Question: Answer the following using All You Ever Wanted To Know About Buybacks In Energy. Vincent G Piazza Team: Energy BI Senior Industry Analyst Key Research

Answer the following using All You Ever Wanted To Know About Buybacks In Energy.

Vincent G Piazza Team: Energy BI Senior Industry Analyst Key Research Stop The Buybacks Already Hiding Cash Under The Mattress The False Promise Table of Contents All You Ever Wanted To Know About Buybacks In Energy BI Crude Oil Production, North America Dashboard

1. A Deeper Look at Energy-Sector Buybacks Leaves Us Puzzled (Bloomberg Intelligence) -- We're most definitely not fans of returning cash to shareholders via stock repurchases. Our extensive analysis highlights weak share-price performance from buyback programs that synthetically boost results but don't change a company's underlying fundamentals. Portfolio managers and investors are compensated based on the direction of share prices, not accounting metrics manipulated by managements. It's our view that the C suite should strive to employ greater creativity when deploying capital in order to develop future businesses. (01/04/19)

Key Research

Stop The Buybacks Already

E&P Management Teams Shouldn't Pretend to Be Portfolio Managers Contributing Analysts Evan Lee (Commodities)

A better option for exploration & production companies than stock buybacks, in our view, is to enhance liquidity amid heightened equities and commodities volatility. Our analysis shows E&Ps have spent more than $10 billion on buybacks in the past five quarters with few finding any consistent success. (12/17/18)

2. Commodity Volatility Makes Buybacks Harder Contributing Analysts Cedric Bourgoin

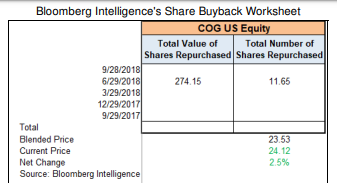

Commodity-price volatility strains an E&P's ability to effectively buy back stock in the open market. Cabot and ConocoPhillips were the only upstream companies to time the market successfully during the period analyzed in our study. Yet Conoco's repurchases in 2Q-3Q, before the latest drawdown in the equity market, were ill-timed. Methodology: We gauged performance of buybacks by analyzing the number and value of shares repurchased since 3Q17. We derived a blended price paid by weighting transactions in each quarter for each E&P, and compared the current share price to judge the program's efficacy. This approach differs from more-traditional studies, which analyze buybacks from the date of a program's announcement, or those that aggregate performance at the sector level with larger transactions skewing the data. (12/17/18)

3. Only a Few E&Ps Do This Well, Most Underperform Contributing Analysts Francois Duflot (Aerospace) While unique idiosyncratic factors may influence an E&P's buyback decision, large- and smaller-cap companies have been generally ineffective at repurchasing shares over the period we covered. Reviewing individual buybacks for each E&P would lead to a more-accurate assessment of a program's effectiveness, yet our analysis does highlight a disturbing, consistent pattern of underperformance more broadly. Investor hypocrisy is leading E&Ps, and companies in other sectors, to choose stock repurchases, in our view. While investors seek return of excess cash from portfolio companies -- a traditional mantra of corporate finance -- funds have tended to build and hoard capital when investment opportunities are scarce. (12/17/18)

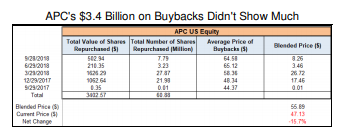

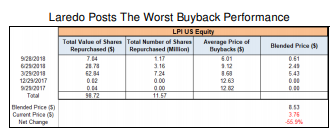

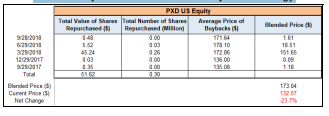

4. The Long-Standing Rule Is: Buy Low, Sell Higher Our study illustrates that management teams of E&Ps haven't shown consistent success buying back their own stock, even though they possess the most intimate institutional knowledge of the franchises they run. When devising the parameters for this study, we tried to place ourselves in the shoes of long-only portfolio managers, operating under the fundamental principle of buying low and selling higher, and building cash when opportunities were rare. Based on our analysis, the buyback programs of large-cap E&Ps Anadarko, Hess, Pioneer, Devon and Noble, along with mid- and smaller-cap brethren Antero, QEP Resources and Laredo, haven't performed well compared with more-recent share prices. (12/17/18)

5. Pioneer Needs to do a Better Job This Time Contributing Analysts Cedric Bourgoin Pioneer's latest announcement to buy back about $2 billion of stock is disappointing. While short-term holders are lobbying for a return of cash, we believe the company should raise its dividend to signal its underlying strength and confidence in the cycle, while boosting liquidity to weather near-term volatility. Repurchase programs aren't commitments to spend capital, and since buybacks occur opportunistically in most cases, longer-term investors discount them compared with the importance of dividend yield as a driver of valuation and stock performance. Pioneer spent about $51.6 million since 3Q17 on buybacks with relatively poor performance in 2018 as oil prices retreated. Some argue Pioneer's internal valuation model supported its decision, but the downdraft in the stock since then disproves that view. (12/17/18)

Pioneer May Wanna Rethink The Buyback Strategy

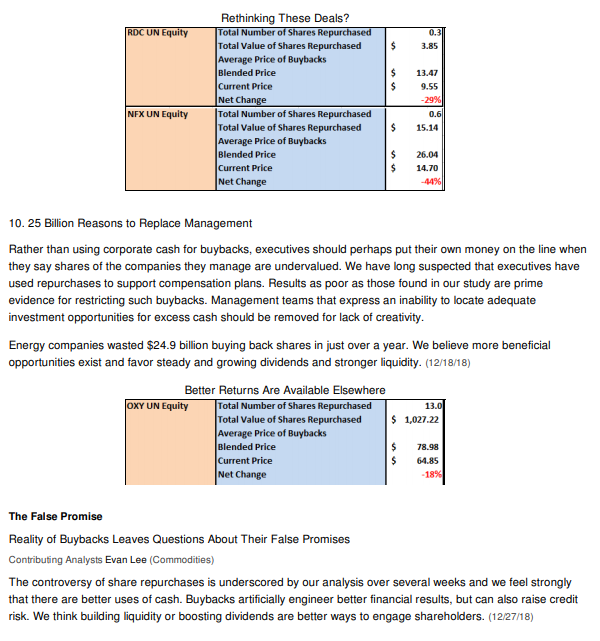

9. Rowan, Newfield Deals Show Share-Repurchase Buy-High Boondoggle Contributing Analysts Mark Rossano (Energy) When examining energy buybacks, two deals are particularly troubling to us. Over the past five quarters, Rowan repurchased stock at a blended price of $13.47 a share. Its acquisition by peer Ensco, announced in early October with Rowan's stock just below $19 a share, hasn't stopped the plunge in price with shares recently trading around $9. Shareholders are right to complain about equity underperformance, but we can't fathom why they continue to favor stock repurchase programs. Encana agreed to purchase Newfield in November when the target's share price was above $20. Newfield bought back stock at an average price of $26 yet its stock is sitting above $14 a share. (12/19/18)

11. Repurchases: You Can Put Lipstick on a Pig, But It's Still a Pig

Investment funds focused on themes related to share buybacks have underperformed the broader equity market by a blended average of more than 300 bps a year since 2015, based on our analysis of ETF returns. We appreciate there may be other reasons for companies to repurchase shares, such as offsetting dilution as executives and other personnel who exercise stock options offered in compensation plans. But we see this is a rather modest point.

Reducing outstanding stock improves financial metrics such as earnings per share while shrinking shareholders' equity and total assets, fabricating a distorted view of returns on assets and equity as well as the trajectory of earnings. But profitability and equity-based accounting metrics tend to be key drivers of executive-pay plans and we all know the C-suite wants to get paid. (12/24/18)

Check Out More of Our Research on This Topic:

Energy Buybacks: You're Better Off Hiding Cash Under Your Mattress | NSN

Stop Already With The Buybacks Please | NSN

Funds Focused on Buybacks Are Underperforming Broader Market | AVAT

Other Research Measures Buybacks From Date of the Announcement Which is Somewhat Disengenuous, Especially if Short Sellers are Forced to Cover Positions and Push the Stock Articifically Higher | DOCC

Comparing Current Prices to Prices When Shares Were Purchased is a Better Measure of Performance (Click Link to Open Our Worksheet) | MMDL

12. Even If Pigs Could Fly, We Wouldnt Recommend Buybacks

Buybacks artificially inflate earnings per share and asset and equity metrics, but underlying operations usually don't improve. In fact, to finance the repurchase, an energy company could increase credit and financial risk, raising leverage and hurting liquidity, typically to the detriment of credit investors. Finance textbooks suggest higher earnings boost a company's stock price to match the price-to-earnings multiple before buybacks. Yet, our analysis of repurchases suggests this is fiction. Inflating results through financial engineering doesn't enhance earnings power or sentiment.

Withdrawing capital reduces investment options and longer-term opportunities. It may placate short-sighted activists and keep management entrenched, but thats not a winning formula, in our view. (12/24/18)

Please answer the following questions:

a) Describe the main method used to evaluate effectiveness of buyback.

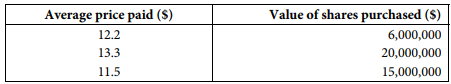

b) Suppose a company paid the following prices for buybacks over a year. What is the blended price? Show calculations.

3)

If current stock price of the company is 12.0, what is the impact of buybacks in terms of price change? Assume that buyback is the only reason for price change.

c) What are the main arguments made against buyback in the document? Do you agree with these arguments? Clearly explain why you agree or not agree.

d) What are the alternatives suggested for using cash?

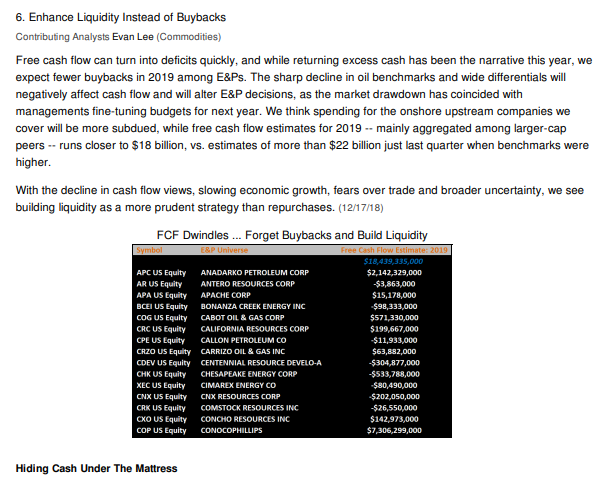

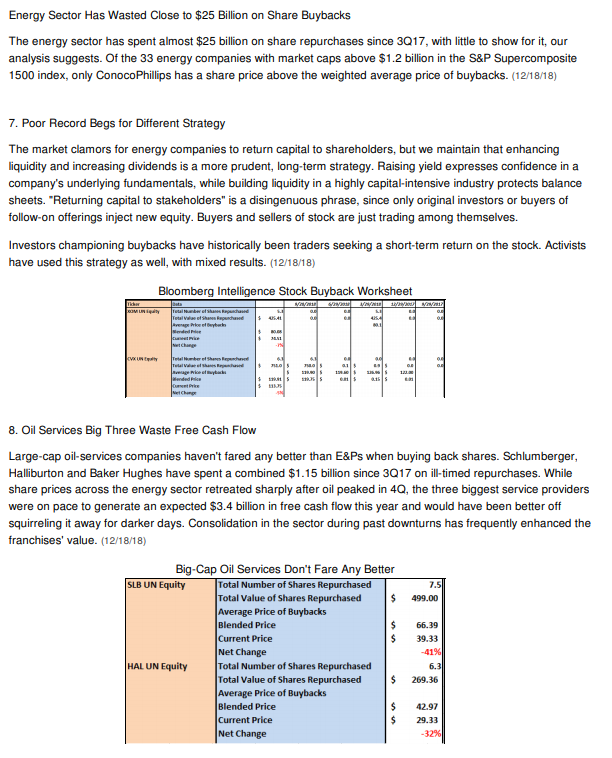

Bloomberg Intelligence's Share Buyback Worksheet COG US Equity Total Value of Total Number of Shares Repurchased Shares Repurchased 9/28/2018 6/29/2018 3/29/2018 12/29/2017 9/29/2017 274.15 1.65 Tota 24.12 2.5% Current Price Net Change Source: Bloomberg Intelligence APC's $3.4 Billion on Buybacks Didn't Show Much APC US Equty otBeaded Price (5) 6 72 Bunded Psce (3) Laredo Posts The Worst Buyback Performance LPI US Equib Total Valae af Shares Total Number of Shares Average Price of Blended Price Repurchased Repurchased pilon 282018 1.12 20.78 29/201 1229/2017 230017 Cant Pic () Net Change Price RepurchasedRegunchased Nition) Duybacks ( 1229/2017 Blanded Prce Net Change 6. Enhance Liquidity Instead of Buybacks Contributing Analysts Evan Lee (Commodities) Free cash flow can turn into deficits quickly, and while returning excess cash has been the narrative this year, we expect fewer buybacks in 2019 among E&Ps. The sharp decline in oil benchmarks and wide differentials will negatively affect cash flow and will alter E&P decisions, as the market drawdown has coincided with managements fine-tuning budgets for next year. We think spending for the onshore upstream companies we cover will be more subdued, while free cash flow estimates for 2019 mainly aggregated among larger-cap peers runs closer to $18 billion, vs. estimates of more than $22 billion just last quarter when benchmarks were higher With the decline in cash flow views, slowing economic growth, fears over trade and broader uncertainty, we see building liquidity as a more prudent strategy than repurchases. (12/17/18) FCF Dwindles Forget Buybacks and Build Liquidity 2,142,329,000 APC US Equity ANADARKO PETROLEUM CORP AR US Equity ANTERO RESOURCES CORP APA US Equity APACHE CORP BCE US Equity BONANZA CREEK ENERGY INC COG US Equity CABOT OIL & GAS CORP CRC US Equity CALIFORNIA RESOURCES CORP CPE US Equity CALLON PETROLEUM CO CRZO US Equity CARRIZO OIL & GAS INC CDEV US Equity CENTENNIAL RESOURCE DEVELO-A CHK US Equity CHESAPEAKE ENERGY CORP XEC US Equity CIMAREX ENERGY CO CNx US Equity CNX RESOURCES CORP CRK US Equity COMSTOCK RESOURCES INC CXO US Equity CONCHO RESOURCES INC COP US Equity CONOCOPHILLIPS $15,178,000 $199,667,000 $11,933,000 -5304,877,000 -$533,788,000 $142,973,000 $7,306,299,000 Hiding Cash Under The Mattress Energy Sector Has Wasted Close to $25 Billion on Share Buybacks The energy sector has spent almost $25 billion on share repurchases since 3017, with little to show for it, our analysis suggests. Of the 33 energy companies with market caps above $1.2 billion in the S&P Supercomposite 1500 index, only ConocoPhillips has a share price above the weighted average price of buybacks. (12/18/18) 7. Poor Record Begs for Different Strategy The market clamors for energy companies to return capital to shareholders, but we maintain that enhancing liquidity and increasing dividends is a more prudent, long-term strategy. Raising yield expresses confidence in a company's underlying fundamentals, while building liquidity in a highly capital-intensive industry protects balance sheets. "Returning capital to stakeholders" is a disingenuous phrase, since only original investors or buyers of follow-on offerings inject new equity. Buyers and sellers of stock are just trading among themselves. Investors championing buybacks have historically been traders seeking a short-term return on the stock. Activists have used this strategy as well, with mixed results. (12/18/18) Bloomberg Intelligence Stock Buyback Worksheet 8. Oil Services Big Three Waste Free Cash Flow Large-cap oil-services companies haven't fared any better than E&Ps when buying back shares. Schlumberger Halliburton and Baker Hughes have spent a combined $1.15 billion since 3017 on ill-timed repurchases. While share prices across the energy sector retreated sharply after oil peaked in 4Q, the three biggest service providers were on pace to generate an expected $3.4 billion in free cash flow this year and would have been better off squirreling it away for darker days. Consolidation in the sector during past downturns has frequently enhanced the franchises' value. (12/18/18) Big-Cap Oil Services Don't Fare Any Better SLB UN Equity Total Number of Shares Repurchased Total Value of Shares Repurchased 499.00 Average Price of Buybacks Blended Price Current Price Net Change Total Number of Shares Repurchased Total Value of Shares Repurchased Average Price of Buybacks Blended Price Current Price Net Change $66.39 39.33 HAL UN Equity 6.3 269.36 42.97 529.33 Rethinking These Deals? purc Total Value of Shares Repurchased$3.85 Average Price of Buybacks Blended Price Current Price Net C $13.47 9.55 29% NFX UN Equity Total Number of shares Repurchased 0.6 $15.14 Total Value of Shares Repurchased Average Price of Buybacks Blended Price Current Price Net Change $26.04 514.70 -44% 10. 25 Billion Reasons to Replace Management Rather than using corporate cash for buybacks, executives should perhaps put their own money on the line when they say shares of the companies they manage are undervalued. We have long suspected that executives have used repurchases to support compensation plans. Results as poor as those found in our study are prime evidence for restricting such buybacks. Management teams that express an inability to locate adequate investment opportunities for excess cash should be removed for lack of creativity Energy companies wasted $24.9 billion buying back shares in just over a year. We believe more beneficial opportunities exist and favor steady and growing dividends and stronger liquidity. (12/18/18) Better Returns Are Available Elsewhere OXY UN Equity Total Number of Shares Repurchased Total Value of Shares Repurchased1,027.22 Average Price of Buybacks Blended Price Current Price Net Change $78.98 64.85 18% The False Promise Reality of Buybacks Leaves Questions About Their False Promises Contributing Analysts Evan Lee (Commodities) The controversy of share repurchases is underscored by our analysis over several weeks and we feel strongly that there are better uses of cash. Buybacks artificially engineer better financial results, but can also raise credit risk. We think building liquidity or boosting dividends are better ways to engage shareholders. (12/27/18) Average price paid (S) 12.2 13.3 11.5 Value of shares purchased (S) 6,000,000 20,000,000 15,000,000 Bloomberg Intelligence's Share Buyback Worksheet COG US Equity Total Value of Total Number of Shares Repurchased Shares Repurchased 9/28/2018 6/29/2018 3/29/2018 12/29/2017 9/29/2017 274.15 1.65 Tota 24.12 2.5% Current Price Net Change Source: Bloomberg Intelligence APC's $3.4 Billion on Buybacks Didn't Show Much APC US Equty otBeaded Price (5) 6 72 Bunded Psce (3) Laredo Posts The Worst Buyback Performance LPI US Equib Total Valae af Shares Total Number of Shares Average Price of Blended Price Repurchased Repurchased pilon 282018 1.12 20.78 29/201 1229/2017 230017 Cant Pic () Net Change Price RepurchasedRegunchased Nition) Duybacks ( 1229/2017 Blanded Prce Net Change 6. Enhance Liquidity Instead of Buybacks Contributing Analysts Evan Lee (Commodities) Free cash flow can turn into deficits quickly, and while returning excess cash has been the narrative this year, we expect fewer buybacks in 2019 among E&Ps. The sharp decline in oil benchmarks and wide differentials will negatively affect cash flow and will alter E&P decisions, as the market drawdown has coincided with managements fine-tuning budgets for next year. We think spending for the onshore upstream companies we cover will be more subdued, while free cash flow estimates for 2019 mainly aggregated among larger-cap peers runs closer to $18 billion, vs. estimates of more than $22 billion just last quarter when benchmarks were higher With the decline in cash flow views, slowing economic growth, fears over trade and broader uncertainty, we see building liquidity as a more prudent strategy than repurchases. (12/17/18) FCF Dwindles Forget Buybacks and Build Liquidity 2,142,329,000 APC US Equity ANADARKO PETROLEUM CORP AR US Equity ANTERO RESOURCES CORP APA US Equity APACHE CORP BCE US Equity BONANZA CREEK ENERGY INC COG US Equity CABOT OIL & GAS CORP CRC US Equity CALIFORNIA RESOURCES CORP CPE US Equity CALLON PETROLEUM CO CRZO US Equity CARRIZO OIL & GAS INC CDEV US Equity CENTENNIAL RESOURCE DEVELO-A CHK US Equity CHESAPEAKE ENERGY CORP XEC US Equity CIMAREX ENERGY CO CNx US Equity CNX RESOURCES CORP CRK US Equity COMSTOCK RESOURCES INC CXO US Equity CONCHO RESOURCES INC COP US Equity CONOCOPHILLIPS $15,178,000 $199,667,000 $11,933,000 -5304,877,000 -$533,788,000 $142,973,000 $7,306,299,000 Hiding Cash Under The Mattress Energy Sector Has Wasted Close to $25 Billion on Share Buybacks The energy sector has spent almost $25 billion on share repurchases since 3017, with little to show for it, our analysis suggests. Of the 33 energy companies with market caps above $1.2 billion in the S&P Supercomposite 1500 index, only ConocoPhillips has a share price above the weighted average price of buybacks. (12/18/18) 7. Poor Record Begs for Different Strategy The market clamors for energy companies to return capital to shareholders, but we maintain that enhancing liquidity and increasing dividends is a more prudent, long-term strategy. Raising yield expresses confidence in a company's underlying fundamentals, while building liquidity in a highly capital-intensive industry protects balance sheets. "Returning capital to stakeholders" is a disingenuous phrase, since only original investors or buyers of follow-on offerings inject new equity. Buyers and sellers of stock are just trading among themselves. Investors championing buybacks have historically been traders seeking a short-term return on the stock. Activists have used this strategy as well, with mixed results. (12/18/18) Bloomberg Intelligence Stock Buyback Worksheet 8. Oil Services Big Three Waste Free Cash Flow Large-cap oil-services companies haven't fared any better than E&Ps when buying back shares. Schlumberger Halliburton and Baker Hughes have spent a combined $1.15 billion since 3017 on ill-timed repurchases. While share prices across the energy sector retreated sharply after oil peaked in 4Q, the three biggest service providers were on pace to generate an expected $3.4 billion in free cash flow this year and would have been better off squirreling it away for darker days. Consolidation in the sector during past downturns has frequently enhanced the franchises' value. (12/18/18) Big-Cap Oil Services Don't Fare Any Better SLB UN Equity Total Number of Shares Repurchased Total Value of Shares Repurchased 499.00 Average Price of Buybacks Blended Price Current Price Net Change Total Number of Shares Repurchased Total Value of Shares Repurchased Average Price of Buybacks Blended Price Current Price Net Change $66.39 39.33 HAL UN Equity 6.3 269.36 42.97 529.33 Rethinking These Deals? purc Total Value of Shares Repurchased$3.85 Average Price of Buybacks Blended Price Current Price Net C $13.47 9.55 29% NFX UN Equity Total Number of shares Repurchased 0.6 $15.14 Total Value of Shares Repurchased Average Price of Buybacks Blended Price Current Price Net Change $26.04 514.70 -44% 10. 25 Billion Reasons to Replace Management Rather than using corporate cash for buybacks, executives should perhaps put their own money on the line when they say shares of the companies they manage are undervalued. We have long suspected that executives have used repurchases to support compensation plans. Results as poor as those found in our study are prime evidence for restricting such buybacks. Management teams that express an inability to locate adequate investment opportunities for excess cash should be removed for lack of creativity Energy companies wasted $24.9 billion buying back shares in just over a year. We believe more beneficial opportunities exist and favor steady and growing dividends and stronger liquidity. (12/18/18) Better Returns Are Available Elsewhere OXY UN Equity Total Number of Shares Repurchased Total Value of Shares Repurchased1,027.22 Average Price of Buybacks Blended Price Current Price Net Change $78.98 64.85 18% The False Promise Reality of Buybacks Leaves Questions About Their False Promises Contributing Analysts Evan Lee (Commodities) The controversy of share repurchases is underscored by our analysis over several weeks and we feel strongly that there are better uses of cash. Buybacks artificially engineer better financial results, but can also raise credit risk. We think building liquidity or boosting dividends are better ways to engage shareholders. (12/27/18) Average price paid (S) 12.2 13.3 11.5 Value of shares purchased (S) 6,000,000 20,000,000 15,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts