Question: Answer the following problem and provide solution each. Compute for Net Present Value, Payback Period, Internal Rate of Return and Profitability Index. 1. An investment

Answer the following problem and provide solution each. Compute for Net Present Value, Payback Period, Internal Rate of Return and Profitability Index.

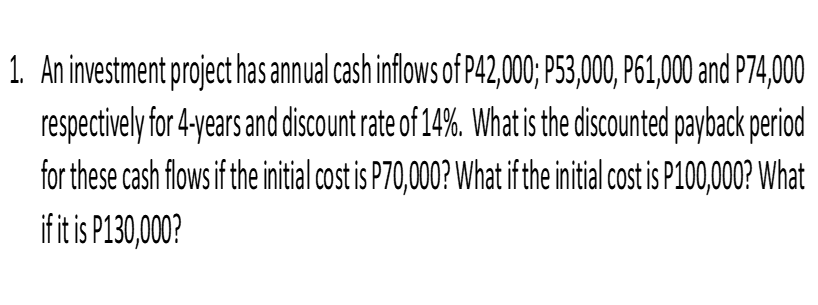

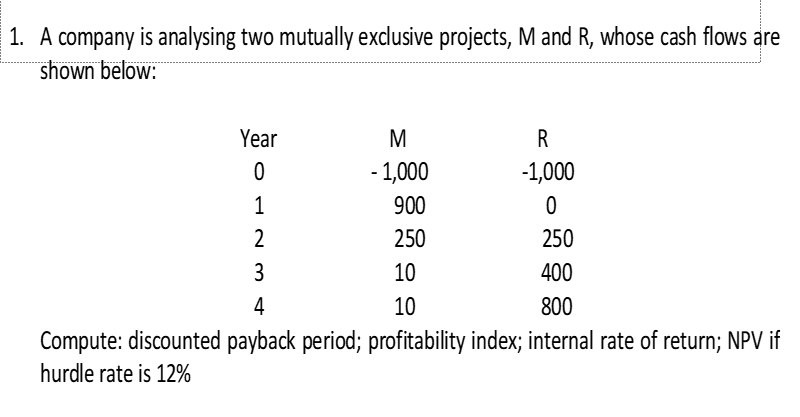

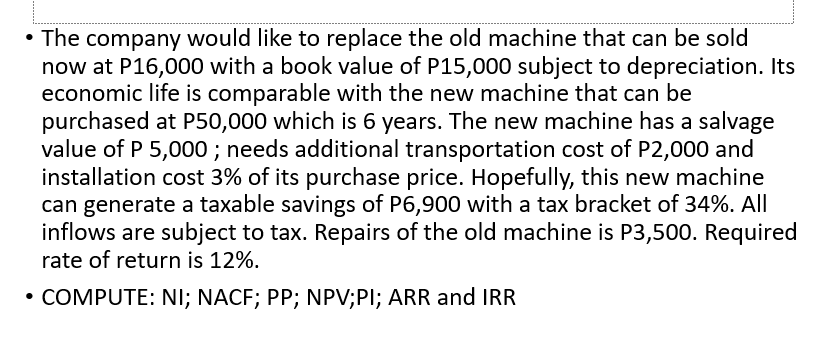

1. An investment project has annual cash inflows of P42,000; P53,000, P61,000 and P74,000 respectively for 4-years and discount rate of 14%. What is the discounted payback period for these cash flows if the initial cost is P70,000? What if the initial cost is P100,000? What if it is P130,000?-.- 1. A company is analysing two mutually exclusive projects, M and R, whose cash flows are shown below: Year M R - 1,000 -1,000 900 250 250 10 400 10 800 Compute: discounted payback period; profitability index; internal rate of return; NPV if hurdle rate is 12%.............................................................................................................................................................................................................................................................. The companv would like to replace the old machine that can be sold now at P16 000 with a book value of P15 000 subject to depreciation. Its economic life is comparable with the new machine that can be purchased at P50,000 which is 6 years. The new machine has a salvage value of P 5,000 ; needs additional transportation cost of P2,000 and installation cost 3% of its purchase price. Hopefully, this new machine can generate a taxable savings of P6300 with a tax bracket of 34%. All inflows are subject to tax. Repairs of the old machine is P3500. Required rate of return is 12%. . COMPUTE: NI; NACF; PP; NPV;PI; ARR and IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts