Question: Answer the following TWO questions: Question One (Chapter 6): If the income tax exemption on municipal bonds were abolished, what would happen to the interest

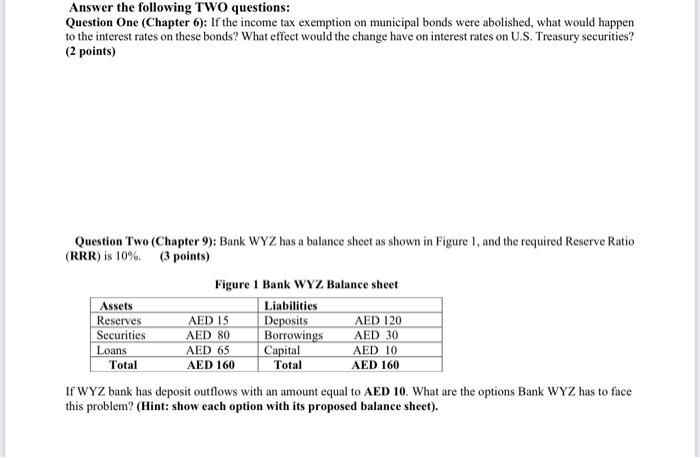

Answer the following TWO questions: Question One (Chapter 6): If the income tax exemption on municipal bonds were abolished, what would happen to the interest rates on these bonds? What effect would the change have on interest rates on U.S. Treasury securities? ( 2 points) Question Two (Chapter 9): Bank WYZ has a balance sheet as shown in Figure 1, and the required Reserve Ratio (RRR) is 10\%. (3 points) Figure 1 Bank WYZ Balance sheet If WYZ bank has deposit outflows with an amount equal to AED 10. What are the options Bank WYZ has to face this problem? (Hint: show each option with its proposed balance sheet)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts