Question: Answer the following multiple-choice questions. Indicate your choice by selecting only one option from the four options given for each question answered. 1. The following

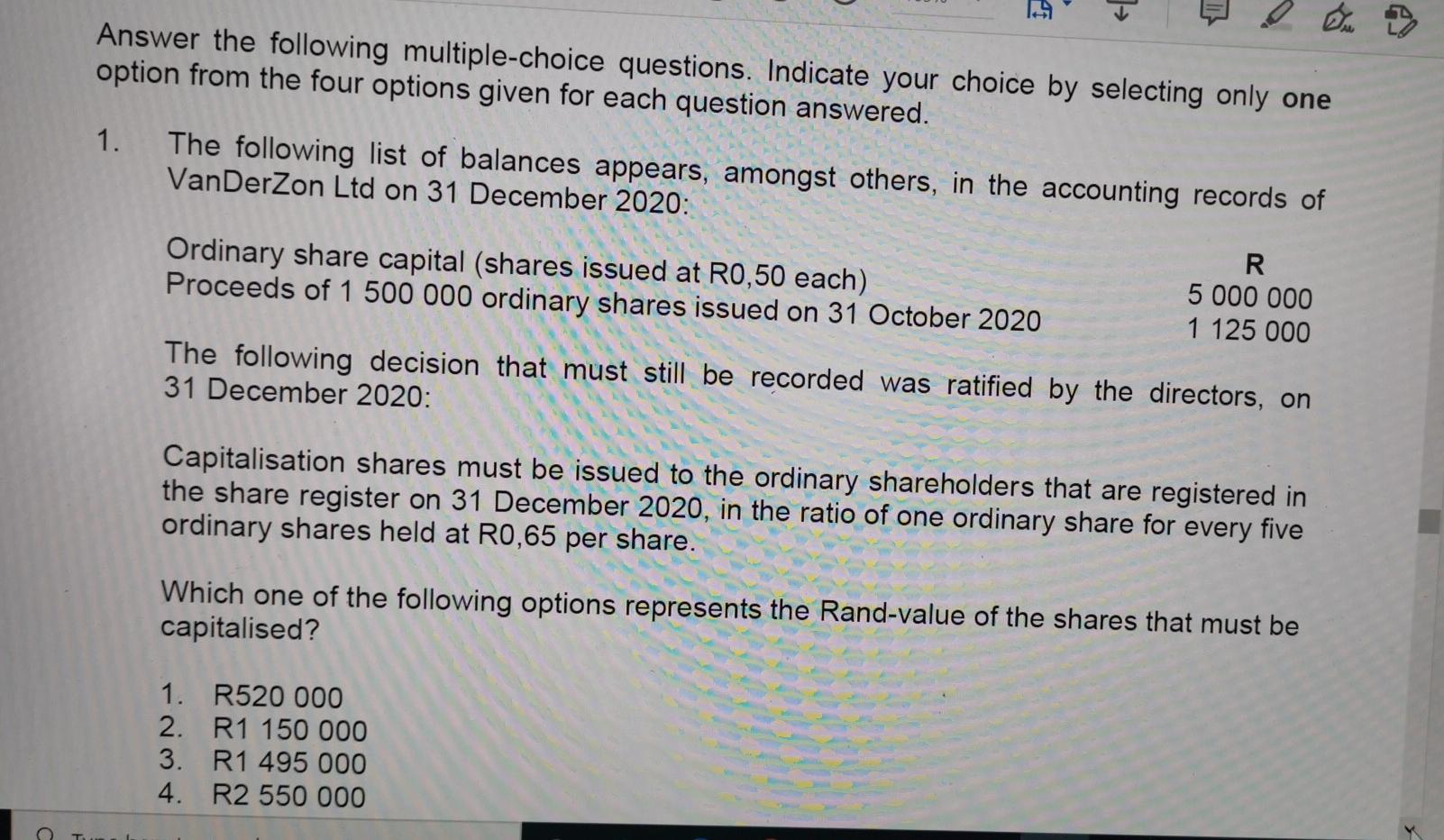

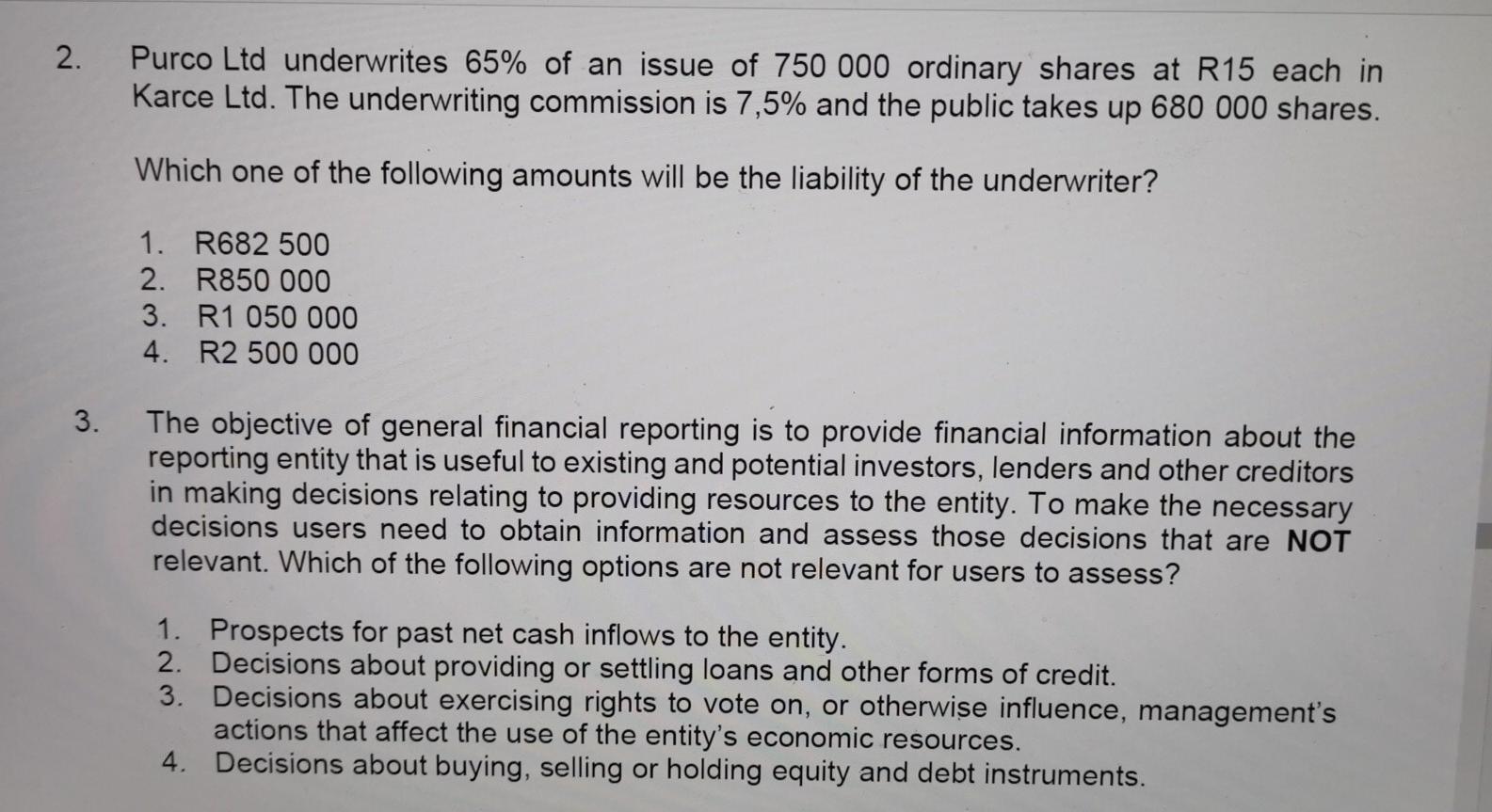

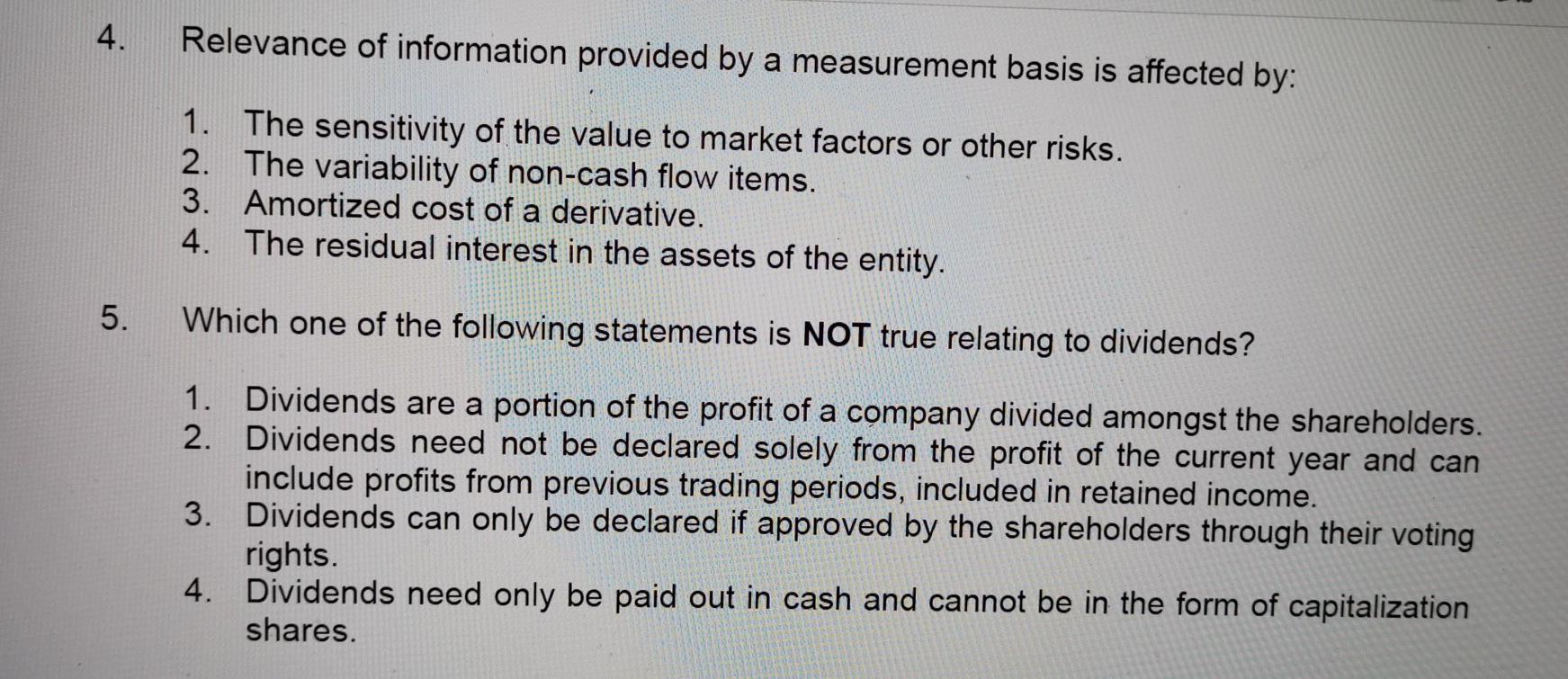

Answer the following multiple-choice questions. Indicate your choice by selecting only one option from the four options given for each question answered. 1. The following list of balances appears, amongst others, in the accounting records of VanDerZon Ltd on 31 December 2020: R Ordinary share capital (shares issued at R0,50 each) 5 000 000 Proceeds of 1 500 000 ordinary shares issued on 31 October 2020 1 125 000 The following decision that must still be recorded was ratified by the directors, on 31 December 2020: Capitalisation shares must be issued to the ordinary shareholders that are registered in the share register on 31 December 2020, in the ratio of one ordinary share for every five ordinary shares held at R0,65 per share. Which one of the following options represents the Rand-value of the shares that must be capitalised? 1. R520 000 2. R1 150 000 3. R1 495 000 4. R2 550 000 2. Purco Ltd underwrites 65% of an issue of 750 000 ordinary shares at R15 each in Karce Ltd. The underwriting commission is 7,5% and the public takes up 680 000 shares. Which one of the following amounts will be the liability of the underwriter? 1. R682 500 2. R850 000 3. R1 050 000 4. R2 500 000 3. The objective of general financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions relating to providing resources to the entity. To make the necessary decisions users need to obtain information and assess those decisions that are NOT relevant. Which of the following options are not relevant for users to assess? 1. Prospects for past net cash inflows to the entity. 2. Decisions about providing or settling loans and other forms of credit. 3. Decisions about exercising rights to vote on, or otherwise influence, management's actions that affect the use of the entity's economic resources. 4. Decisions about buying, selling or holding equity and debt instruments. 4. Relevance of information provided by a measurement basis is affected by: 1. The sensitivity of the value to market factors or other risks. 2. The variability of non-cash flow items. 3. Amortized cost of a derivative. 4. The residual interest in the assets of the entity. 5. Which one of the following statements is NOT true relating to dividends? 1. Dividends are a portion of the profit of a company divided amongst the shareholders. 2. Dividends need not be declared solely from the profit of the current year and can include profits from previous trading periods, included in retained income. 3. Dividends can only be declared if approved by the shareholders through their voting rights. 4. Dividends need only be paid out in cash and cannot be in the form of capitalization shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts