Question: answer the following Operating Leverage we to Joe Cop Fixed Costs Current Year Total Peco Sale Required enter S. Cost 23Chapter S Cost- Volume-Profit Analysis

answer the following

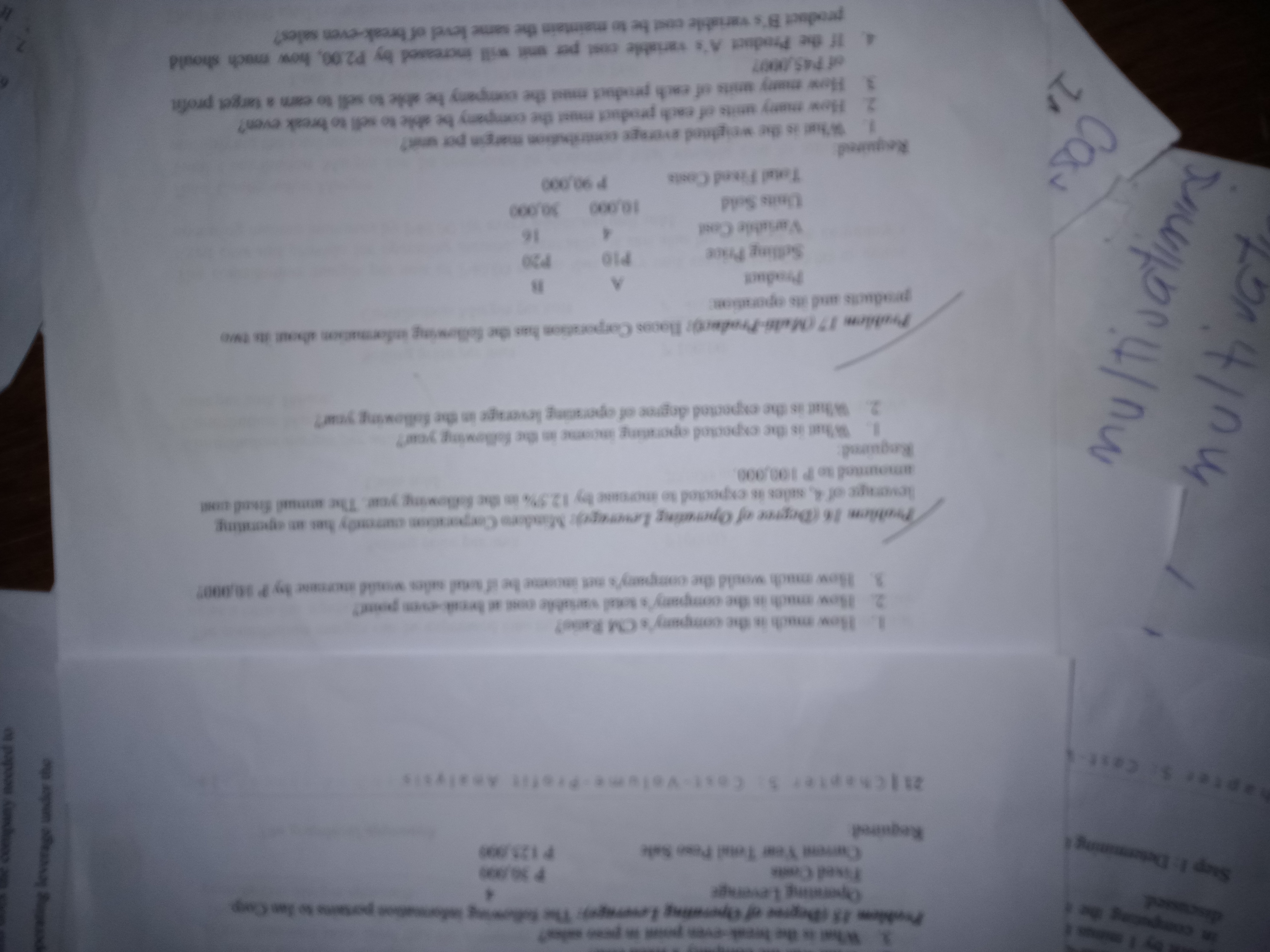

Operating Leverage we to Joe Cop Fixed Costs Current Year Total Peco Sale Required enter S. Cost 23Chapter S Cost- Volume-Profit Analysis 1. How much is the company's Cl Ratio? 2. How much is the company's soul variable on it beout even pont" 3. How much would the company's net income be if toul sides would moreune by P 10/090" Protien 16 (Degree of Operating Leverage: Mindoro Corporation currently has an operating leverage of 4, sales is expected to imoroute by 12.3% in the following your. The all five at amounted to P 103,090. Required: 1. What is the expected aporating income in the following your? 2. What is the expected Angroe of operating leverage in the following your? multivatiming Problem 17 (Mels-Product); Boces Corporation has the following information about its two products and its operation Product Selling Price PIO Variable Cast 16 Units Sold 10,090 30,090 Total Fined Costs P 90,000 Required What is the weighted everage contribution margin por witt? How marry units of each product must the company be able to sell to break even? How many units of each product that the company be able to sell to earn a target profit off PAS,DOUT If the Product A's variable cost per unit will increased by P2.00, how much should product B's variable cost he to maintain the same level of break-even sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts