Question: Answer the following question in a word document: only put the answers in the answers word document (do n paste questions). - For each answer

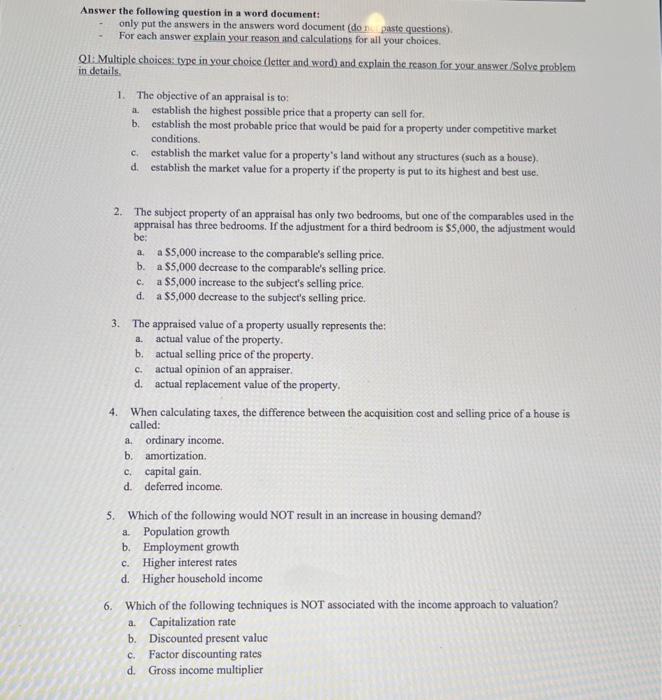

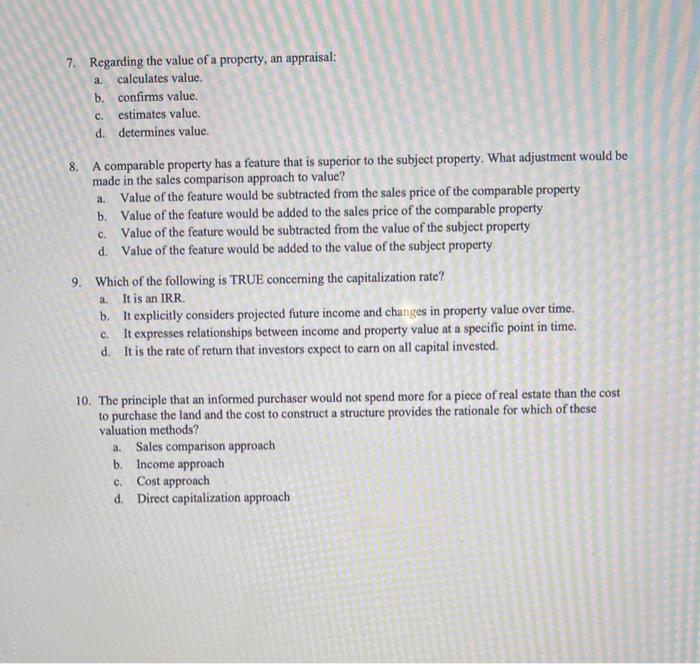

Answer the following question in a word document: only put the answers in the answers word document (do n paste questions). - For each answer explain your reason and calculations for all your choices. Q1: Multiple choices: type in your choice (letter and word) and explain the reason for your answer / Solve problem in details. 1. The objective of an appraisal is to: a. establish the highest possible price that a property can sell for. b. establish the most probable price that would be paid for a property under competitive market conditions. c. establish the market value for a property's land without any structures (such as a bouse). d. establish the market value for a property if the property is put to its highest and best use. 2. The subject property of an appraisal has only two bedrooms, but one of the comparables used in the appraisal has three bedrooms. If the adjustment for a third bedroom is $5,000, the adjustment would be: a. a $5,000 increase to the comparable's selling price. b. a $5,000 decrease to the comparable's selling price. c. a $5,000 increase to the subject's selling price. d. a $5,000 decrease to the subject's selling price. 3. The appraised value of a property usually represents the: a. actual value of the property. b. actual selling price of the property. c. actual opinion of an appraiser. d. actual replacement value of the property. 4. When calculating taxes, the difference between the acquisition cost and selling price of a house is called: a. ordinary income. b. amortization. c. capital gain. d. deferred income. 5. Which of the following would NOT result in an increase in bousing demand? a. Population growth b. Employment growth c. Higher interest rates d. Higher houschold income 6. Which of the following techniques is NOT associated with the income approach to valuation? a. Capitalization rate b. Discounted present value c. Factor discounting rates d. Gross income multiplier 7. Regarding the value of a property, an appraisal: a. calculates value. b. confirms value. c. estimates value. d. determines value. 8. A comparable property has a feature that is superior to the subject property. What adjustment would be made in the sales comparison approach to value? a. Value of the feature would be subtracted from the sales price of the comparable property b. Value of the feature would be added to the sales price of the comparable property c. Value of the feature would be subtracted from the value of the subject property d. Value of the feature would be added to the value of the subject property 9. Which of the following is TRUE conceming the capitalization rate? a. It is an IRR. b. It explicitly considers projected future income and changes in property value over time. c. It expresses relationships between income and property value at a specific point in time. d. It is the rate of return that investors expect to carn on all capital invested. 10. The principle that an informed purchaser would not spend more for a piece of real estate than the cost to purchase the land and the cost to construct a structure provides the rationale for which of these valuation methods? a. Sales comparison approach b. Income approach c. Cost approach d. Direct capitalization approach ASP company is considering the purchase of an wholesale property. After a review of the market and the leases that are in place, ASP believes that first year's cash flow will be $100,000. It also believes that the cash flow will rise in the amount of $5,400 each year for the foresecable future. It plans to own the property for at least 10 years. Based on a review of sales of properties that are now 10 years older than the subject property, ASP has determined that cap rates are in a range of 10%. ASP believes that it should earn a required retum of at least 11 percent. Required: What is the estimated value of this property (assume a 0.10 terminal cap rate)? 2. An investor is considering the purchase of a small office building. The NOI is expected to be the following: Year 1, \$202,000; Year 2, \$212,000; Year 3,\$222,000; Year 4, \$232,000; Ycar 5, \$242,000. The property will be sold at the end of year 5 and the investor believes that the property value should have appreciated at a rate of 3 percent per year during the five-year period. The investor plans to pay all cash for the property and wants to earn a 10 percent retum on investment (IRR) compounded annually. Required: a. What should be the present value of the property today? b. What should be the property value (REV) at the end of year 5 in order for the investor to eam the 10% IRR? c. Based on your answer in (b), if the building could be reproduced for $2,320,000 today, what would be the underlying value of the land

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts