Question: Answer the following questions. Please explain them fully. 10 A company has inventories of 1500,000, trade receivables of $600,000, a bank overdraft of (200,000 and

Answer the following questions. Please explain them fully.

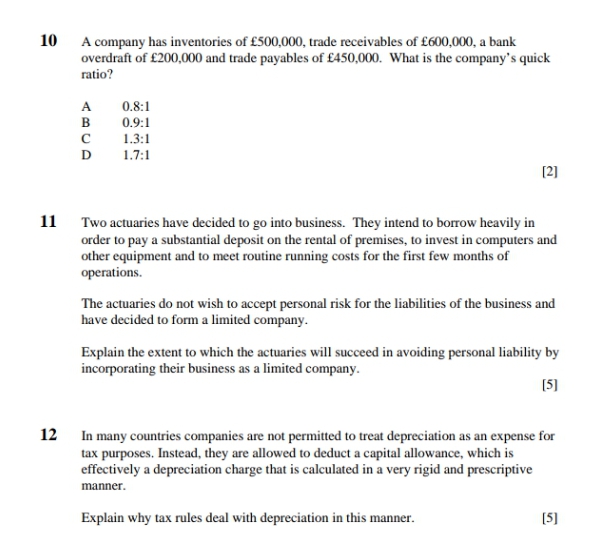

10 A company has inventories of 1500,000, trade receivables of $600,000, a bank overdraft of (200,000 and trade payables of $450,000. What is the company's quick ratio? A 0.8:1 B 0.9:1 1.3:1 D 1.7:1 [2] 11 Two actuaries have decided to go into business. They intend to borrow heavily in order to pay a substantial deposit on the rental of premises, to invest in computers and other equipment and to meet routine running costs for the first few months of operations. The actuaries do not wish to accept personal risk for the liabilities of the business and have decided to form a limited company. Explain the extent to which the actuaries will succeed in avoiding personal liability by incorporating their business as a limited company. [5] 12 In many countries companies are not permitted to treat depreciation as an expense for tax purposes. Instead, they are allowed to deduct a capital allowance, which is effectively a depreciation charge that is calculated in a very rigid and prescriptive manner. Explain why tax rules deal with depreciation in this manner. [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts