Question: answer the last problem for both 2. Consider the following two stocks. Probabilities (Pi) Stock a Stock b Recession P1 = 24% 1-9% 15% =

answer the last problem for both

2.

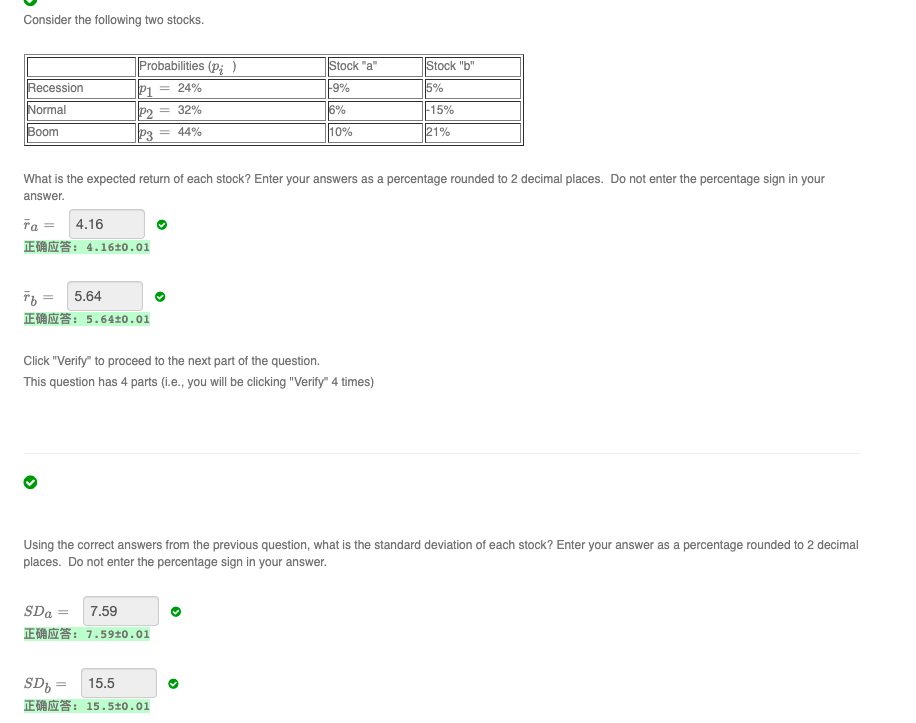

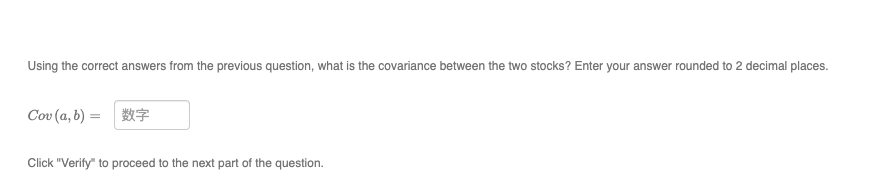

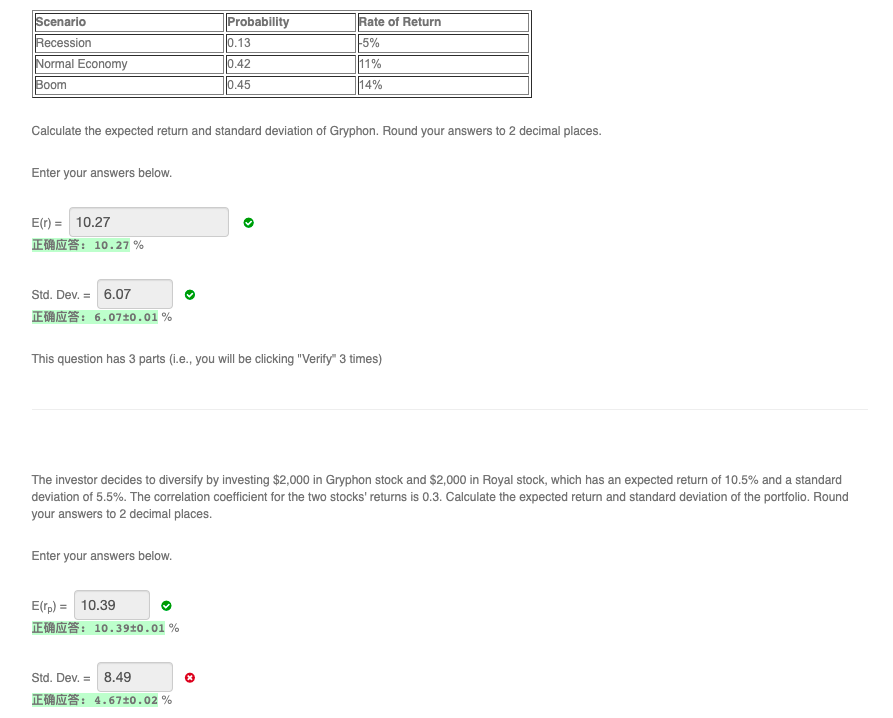

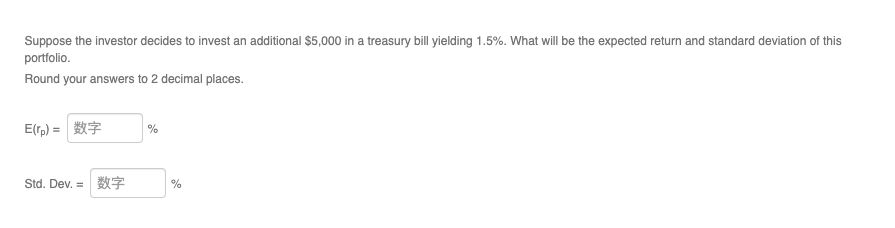

Consider the following two stocks. Probabilities (Pi) Stock "a" Stock "b" Recession P1 = 24% 1-9% 15% = 32% 16% -15% Normal Boom P2 P3 = 44% 110% 21% What is the expected return of each stock? Enter your answers as a percentage rounded to 2 decimal places. Do not enter the percentage sign in your answer Ta = 4.16 :4.160.01 = 5.64 : 5.640.01 : + Click "Verify" to proceed to the next part of the question. This question has 4 parts (i.e., you will be clicking "Verify" 4 times) Using the correct answers from the previous question, what is the standard deviation of each stock? Enter your answer as a percentage rounded to 2 decimal places. Do not enter the percentage sign in your answer. SDA 7.59 : 7.590.01 SD 15.5 IEWS: 15.500.01 Using the correct answers from the previous question, what is the covariance between the two stocks? Enter your answer rounded to 2 decimal places. Cov (a, b) = Click "Verify" to proceed to the next part of the question. Probability 10.13 Rate of Return 5% Scenario Recession Normal Economy Boom 10.42 11% 10.45 14% Calculate the expected return and standard deviation of Gryphon. Round your answers to 2 decimal places. Enter your answers below. E(T) = 10.27 > :10.27% Std. Dev. = 6.07 TE: 6.07+0.01% This question has 3 parts (i.e., you will be clicking "Verify" 3 times) The investor decides to diversify by investing $2,000 in Gryphon stock and $2,000 in Royal stock, which has an expected return of 10.5% and a standard deviation of 5.5%. The correlation coefficient for the two stocks' returns is 0.3. Calculate the expected return and standard deviation of the portfolio. Round your answers to 2 decimal places. Enter your answers below. E(rp) = 10.39 :10.3940.01% : Std. Dev. = 8.49 :4.670.02% : % Suppose the investor decides to invest an additional $5,000 in a treasury bill yielding 1.5%. What will be the expected return and standard deviation of this portfolio Round your answers to 2 decimal places. E(rp) = % Std. Dev. = 2 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts