Question: Gonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on Investments is 10%. (PV

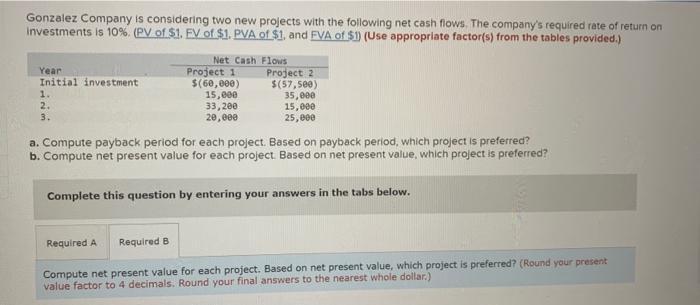

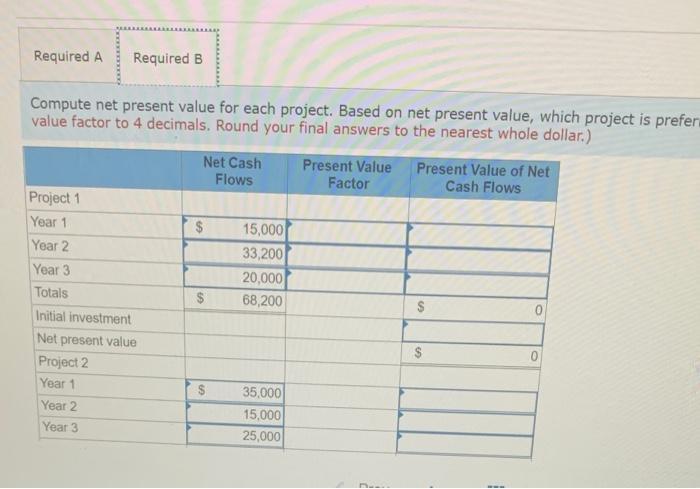

Gonzalez Company is considering two new projects with the following net cash flows. The company's required rate of return on Investments is 10%. (PV of $1. EV of $1. PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided.) Year Initial investment 1. 2. 3. Net Cash Flows Project 1 $(60,000) 15,000 33,200 20,000 Project 2 $(57,500) 35,000 15,000 25,000 a. Compute payback period for each project. Based on payback period, which project is preferred? b. Compute net present value for each project. Based on net present value, which project is preferred? Complete this question by entering your answers in the tabs below. Required A Required B Compute net present value for each project. Based on net present value, which project is preferred? (Round your present value factor to 4 decimals. Round your final answers to the nearest whole dollar.) Required A Required B Compute net present value for each project. Based on net present value, which project is prefer value factor to 4 decimals. Round your final answers to the nearest whole dollar.) Project 1 Year 1 Year 2 Year 3 Totals Initial investment Net present value Project 2 Year 1 Year 2 Year 3 Net Cash Flows $ 15,000 33,200 20,000 68,200 35,000 15,000 25,000 Present Value Factor Present Value of Net Cash Flows $ $ 0

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts