Question: Need answer for the standard deviation for a and b Consider the following two stocks. Probabilities (Pi) Stock A Stock B Recession P1 = 37%

Need answer for the standard deviation for a and b

Need answer for the standard deviation for a and b

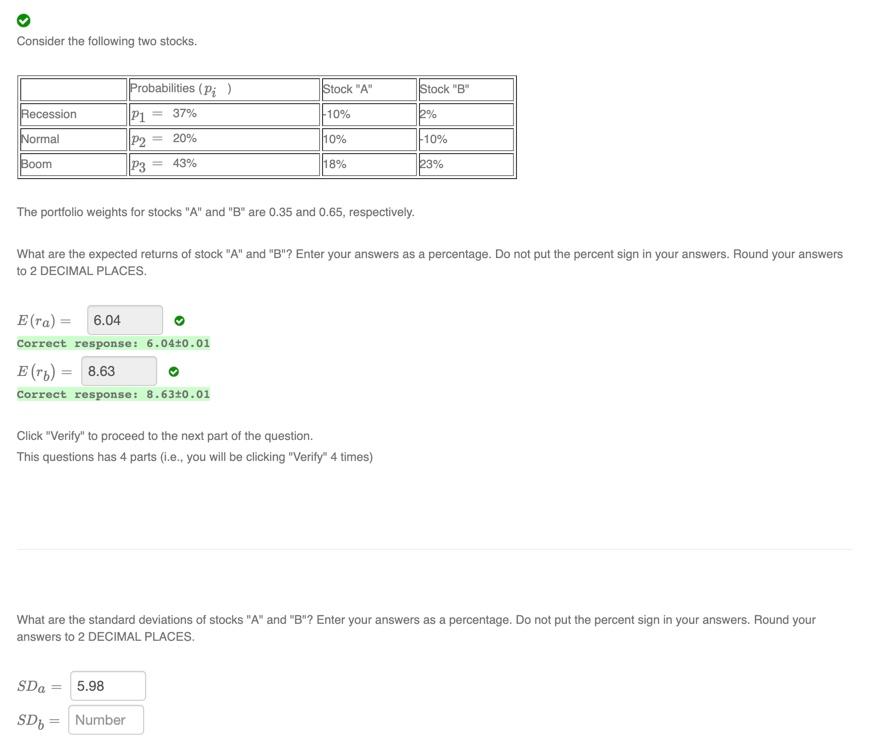

Consider the following two stocks. Probabilities (Pi) Stock "A" Stock "B" Recession P1 = 37% -10% 2% Normal 10% 10% P2 = 20% P3 = 43% Boom 118% 23% The portfolio weights for stocks "A" and "B" are 0.35 and 0.65, respectively. What are the expected returns of stock "A" and "B"? Enter your answers as a percentage. Do not put the percent sign in your answers. Round your answers to 2 DECIMAL PLACES E(ra) = 6.04 Correct response: 6.04+0.01 Erb) = 8.63 Correct response: 8.630.01 Click "Verify" to proceed to the next part of the question. This questions has 4 parts (i.e.. you will be clicking "Verify" 4 times) What are the standard deviations of stocks "A" and "B"? Enter your answers as a percentage. Do not put the percent sign in your answers. Round your answers to 2 DECIMAL PLACES SDA 5.98 SD Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts