Question: Answer the four questions . You are evaluating a project that will cost $459,000, but is expected to produce cash flows of $127,000 per year

Answer the four questions

Answer the four questions

.

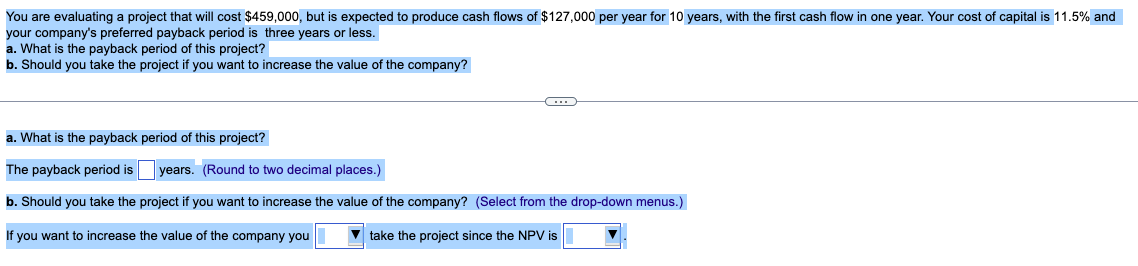

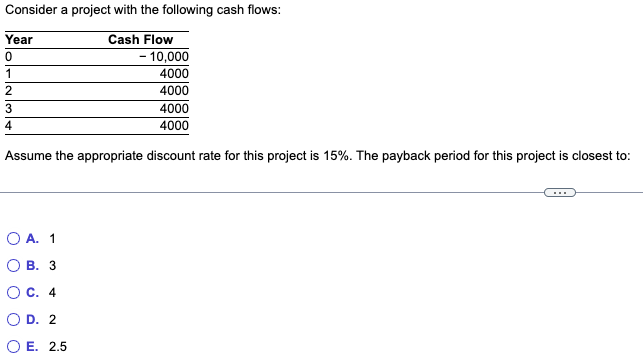

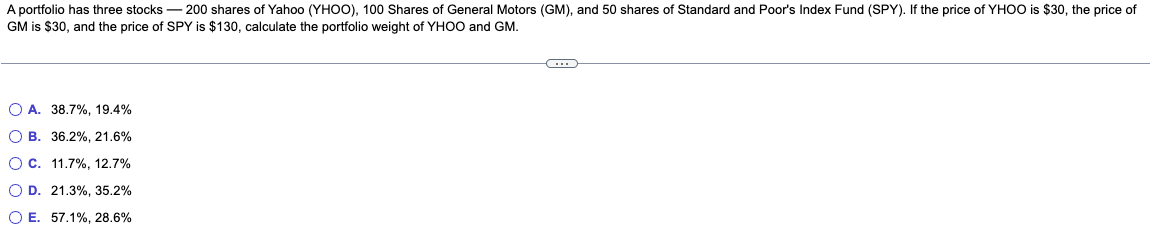

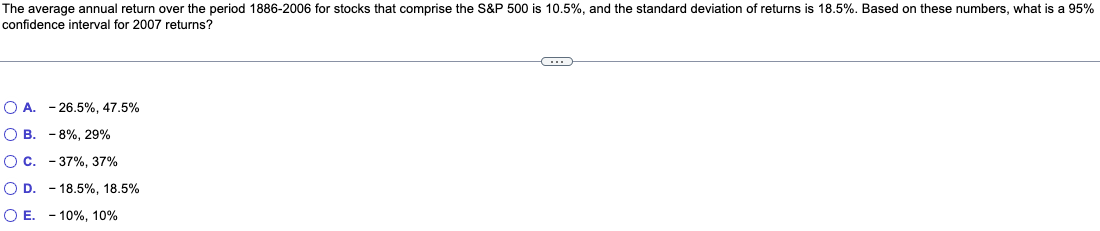

You are evaluating a project that will cost $459,000, but is expected to produce cash flows of $127,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 11.5% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? (Select from the drop-down menus.) If you want to increase the value of the company you take the project since the NPV is Consider a project with the following cash flows: Assume the appropriate discount rate for this project is 15%. The payback period for this project is closest to: A. 1 B. 3 C. 4 D. 2 E. 2.5 A portfolio has three stocks - 200 shares of Yahoo (YHOO), 100 Shares of General Motors (GM), and 50 shares of Standard and Poor's Index Fund (SPY). If the price of YHOO is $30, the price of GM is $30, and the price of SPY is $130, calculate the portfolio weight of YHOO and GM. A. 38.7%,19.4% B. 36.2%,21.6% C. 11.7%,12.7% D. 21.3%,35.2% E. 57.1%,28.6% The average annual return over the period 18862006 for stocks that comprise the S\&P 500 is 10.5%, and the standard deviation of returns is 18.5%. Based on these numbers, what is a 95% confidence interval for 2007 returns? A. 26.5%,47.5% B. 8%,29% C. 37%,37% D. 18.5%,18.5% E. 10%,10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts