Question: Answer the following questions and do the following problems anetihclude them in you ECP Notes. If the cost of new common equity is higher than

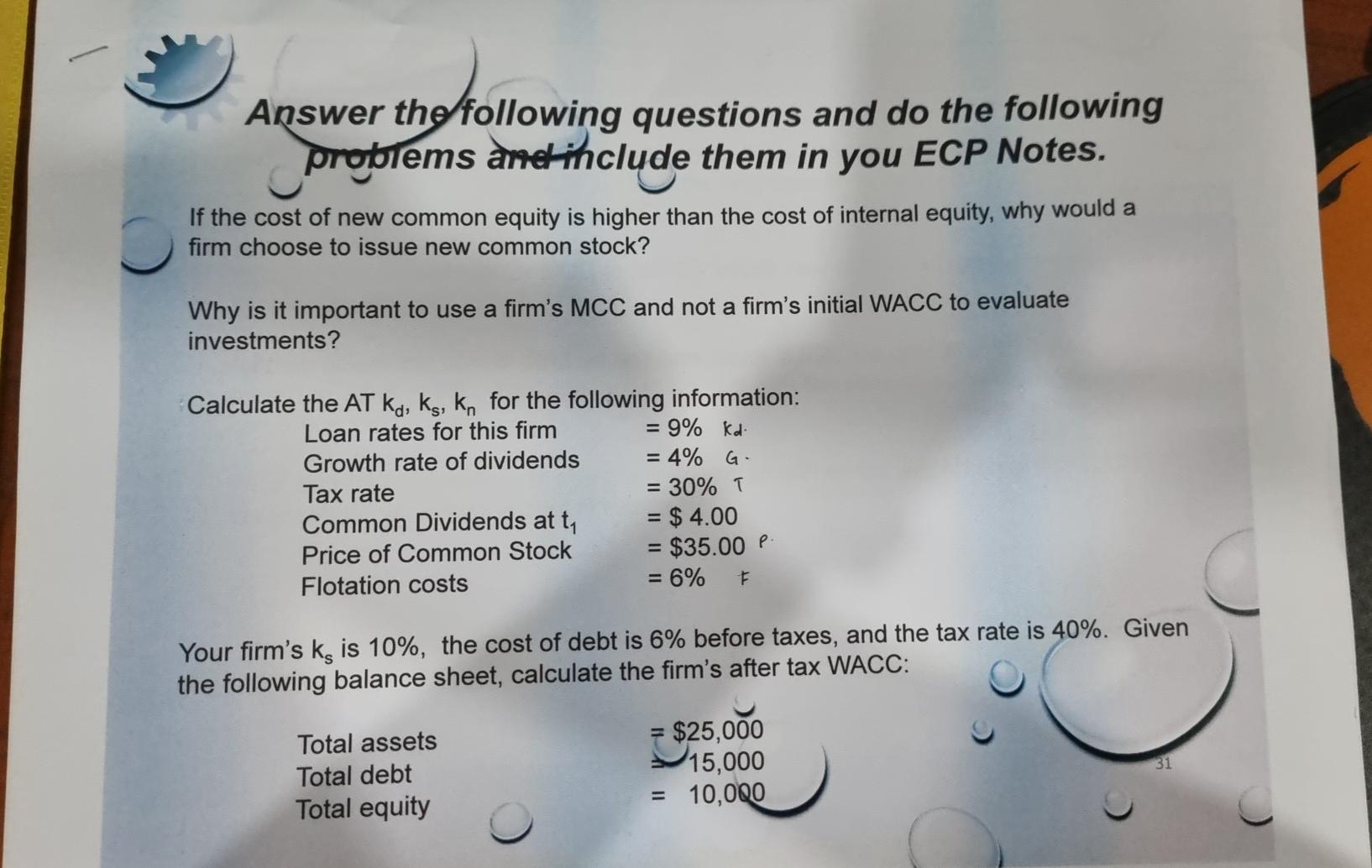

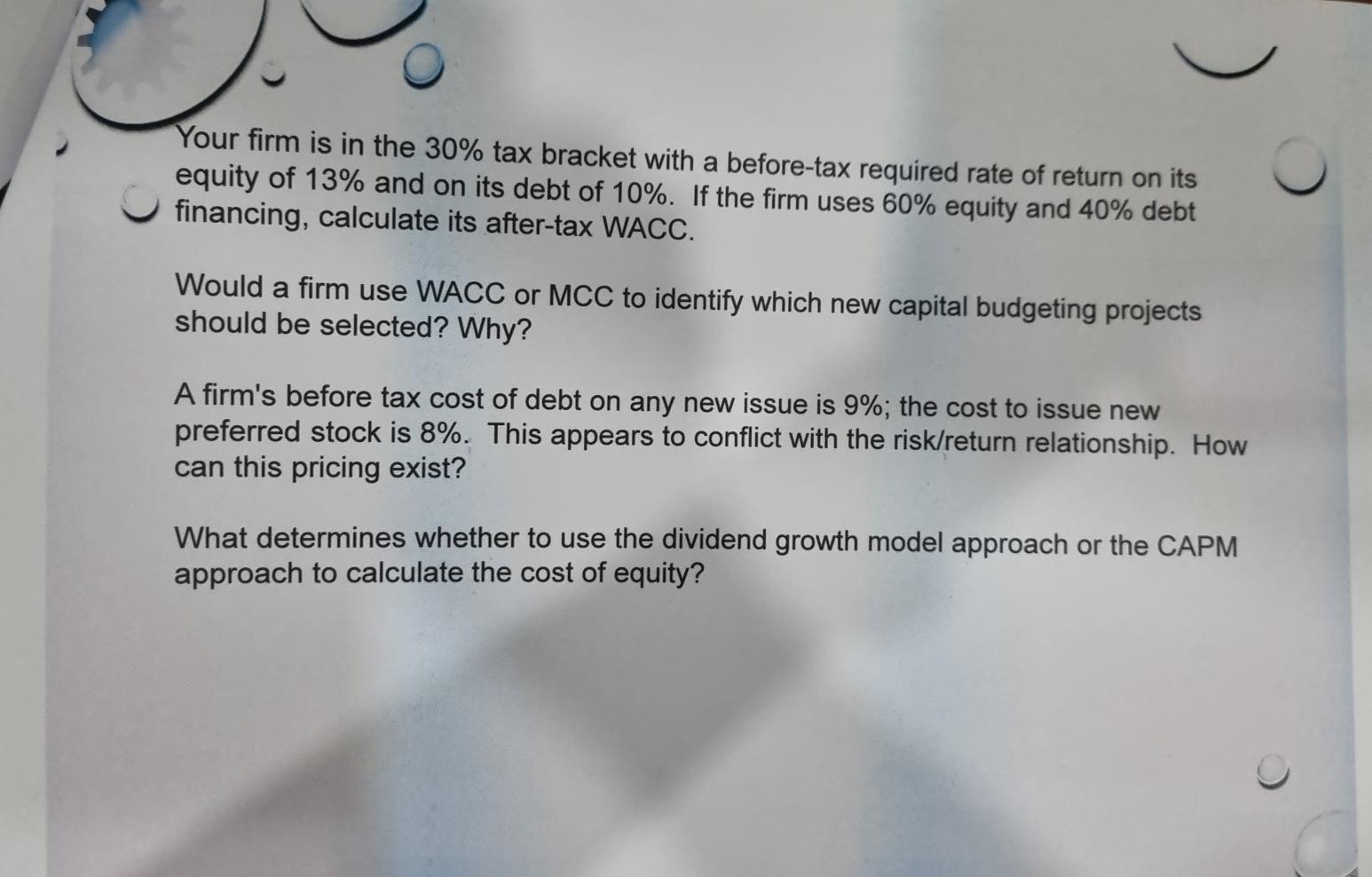

Answer the following questions and do the following problems anetihclude them in you ECP Notes. If the cost of new common equity is higher than the cost of internal equity, why would a firm choose to issue new common stock? Why is it important to use a firm's MCC and not a firm's initial WACC to evaluate investments? Calculate the AT kd, ks, kn for the following information: Loan rates for this firm = 9% kad Growth rate of dividends = 4% G Tax rate = 30% T Common Dividends at ty = $ 4.00 Price of Common Stock = $35.00 P Flotation costs = 6% F Your firm's ks is 10%, the cost of debt is 6% before taxes, and the tax rate is 40%. Given the following balance sheet, calculate the firm's after tax WACC: Total assets Total debt Total equity = $25,000 15,000 = 10,000 31 Your firm is in the 30% tax bracket with a before-tax required rate of return on its equity of 13% and on its debt of 10%. If the firm uses 60% equity and 40% debt financing, calculate its after-tax WACC. Would a firm use WACC or MCC to identify which new capital budgeting projects should be selected? Why? A firm's before tax cost of debt on any new issue is 9%; the cost to issue new preferred stock is 8%. This appears to conflict with the risk/return relationship. How can this pricing exist? What determines whether to use the dividend growth model approach or the CAPM approach to calculate the cost of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts