Question: Answer the following True and False statements and JUSTIFY the False statements. 1. A company paid $9,000 for a six-month insurance policy. The policy coverage

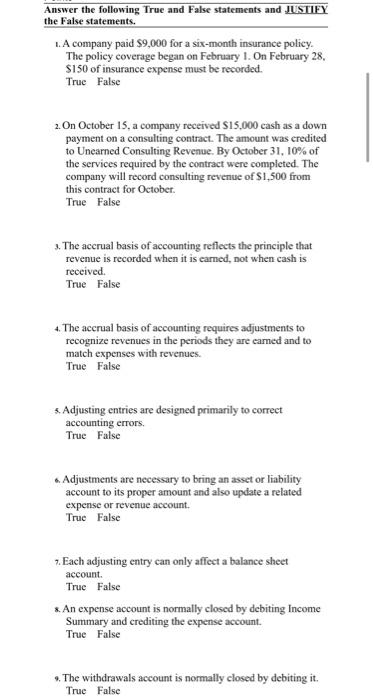

Answer the following True and False statements and JUSTIFY the False statements. 1. A company paid $9,000 for a six-month insurance policy. The policy coverage began on February 1. On February 28, $150 of insurance expense must be recorded. True False 2. On October 15, a company received $15.000 cash as a down payment on a consulting contract. The amount was credited to Unearned Consulting Revenue. By October 31, 10% of the services required by the contract were completed. The company will record consulting revenue of S1,500 from this contract for October True False 3. The accrual basis of accounting reflects the principle that revenue is recorded when it is camed, not when cash is received True False 4. The accrual basis of accounting requires adjustments to recognize revenues in the periods they are cared and to match expenses with revenues. True False 6. Adjusting entries are designed primarily to con correct accounting errors. True False Adjustments are necessary to bring an asset or liability account to its proper amount and also update a related expense or revenue account. True False 7. Each adjusting entry can only affect a balance sheet account. True False & An expense account is normally closed by debiting Income Summary and crediting the expense account. True False The withdrawals account is normally closed by debiting it. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts