Question: Please help Question 3 (1 point) Saved A 7-year bond with a 5% annual coupon has a yield to maturity of 590, what is the

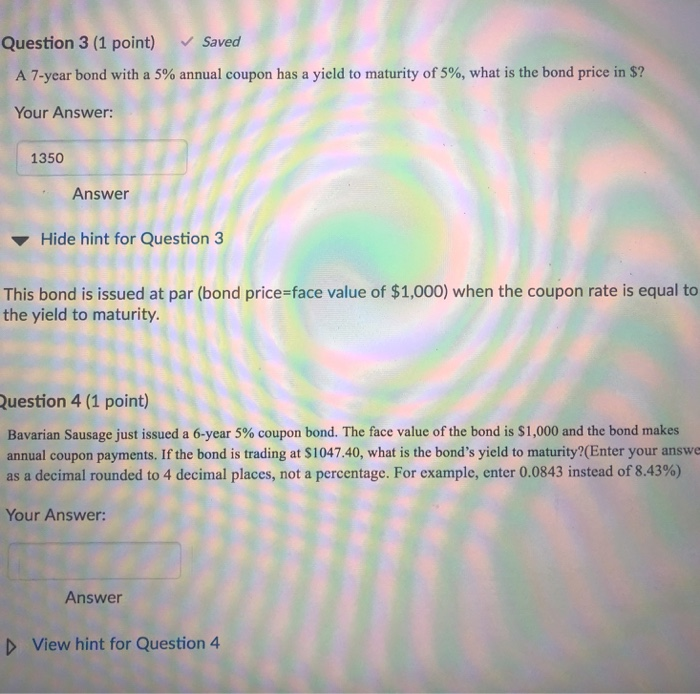

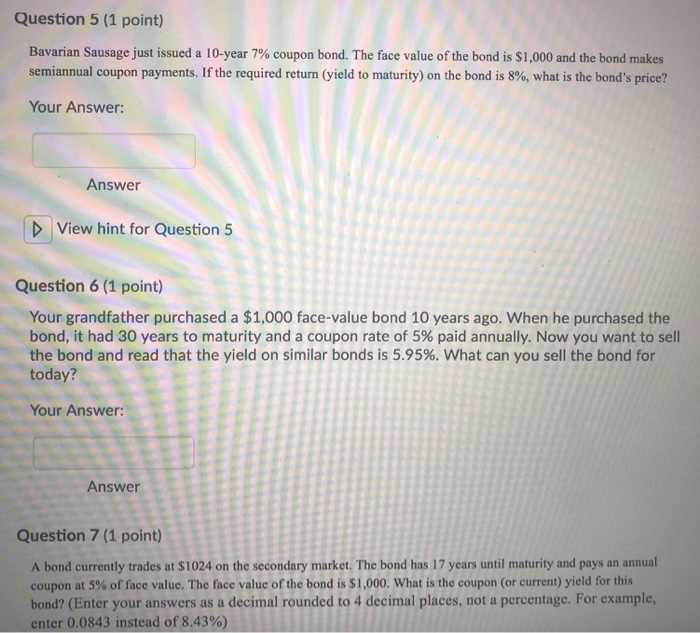

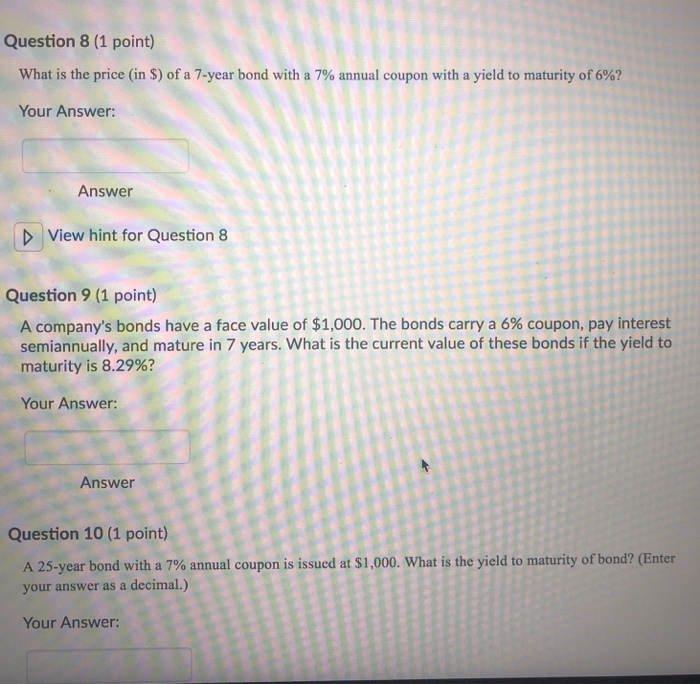

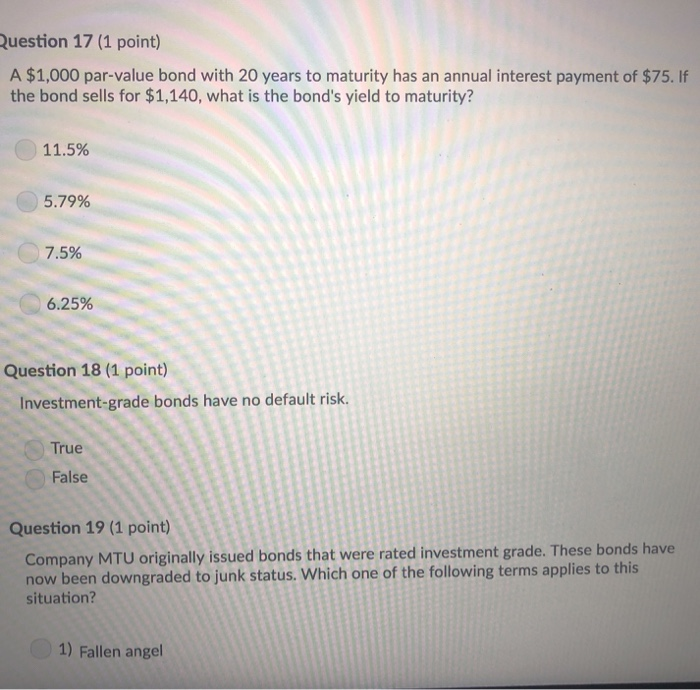

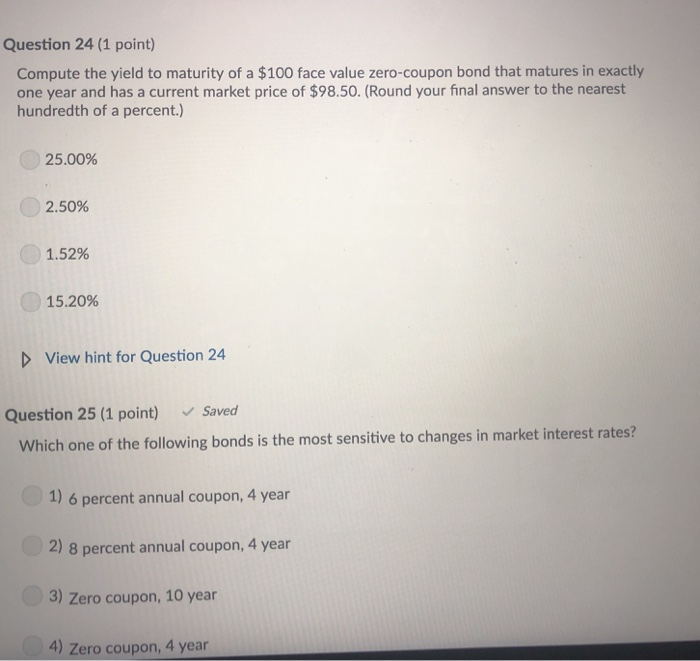

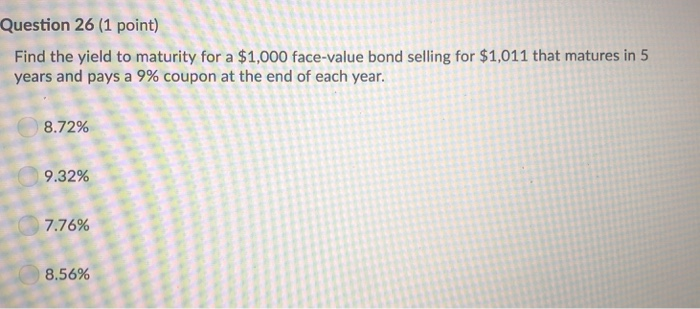

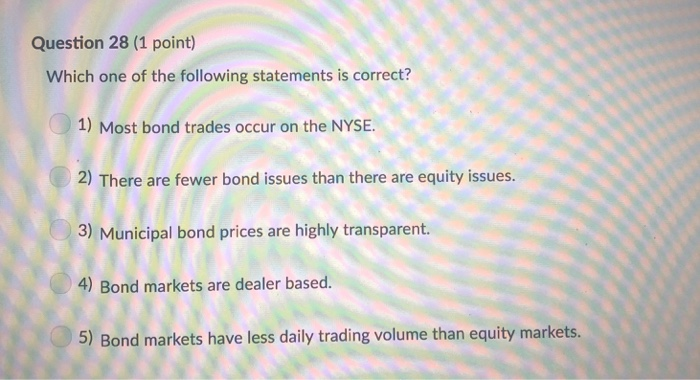

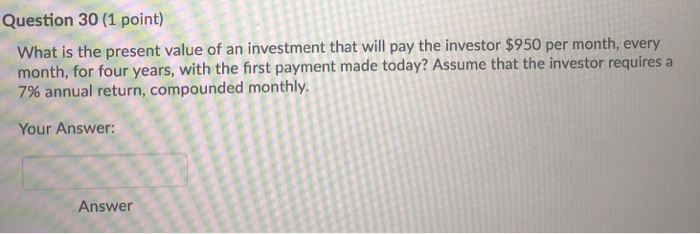

Question 3 (1 point) Saved A 7-year bond with a 5% annual coupon has a yield to maturity of 590, what is the bond price in S? Your Answer 1350 Answer Hide hint for Question 3 This bond is issued at par (bond price-face value of $1,000) when the coupon rate is equal to the yield to maturity uestion 4 (1 point) Bavarian Sausage just issued a 6-year 5% coupon bond. The face value of the bond is S 1,000 and the bond makes annual coupon payments. If the bond is trading at $1047.40, what is the bond's yield to maturity?(Enter your answe as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8.4396) Your Answer: Answer D View hint for Question 4 Question 5 (1 point) Bavarian Sausage Just issued a 10-year 7% coupon bond. The face value of the bond is $1,000 and the bond makes semiannual coupon payments. If the required return (yield to maturity) on the bond is 8%, what is the bond's price? Your Answer: Answer View hint for Question 5 Question 6 (1 point) Your grandfather purchased a $1,000 face-value bond 10 years ago. When he purchased the bond, it had 30 years to maturity and a coupon rate of 5% paid annually. Now you want to sell the bond and read that the yield on similar bonds is 5.95%. What can you sell the bond for today? Your Answer: Answer Question 7 (1 point) A bond currently trades at $1024 on the secondary market. The bond has 17 years until maturity and pays an annual coupon at 5% of face value. The face value of the bond is $1,000, what is the coupon (or current) yield for this bond? (Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8.43%) 111 Question 8 (1 point) What is the price (in $) of a 7-year bond with a 7% annual coupon with a yield to maturity of 6%? Your Answer: Answer View hint for Question 8 Question 9 (1 point) A company's bonds have a face value of $1,000. The bonds carry a 6% coupon, pay interest semiannually, and mature in 7 years. What is the current value of these bonds if the yield to maturity is 8.29%? Your Answer Answer Question 10 (1 point) A 25-year bond with a 7% annual coupon is issued at $1,000. What is the yield to maturity of bond? (Enter your answer as a decimal.) Your Answer: uestion 17 (1 point) A $1,000 par-value bond with 20 years to maturity has an annual interest payment of $75. If the bond sells for $1,140, what is the bond's yield to maturity? 11.5% 5.79% 75% 6.25% Question 18 (1 point) Investment-grade bonds have no default risk True False Question 19 (1 point) Company MTU originally issued bonds that were rated investment grade. These bonds have now been downgraded to junk status. Which one of the following terms applies to this situation? 1) Fallen angel Question 24 (1 point) Compute the yield to maturity of a $100 face value zero-coupon bond that matures in exactly one year and has a current market price of $98.50. (Round your final answer to the nearest hundredth of a percent.) 25.00% 2.50% 1.52% 15.20% D View hint for Question 24 Question 25 (1 point) Saved Which one of the following bonds is the most sensitive to changes in market interest rates? 1) 6 percent annual coupon, 4 year 2) 8 percent annual coupon, 4 year 3) Zero coupon, 10 year 4) Zero coupon, 4 year Question 26 (1 point) Find the yield to maturity for a $1,000 face-value bond selling for $1,011 that matures in 5 years and pays a 9% coupon at the end of each year. 8.72% 9.32% 775% 8.56% Question 28 (1 point) Which one of the following statements is correct? 1) Most bond trades occur on the NYSE. 2) There are fewer bond issues than there are equity issues. 3) Municipal bond prices are highly transparent. 4) Bond markets are dealer based. 5) Bond markets have less daily trading volume than equity markets. Question 30 (1 point) What is the present value of an investment that will pay the investor $950 per month, every month, for four years, with the first payment made today? Assume that the investor requires a 7% annual return, compounded monthly. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts