shares)............... Retained earnings 4,000,000 Total shareholders' equity.................. $6,500,000 Assume the company declared and issued a 50% stock dividend. The effect of this dividend would O increase common shares by $1,250,000 and shares issued and outstanding by 62,500. O increase common shares by $1,250,000 with no change in the number of issued and outstanding shares. O leave total shareholders' equity unchanged but increase the number of shares issued and outstanding to 187,500. O reduce retained earnings by $2,000,000 and double the number of shares issued and outstanding Which of the following ratios would be considerably higher for a financial services company as opposed to a manufacturer? O EPS O debt to equity O net profit margin O price/earings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts