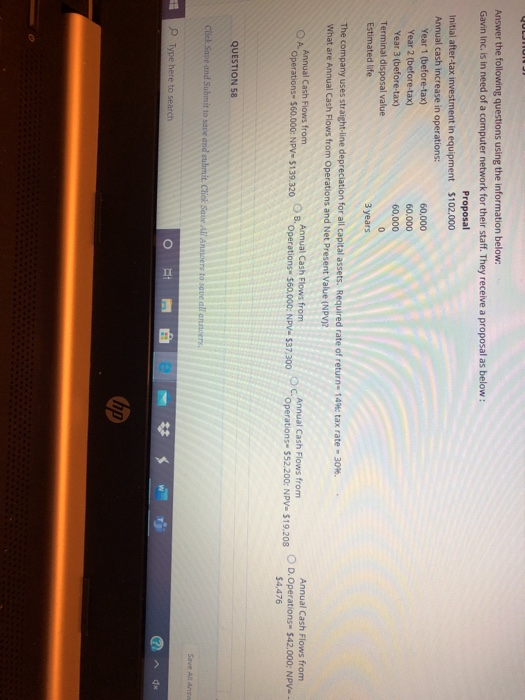

Question: Answer the following questions using the information below: Gavin Inc. is in need of a computer network for their staff. They receive a proposal as

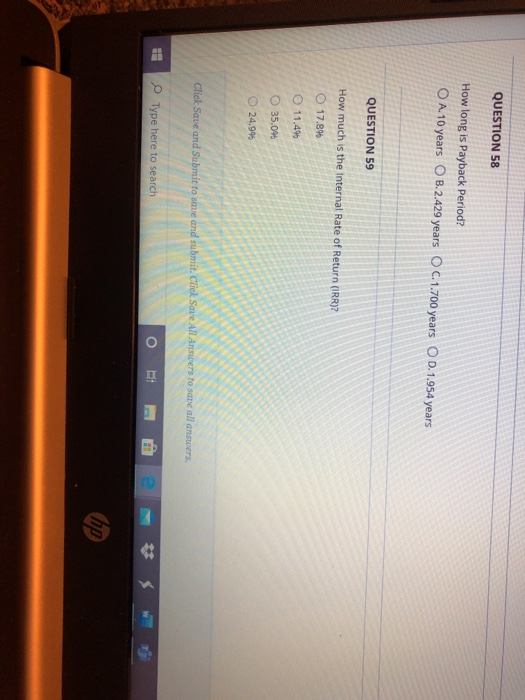

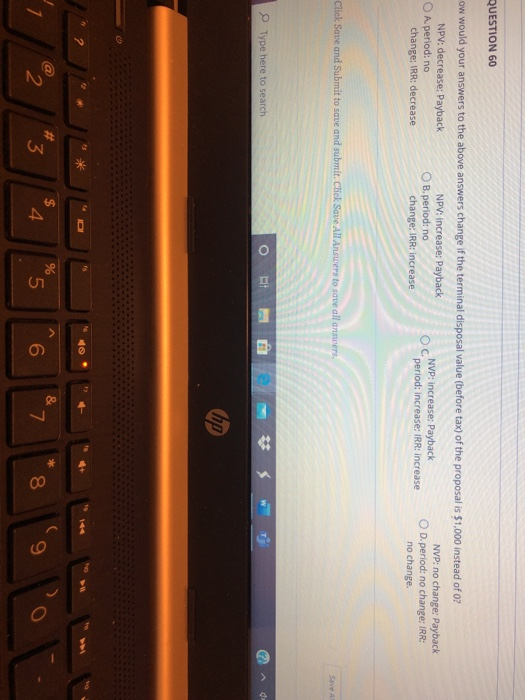

Answer the following questions using the information below: Gavin Inc. is in need of a computer network for their staff. They receive a proposal as below: Proposal Initial after-tax investment in equipment $102,000 Annual cash increase in operations: Year 1 (before-tax) 60,000 Year 2 (before-tax) 60.000 Year 3 (before-tax) 60.000 Terminal disposal value Estimated life 3 years The company uses straight-line depreciation for all capital assets. Required rate of return-14%: tax rate - 30%. What are Annual Cash Flows from Operations and Net Present Value (NPV)? . Annual Cash Flows from Operations- 560.000: NPV = 5139.320 Annual Cash Flows from "Operations- $60,000: NPV-$37,300 Annual Cash Flows from Operations- 552,200 NPV 519,208 Annual Cash Flows from D. Operations $42.000: NPV- 54,476 QUESTION 58 Click Save and Submit to save and submit. Click Save All Answers to see all a Save All Anu Type here to search hp QUESTION 58 How long is Payback Period? O A. 10 years o B.2.429 years o C.1.700 years o D. 1.954 years QUESTION 59 How much is the internal Rate of Return (IRR)? O 17.8% O 11.496 35.0% 24.9% Click Save and Submit to save and submit. Click Save All Answers to save all answers. Type here to search QUESTION 60 ow would your answers to the above answers change if the terminal disposal value (before tax) of the proposal is $1.000 instead of o? NPV: decrease: Payback NPV: increase: Payback NVP: no change: Payback NVP: increase: Payback O A. period: no O B. period: no period: Increase: IRR: Increase OD.period: no change: IRR: change: IRR: decrease change: IRR: increase no change. Click Save and Submit to save and submit. Click Save All Answers to save all answers Type here to search hp

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts