Question: Answer the following problem and provide solution each. Compute for Net Present Value, Payback Period, Internal Rate of Return and Profitability Index. 1 ii

Answer the following problem and provide solution each. Compute for Net Present Value, Payback Period, Internal Rate of Return and Profitability Index.

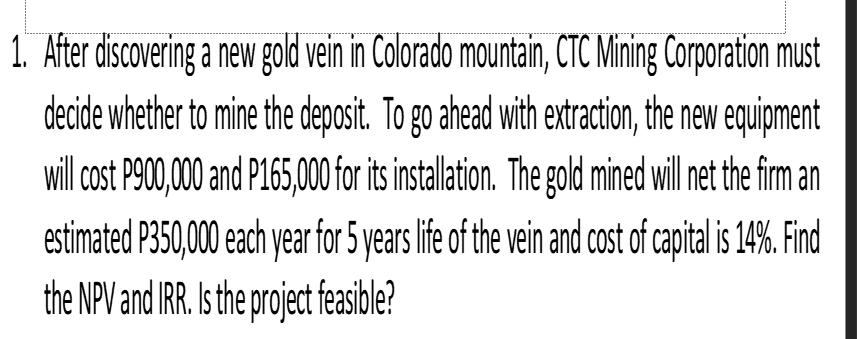

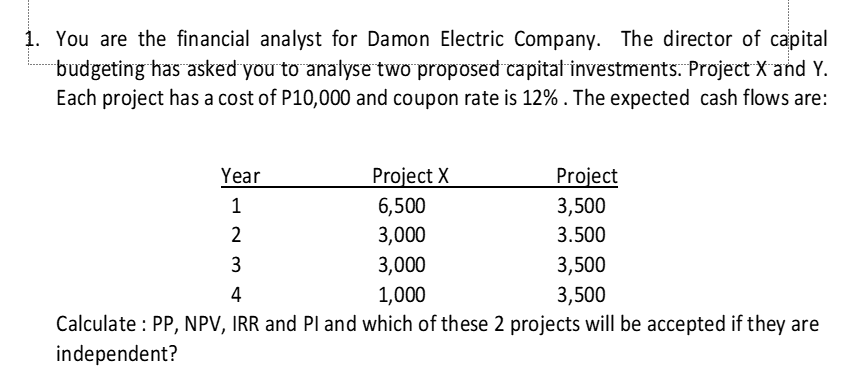

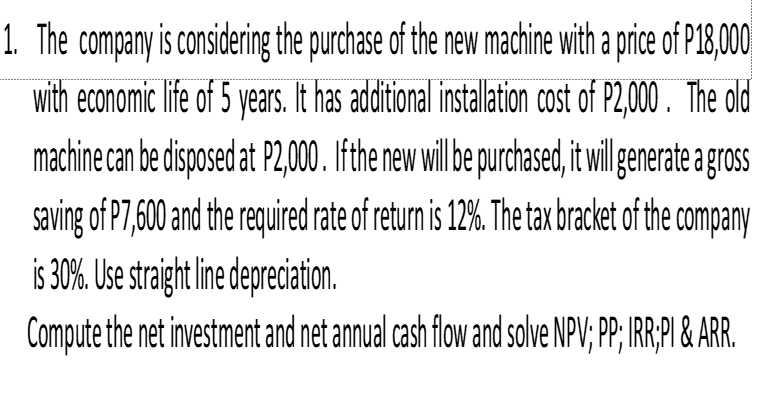

1 """ ii iterdisconeringanewgoldneininColoradomountain,CTCMiningCorporationrlrust decide whether to mine the deposit. To go ahead with extraction, the new equipment will cost P900000 and P165000 for its installation. The gold mined will net the rm an estimated P350000 each year for 5 years life of the vein and cost of capital is 14%. Find the NPV and Hill. lsthe project feasible? 1. You are the financial analyst for Damon Electric Company. The director of capital budgeting has asked you to analyse two proposed capital investments. Project X and Y. Each project has a cost of P10,000 and coupon rate is 12% . The expected cash flows are: Year Project X Project 6,500 3,500 3,000 3.500 3,000 3,500 1,000 3,500 Calculate : PP, NPV, IRR and PI and which of these 2 projects will be accepted if they are independent?1. The company is considering the purchase of the new machine with a price of P18,000 with economic life of 5 years. It has additional installation cost of P2,000 . The old machine can be disposed at P2,000. If the new will be purchased, it will generate a gross saving of P7,600 and the required rate of return is 12%. The tax bracket of the company is 30%. Use straight line depreciation. Compute the net investment and net annual cash flow and solve NPV; PP; IRR;PI & ARR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts