Question: Answer the following Question based on this Table: (Step by Step) Question 1) Suppose you decide you will construct a price-weighted index. What will be

Answer the following Question based on this Table: (Step by Step)

Question 1)

Suppose you decide you will construct a price-weighted index. What will be the weighting of Stock Alpha in the index?

a. 22.41%

b. 19.21%

c. 25.00%

d. 26.89%

Question 2)

Suppose you decide you will construct a value-weighted index. What will be the weighting of Stock Gamma in the index?

a. 27.44%

b. 24.24%

c. 22.78%

d. 25.00%

Question 3)

Suppose you decide you want to construct an index that will never need rebalancing. What will be the weighting of Stock Delta in the index?

a. 19.71%

b. 25.00%

c. 20.16%

d. 16.96%

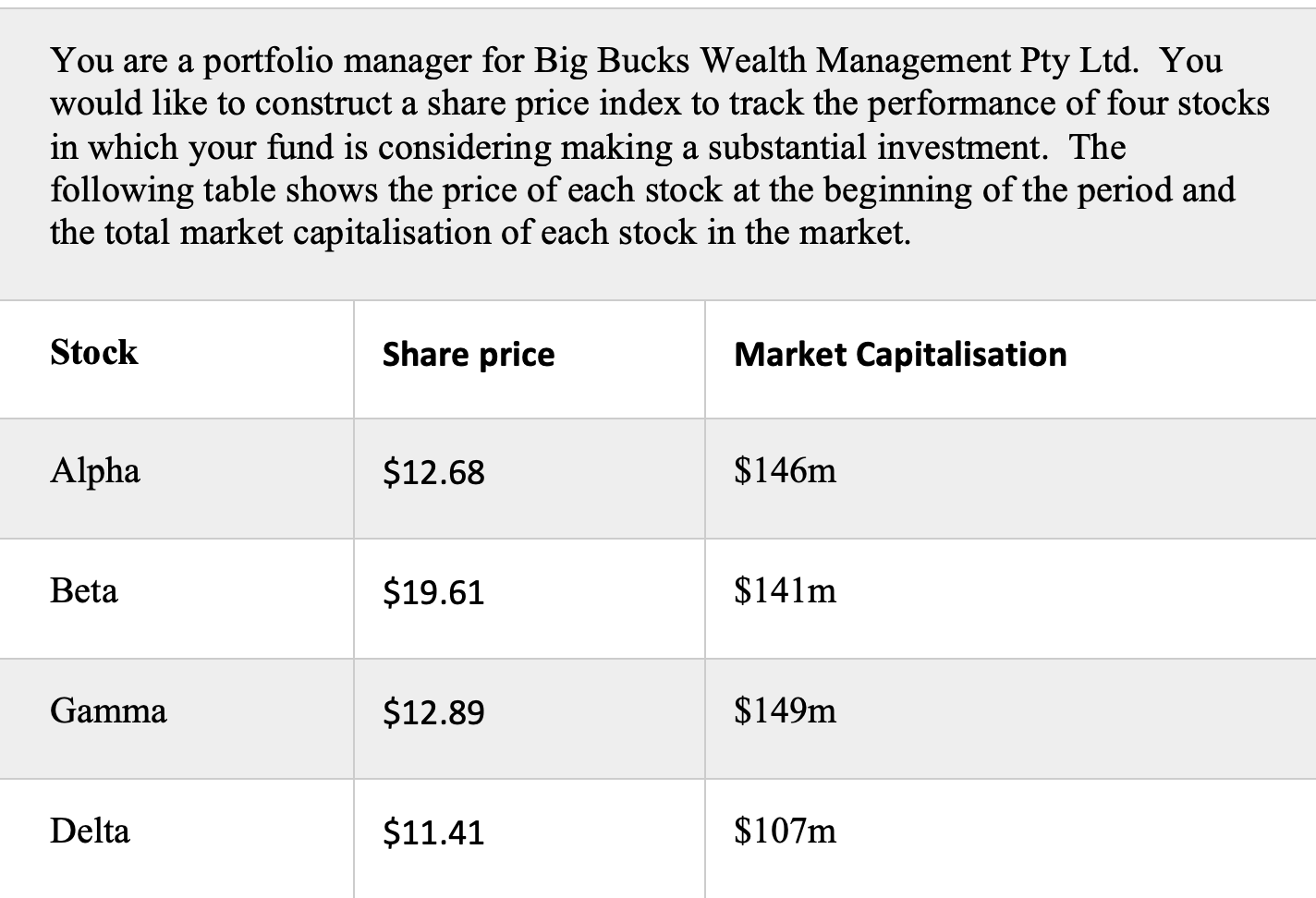

You are a portfolio manager for Big Bucks Wealth Management Pty Ltd. You would like to construct a share price index to track the performance of four stocks in which your fund is considering making a substantial investment. The following table shows the price of each stock at the beginning of the period and the total market capitalisation of each stock in the market. Stock Share price Market Capitalisation Alpha $12.68 $146m Beta $19.61 $141m Gamma $12.89 $149m Delta $11.41 $107m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts