Question: Question 24 (7 marks) Answer the following multiple choice questions with the most correct answer The purchase of land for a combination of cash and

Question 24 (7 marks) Answer the following multiple choice questions with the most correct answer

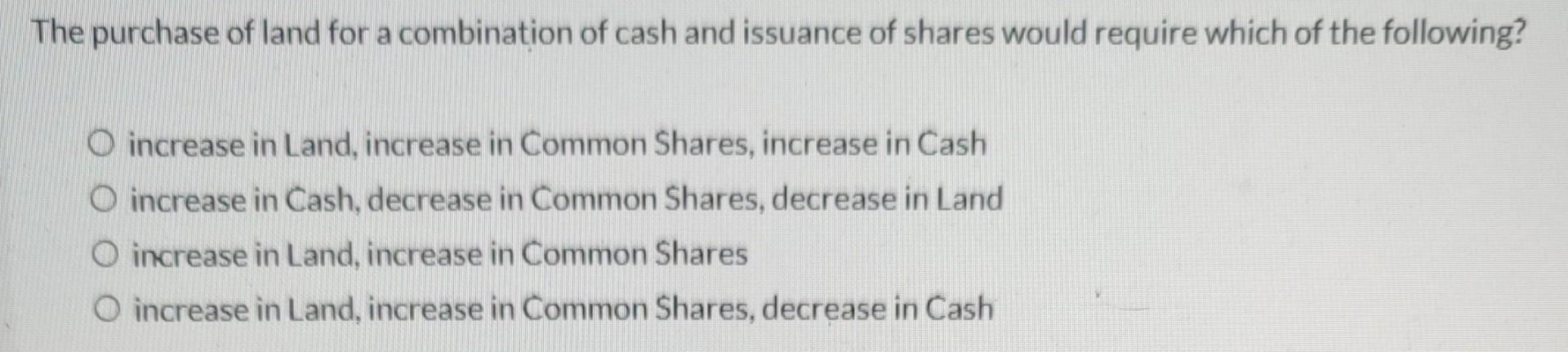

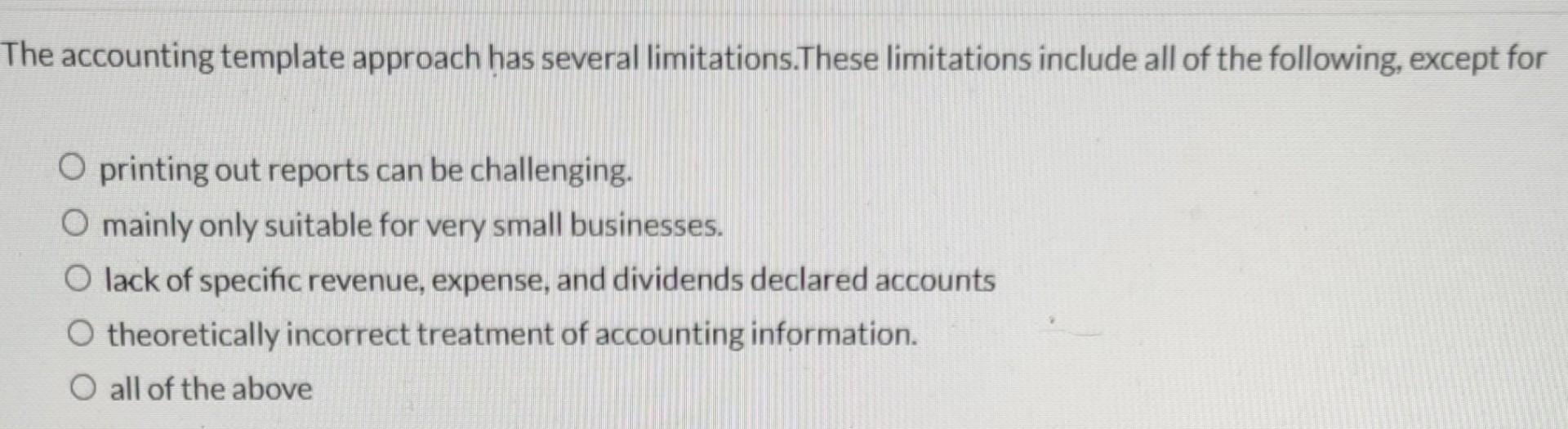

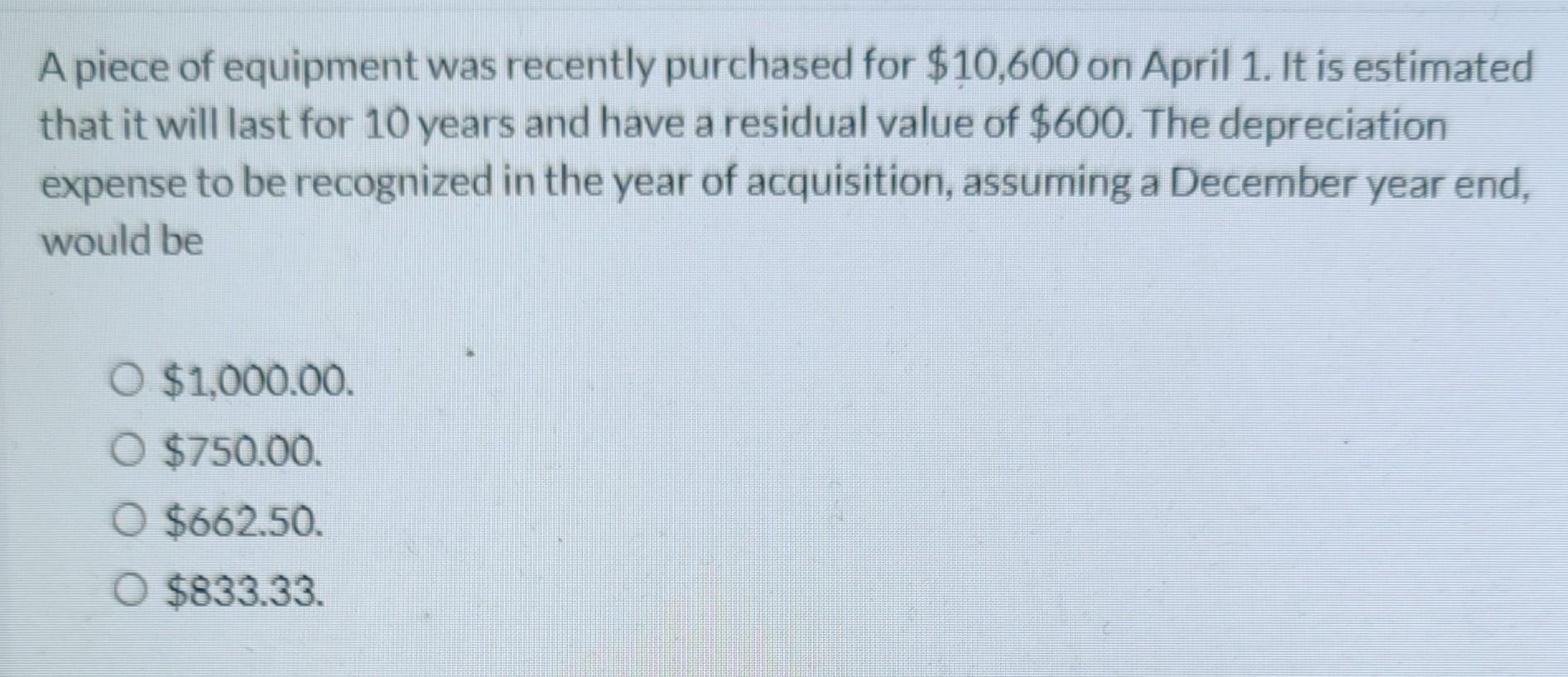

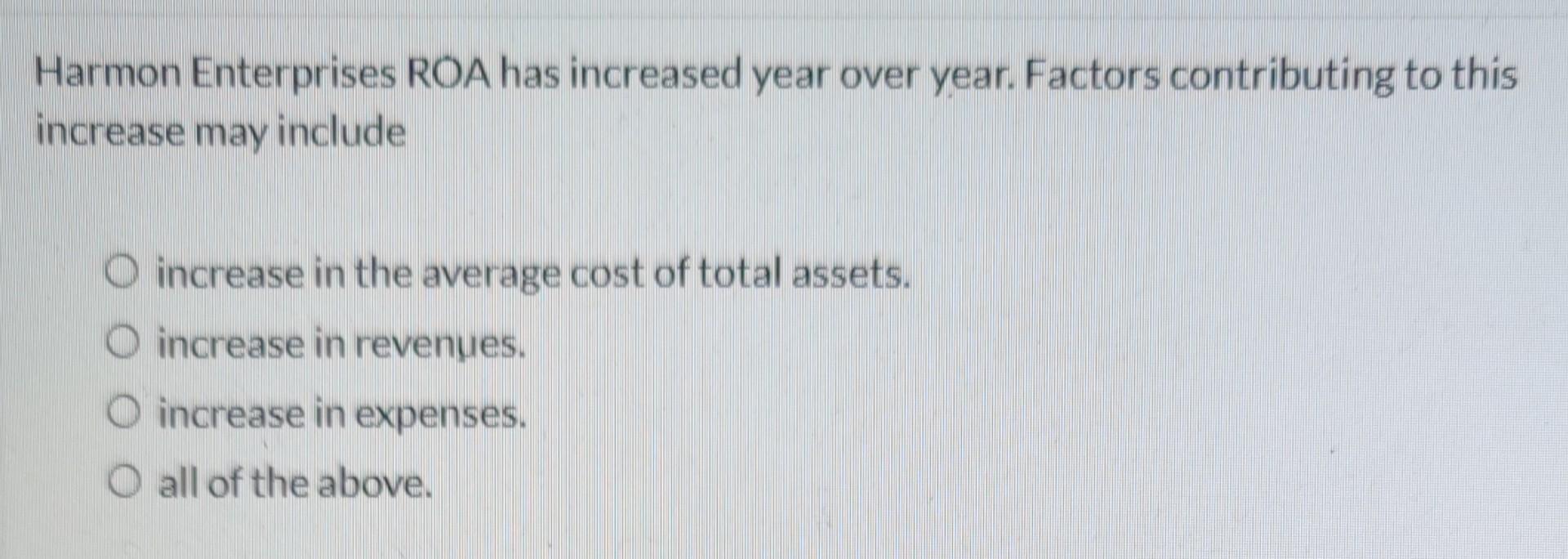

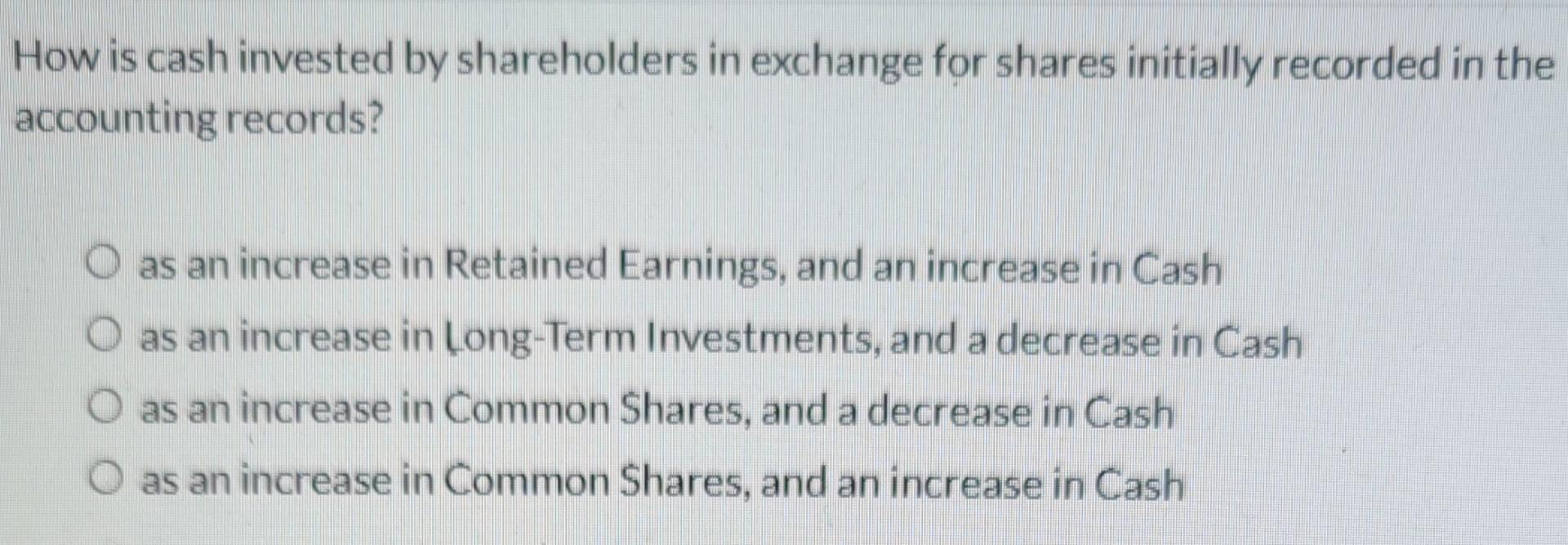

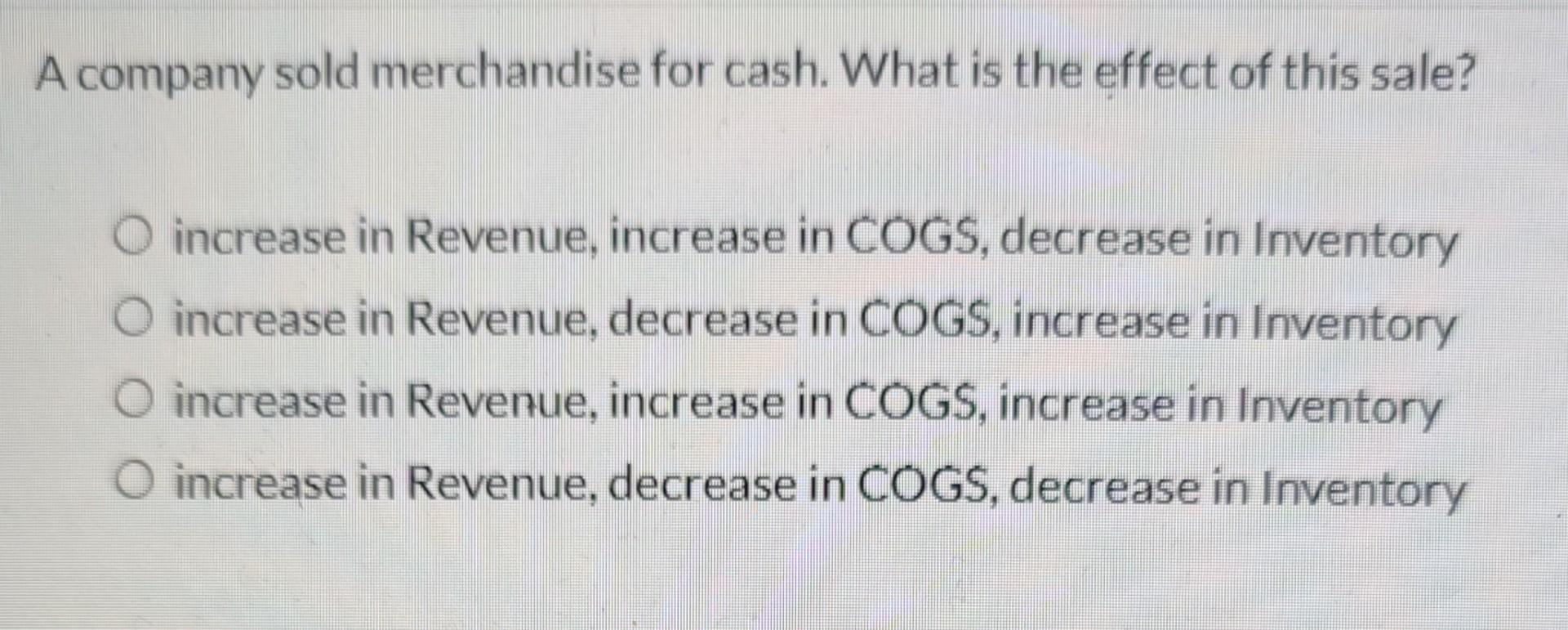

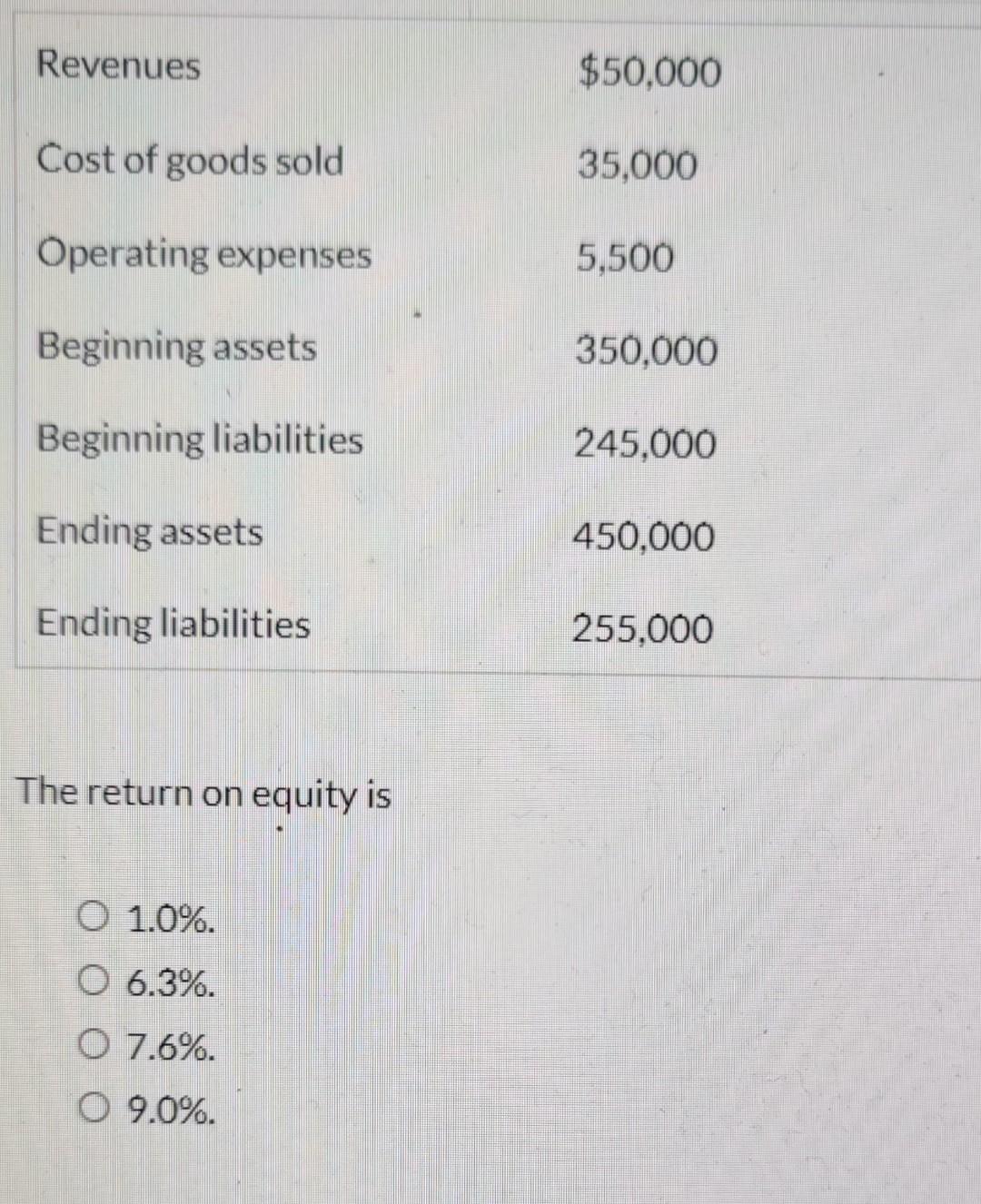

The purchase of land for a combination of cash and issuance of shares would require which of the following? O increase in Land, increase in Common Shares, increase in Cash O increase in Cash, decrease in Common Shares, decrease in Land O increase in Land, increase in Common Shares O increase in Land, increase in Common Shares, decrease in Cash The accounting template approach has several limitations. These limitations include all of the following, except for O printing out reports can be challenging. O mainly only suitable for very small businesses. O lack of specific revenue, expense, and dividends declared accounts O theoretically incorrect treatment of accounting information. O all of the above a A piece of equipment was recently purchased for $10,600 on April 1. It is estimated that it will last for 10 years and have a residual value of $600. The depreciation expense to be recognized in the year of acquisition, assuming a December year end, would be O $1,000.00 O $750.00. O $662.50. O $833.33 Harmon Enterprises ROA has increased year over year. Factors contributing to this increase may include O increase in the average cost of total assets. O increase in revenues. o increase in expenses. O all of the above. How is cash invested by shareholders in exchange for shares initially recorded in the accounting records? as an increase in Retained Earnings, and an increase in Cash O as an increase in Long-Term Investments, and a decrease in Cash O as an increase in Common Shares, and a decrease in Cash O as an increase in Common Shares, and an increase in Cash A company sold merchandise for cash. What is the effect of this sale? O increase in Revenue, increase in COGS, decrease in Inventory O increase in Revenue, decrease in COGS, increase in Inventory O increase in Revenue, increase in COGS, increase in Inventory O increase in Revenue, decrease in COGS, decrease in Inventory Revenues $50,000 Cost of goods sold 35,000 Operating expenses 5,500 Beginning assets 350,000 Beginning liabilities 245,000 Ending assets 450,000 Ending liabilities 255.000 The return on equity is 01.0%. O 6.3%. O 7.6%. O 9.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts