Question: Answer the following question Question 3 KTC Ltd is currently an all-equity company and has an unlevered value of $100million. The firm's current cost of

Answer the following question

Answer the following question

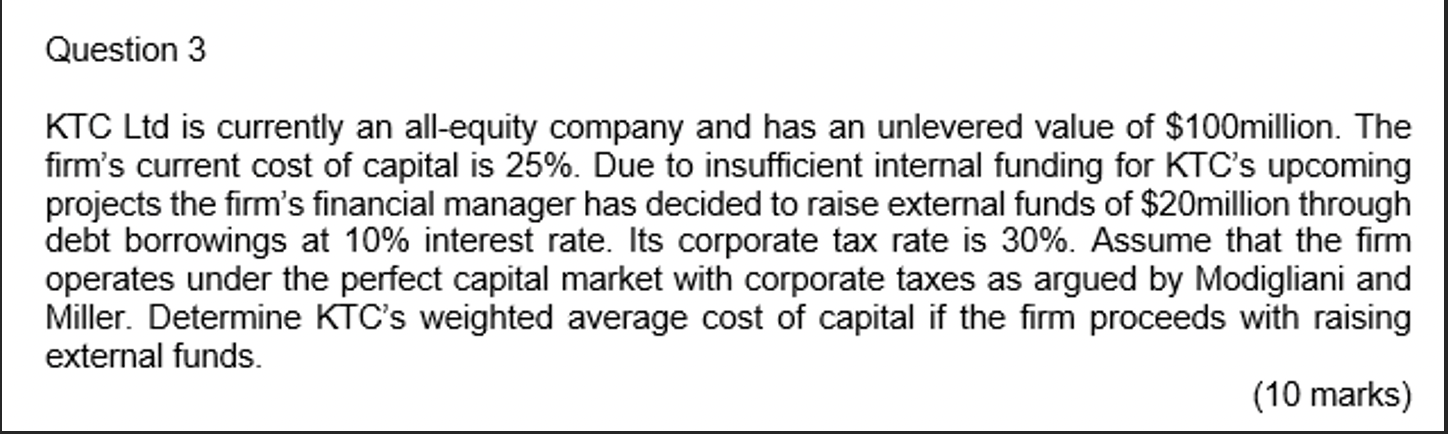

Question 3 KTC Ltd is currently an all-equity company and has an unlevered value of $100million. The firm's current cost of capital is 25%. Due to insufficient internal funding for KTC's upcoming projects the firm's financial manager has decided to raise external funds of $20million through debt borrowings at 10% interest rate. Its corporate tax rate is 30%. Assume that the firm operates under the perfect capital market with corporate taxes as argued by Modigliani and Miller. Determine KTC's weighted average cost of capital if the firm proceeds with raising external funds. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts